European equities sink as Eurozone inflation reduces odds of ECB rate cut, US NFP thumps forecasts

- European equity indexes closed broadly lower on Friday after EU inflation rebounded.

- The end of EU energy subsidies bodes poorly for ECB rate cut expectations.

- US jobs data likewise firms up US economic backdrop, reducing odds of Fed cuts.

European equity indexes shed weight on Friday, plunging on a rebound in Eurozone inflation figures while the US’ Nonfarm Payrolls (NFP) solidly steamrolled forecasts, adding the most jobs since October while markets were expecting a slight fallback in the headline jobs figure.

The European Harmonized Index of Consumer Prices (HICP) rose to 2.9% for the year ended December, slightly less than the market forecast of 3.0% but still a healthy rebound from the previous period’s 2.4%. Annualized Core HICP ticked lower to 3.4% in December, down slightly from November’s YoY 3.6% and missing the forecast 3.5%, highlighting how much of Eurozone inflation is being driven by rising energy prices. EU subsidies meant to cap energy volatility are expiring, and the added price growth will plague EU inflation looking forward, making it more difficult for the European Central Bank (ECB) to cut interest rates.

See More: Euro area HICP inflation rises to 2.9% in December vs. 3% expected

European equities plunged to near-term lows after headline EU inflation ticked higher, sending the German DAX index to a four-week low of €16,434. European indexes recovered from early Friday’s inflation plunge before getting yanked lower again by US NFP figures that thoroughly trounced expectations.

Friday’s NFP print showed the US added 216K net job additions to the American employment landscape, easily clearing the median market forecast of 170K, and stepping over November’s revised print of 173K (revised down from 199K). Investors will also note that October’s NFP print saw further revisions, declining to 105K from the previous 150K).

Germany’s DAX ended the week at €16,594.21, down a little over 23 points to end Friday down 0.14%, while the French CAC 40 fell nearly 30 points to close down 0.4% at €7,420.69. The pan-European STOXX600 fell 1.3 points to end at €476.38, down around a quarter of a percent. London’s FTSE index also slid four-tenths of one percent to close down 33.46 points at £7,689.61.

DAX Technical Outlook

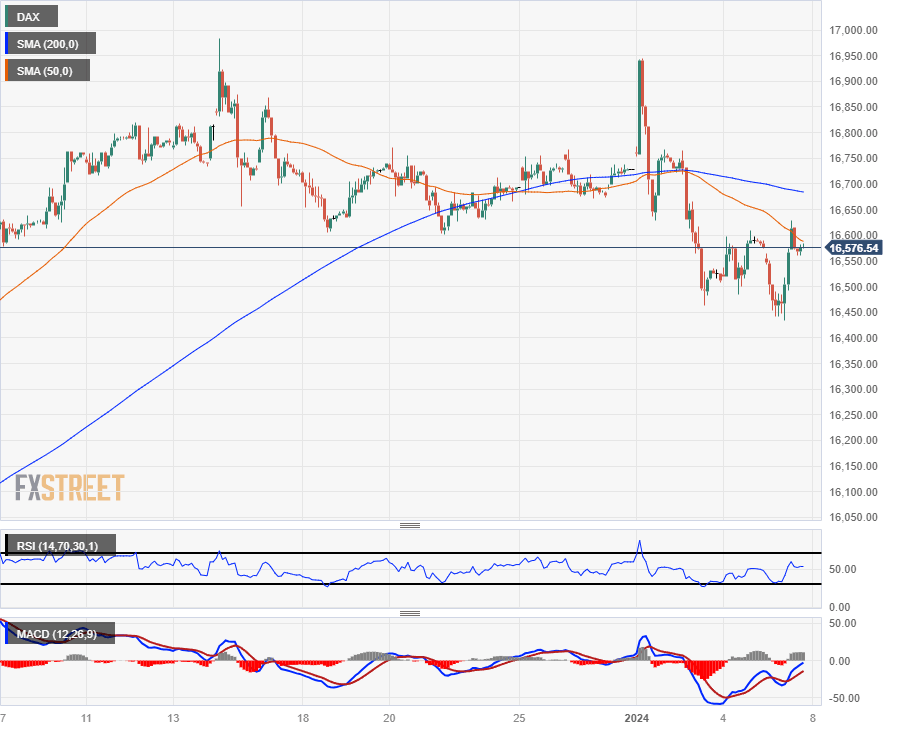

The German DAX 40 major equity index fell on Friday, and efforts by stock traders to bolster stocks back from the day’s lows saw a late break back below the €16,600 level heading into the Friday closing bell.

The DAX kicked off 2024 with an early rally into €16,950 as investors keep an eye turned to the major 17,000 handle, but the equity index continues to get dragged below the 200-hour Simple Moving Average (SMA) near €16,700.

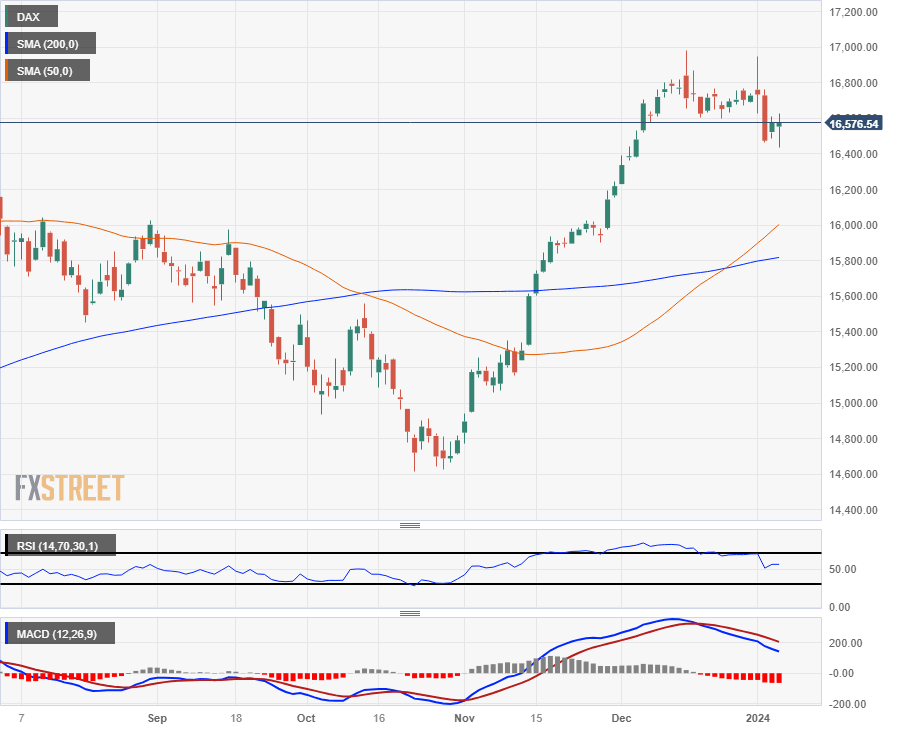

Despite near-term congestion and a bearish lean to technical indicators on the daily candlesticks, the DAX remains well-bid from late 2023’s lows, up nearly 13.5% from late October’s bottom near €14,620.

DAX Hourly Chart

DAX Daily Chart

DAX Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.