Euro pops with markets applauding possible fresh government formation in France ahead

- The Euro recovers firmly ahead of the US opening bell on Tuesday.

- Traders are supporting the Euro with possible fresh government formation as soon as Wednesday.

- The US Nonfarm Payrolls release is due Friday with JOLTS being printed this Tuesday.

The Euro pops further above 1.05 in a recovery attempt, after having lost 0.78% on Monday due to concerns over the stability of the French government. French Prime Minister Michel Barnier used a special decree to pass his social budget reform by circumventing the French parliament, a move that set off bad blood with the opposition parties, which were very quick to support a vote of no confidence that could be held as early as Wednesday.

Meanwhile in the US, Federal Reserve Governor Christopher Waller said that he is keen for a December interest-rate cut. This has pushed up the odds for that rate cut to take place, narrowing the rate differential between European and US bond yields. Some further easing from the US Dollar should materialize on the back of this, giving further impulse to the EUR/USD pair ahead of the US JOLTS Job Openings report to be published in Tuesday’s American session.

Daily digest market movers: Fresh politics is always supportive

- The main economic event this Tuesday will be the US JOLTS Jobs Openings report for October. Expectations are for 7.48 million job openings against the previous 7.443 million, ahead of the retail-intensive Christmas Holiday period.

- Spanish Unemployment in November fell by around 16,000 people, coming from the 26,800 uptick in joblessness seen the previous month.

- Bloomberg confirms that a vote of no confidence will take place Wednesday in France.

- European equities are positive though off their intraday high, where the German Dax hitted 20,000 points for the first time ever.

- European Central Bank (ECB) Executive Board member Piero Cipollone said on Tuesday that Europe is growing much less than it could, with upcoming US tariffs possibly lowering the growth outlook even more. This opens the door for larger rate cuts from the ECB, Bloomberg reports.

Technical Analysis: Buy the rumour, sell the fact

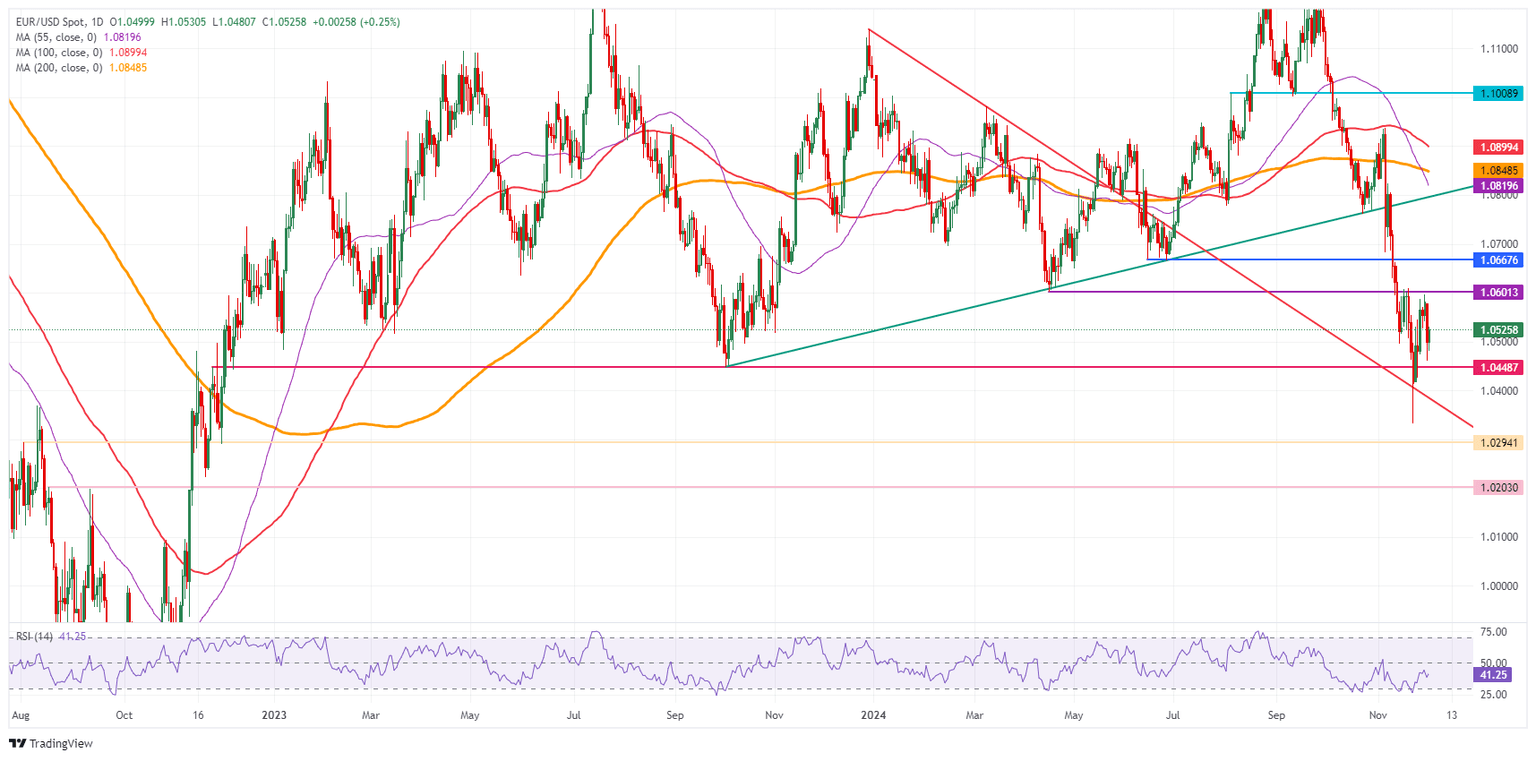

EUR/USD has a long road to recover after its stellar correction in November. With policies from US President-elect Donald Trump being priced in, a lot could be priced out once it turns out that bold statements were a bargaining chip to get some deal or consensus done.

Major banks are already calling for parity, but it would not come as a surprise that parity does not materialize. There is the possibility that the EUR/USD pair reverts back to 1.0600 and 1.0800 in the coming weeks as traders unwind positions ahead of the Christmas season and the end of the year.

On the upside, three firm lines of resistance can be seen. The first is the previous 2024 low at 1.0601 registered on April 16. If that level breaks, the triple bottom from June at 1.0667 will be the next cap upwards. Further up, the 1.0800 round level, which roughly coincides with the green ascending trend line from the low of October 3, 2023, could deliver a harsh rejection.

Looking for support, the 2023 low at 1.0448 is the next technical candidate. The current two-year low at 1.0332 is the second level to look out for. Further down, 1.0294 and 1.0203 are the next levels to consider.

EUR/USD: Daily Chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.