EUR/USD demonstrates strength amid uncertainty over US economic outlook

- EUR/USD rises to near 1.0850 as the US Dollar weakens amid accelerating concerns over the US economic outlook.

- US President Trump’s policies are expected to slow down the US economic growth.

- ECB’s Centeno expects that Eurozone inflation is almost out of the woods.

EUR/USD trades firmly around 1.0850 after recovering early losses in Monday’s North American session. The major currency pair strengthens as the US Dollar (USD) struggles to gain ground after last week’s sharp drop. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades vulnerable near a fresh four-month low of 103.50.

The outlook of the US Dollar is uncertain, with investors becoming increasingly concerned over how United States (US) President Donald Trump’s ‘America first’ policies will shape the economy. On Friday, the comments from the President in an interview with Fox News indicated that Trump’s policies should lead to short-term economic shocks.

"There is a period of transition because what we are doing is very big,” Trump told the "Sunday Morning Futures" program. This comment came after he was asked about the possibility of a recession.

Lately, a slew of US data has indicated signs of an economic slowdown, such as 15-month low Consumer Confidence, an unexpected decline in the ISM Manufacturing New Orders, and slightly lower-than-expected Nonfarm Payrolls (NFP) data for February. Weak data has forced traders to raise bets supporting the Federal Reserve (Fed) to resume the policy-easing cycle in the June meeting. The likelihood for the Fed to cut interest rates in June has increased to 82% from 54% a month ago, according to the CME FedWatch tool.

Meanwhile, Fed Chair Jerome Powell continued to guide a “wait and see” approach on interest rates due to the lack of clarity on Trump’s tariff and tax policies. “Uncertainty around Trump administration policies and their economic effects remains high,” Powell said in an economic forum at the University of Chicago Booth School on Friday, and the “net effect of trade, immigration, fiscal, and regulation policy is what matters for the economy and the monetary policy.”

Daily digest market movers: EUR/USD shows strength despite Euro trades with caution

- EUR/USD remains higher while the Euro (EUR) trades with caution against its major peers at the start of the week. The Euro faces pressure as profit-booking kicks in after a robust upside move last week. The Euro outperformed as German leaders, including likely new Chancellor Frederich Merz, agreed to stretch the borrowing limit or so-called “debt brake” and create a 500 billion Euro (EUR) infrastructure fund to boost defense spending and stimulate economic growth.

- Germany’s decision of large economic stimulus forced traders to pare bets supporting the European Central Bank (ECB) to cut interest rates two times more this year, assuming that the impact could be inflationary for the Eurozone. Last week, the ECB reduced its Deposit Facility rate by 25 basis points (bps) to 2.5% but didn’t commit a preset monetary expansion path.

- Meanwhile, comments from ECB policymaker and Governor of Bank of Portugal Mario Centeno in a conference on Friday indicated that more interest rate cuts are in the pipeline. Centeno said that the Eurozone is on its way to “normalizing monetary policy”. On the inflation outlook, Centeno said that inflation is "almost out of the woods" and has decelerated to "a level that is very much closer to our target".

- On the economic front, month-on-month German Industrial Production data grew at a faster-than-expected pace in January. The industrial production of the Eurozone’s locomotive rose by 2%, strongly than estimates of 1.5%. In December, it declined by 1.5%. Meanwhile, Eurozone Sentix Investor Confidence improves to -2.9 in March from -12.7 in February.

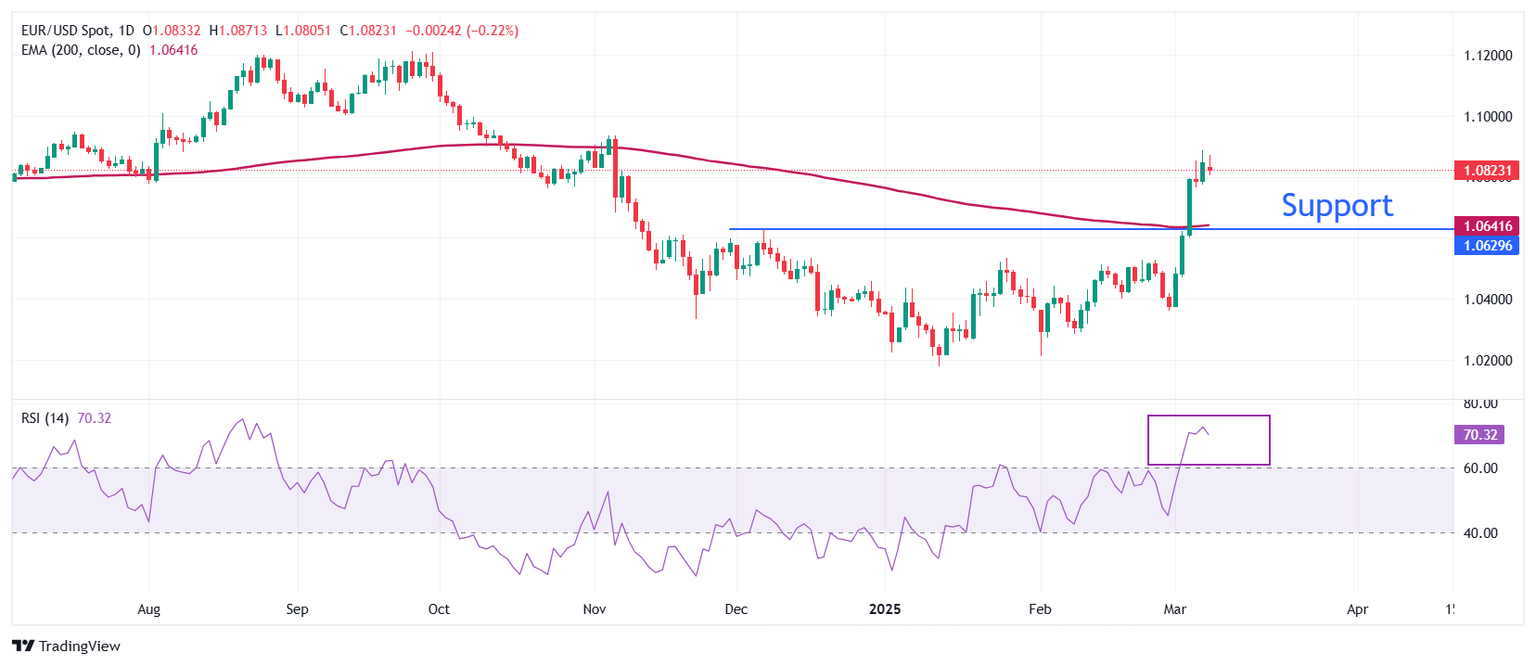

Technical Analysis: EUR/USD stays above 200-day EMA

EUR/USD stabilizes around 1.0850 after correcting to near 1.0800 on Monday. The major currency pair strengthened after a decisive breakout above the December 6 high of 1.0630 last week. The long-term outlook of the major currency pair is bullish as it holds above the 200-day Exponential Moving Average (EMA), which trades around 1.0640.

The 14-day Relative Strength Index (RSI) jumps to near 70.00, indicating a strong bullish momentum.

Looking down, the December 6 high of 1.0630 will act as the major support zone for the pair. Conversely, the November 6 high of 1.0937 and the psychological level of 1.1000 will be key barriers for the Euro bulls.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.