EUR/USD drops as US Dollar gains while US-China trade uncertainty escalates

- EUR/USD faces slight pressure above 1.1400 as the US Dollar steadies, with investors seeking clarity on the US-China trade outlook.

- US Treasury Secretary Bessent has put the responsibility for the US-China trade progress on Beijing.

- ECB officials support the need for more interest rate cuts.

EUR/USD trades lower around 1.1390 during North American trading hours on Tuesday. The major currency pair ticks lower as the US Dollar (USD) steadies despite escalating uncertainty about the trade outlook between the United States (US) and China. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, gains to near 99.35.

The comments from US Treasury Secretary Scott Bessent that China should be the one to initiate trade talks with the US have increased investors’ doubts about whether trade discussions are underway. “I believe that it’s up to China to de-escalate, because they sell five times more to us than we sell to them, Bessent said in an interview on CNBC’s Squawk Box on Monday.

Meanwhile, contradictory statements from US President Donald Trump and Beijing about Chinese President Xi Jinping calling Trump to discuss terms and conditions on trade have also diminished hopes of a resolution of the US-China trade war in the near term.

Donald Trump has been insisting that China’s Xi has called him several times to discuss bilateral trade since the imposition of higher tariffs on Beijing. However, the Chinese Foreign Ministry continues to deny any economic and trade discussions between Trump and Xi.

Apart from comments from the White House on US-China trade talks, a slew of US economic data will influence action in the US Dollar this week. Investors will pay close attention to the preliminary Q1 Gross Domestic Product (GDP), ISM Purchasing Managers’ Index (PMI), ADP Employment Change and Nonfarm Payrolls (NFP) data for April, and Personal Consumption Expenditure Price Index (PCE) data for March, which will influence market expectations for the Federal Reserve’s (Fed) monetary policy outlook.

In Tuesday’s American session, the US JOLTS Job Openings data for March missed estimates. US employers posted fresh 7.19 million jobs, lower than expectations of 7.5 million and 7.48 million seen in February.

Daily digest market movers: EUR/USD drops as US Dollar ticks higher

- A mild downside move in the EUR/USD pair is also driven by a slight selling pressure in the Euro (EUR), with European Central Bank (ECB) officials expressing the need for more interest rate cuts. On Monday, ECB policymaker and Finnish central bank governor Olli Rehn supported the need for further monetary policy expansion and expressed concerns about deepening risks to Eurozone inflation undershooting the central bank’s target of 2% in the face of Trump’s tariffs

- Rehn didn’t rule out the possibility of interest rates sliding below the neutral rate. "We must analyse all options with an open mind and not a priori rule out rate cuts below the neutral rate,” Rehn said at an event, Reuters reported.

- Separately, ECB official and Governor of the Bank of France François Villeroy de Galhau also emphasized the need for more interest rate cuts amid fears that Trump’s tariff policy could lead to an economic slowdown. “We still have room to lower interest rates," Villeroy de Galhau said after expressing confidence that inflation will return to the 2% target in a radio interview on Monday, Reuters reported.

- For more cues on the ECB’s monetary policy outlook, investors look to the Eurozone’s flash Q1 GDP and the Harmonized Index of Consumer Prices (HICP) data for April, which will be released on Wednesday and Friday, respectively.

- Meanwhile, Spain's GDP data for the January-March period has come in weaker than expected. The economy rose by 0.6% in the first quarter, missing expectations of 0.7% and the prior release of 0.8%. The Spain HICP data grew steadily by 2.2% year-on-year in April. On month, the inflation data rose at a moderate pace of 0.6%, compared to 0.7% growth seen in March.

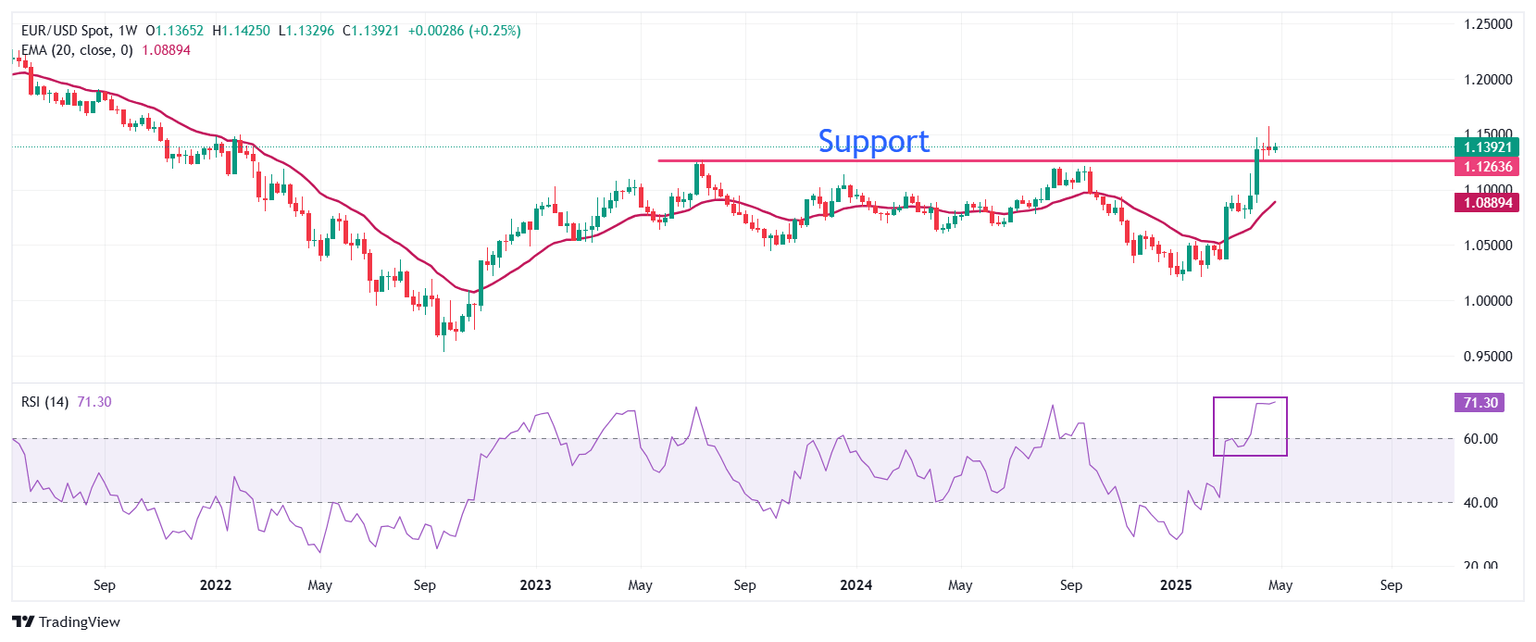

Technical Analysis: EUR/USD holds key 20-week EMA

EUR/USD ticks down around 1.1400 in Tuesday’s North American session. The outlook of the major currency pair remains bullish as the 20-week Exponential Moving Average (EMA) is sloping higher around 1.0890.

The 14-week Relative Strength Index (RSI) climbs to overbought levels above 70.00 in the weekly chart, which indicates a strong bullish momentum, but chances of some correction cannot be ruled out.

Looking up, the psychological level of 1.1500 will be the major resistance for the pair. Conversely, the July 2023 high of 1.1276 will be a key support for the Euro bulls.

Economic Indicator

Harmonized Index of Consumer Prices (YoY)

The Harmonized Index of Consumer Prices (HICP) measures changes in the prices of a representative basket of goods and services in the European Monetary Union. The HICP, released by Eurostat on a monthly basis, is harmonized because the same methodology is used across all member states and their contribution is weighted. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is seen as bullish for the Euro (EUR), while a low reading is seen as bearish.

Read more.Next release: Fri May 02, 2025 09:00 (Prel)

Frequency: Monthly

Consensus: 2.1%

Previous: 2.2%

Source: Eurostat

BRANDED CONTENT

Finding the right broker for trading EUR/USD is crucial, and we've identified the top choices for this major currency pair. Read about their unique features to make an informed decision.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.