EUR/USD tests key resistance as US-EU trade talks reach critical juncture and ECB decision nears

- EUR/USD tests key resistance as the ECB rate decision and policy outlook come into focus.

- US-EU trade talks near breaking point ahead of tariff deadline; US Dollar weakens.

- EUR/USD recovers above the descending trendline from the July high to trade near 1.1700 at the time of writing.

EUR/USD is trading marginally higher on Tuesday as investors continue to monitor developments in trade and economic policy.

With the Euro (EUR) remaining in a longer-term uptrend against the US Dollar (USD), EUR/USD is trading above 1.1700 at the time of writing.

With the Federal Reserve (Fed) currently in a blackout period ahead of the July 30 rate decision, focus has now shifted to ongoing trade tensions.

These factors have recently provided a tailwind for the EUR/USD pair despite Europe’s own economic concerns.

US-EU trade talks near breaking point ahead of tariff deadline

Trade tensions between the European Union and the United States remain fragile. With the August 1 tariff deadline swiftly approaching, trade negotiations have reached a critical stage.

With talks currently underway in Brussels and Washington, markets are growing increasingly weary. July 22–23 meetings mark the final working-group window ahead of the hard deadline.

If negotiations break down, the EU is preparing a package of retaliatory tariffs targeting key American exports, including digital services, aerospace products, and bourbon. This wouldn’t offset the impact from the 30% tariff rate threatened by US President Donald Trump.

However, it could continue to weigh on the US Dollar as more nations fail to solidify a deal that benefits both counterparts.

Moreover, sector-specific tariffs, such as those imposed on autos, steel, and aluminium, remain in effect. These have already been creeping into economic data releases, bringing this week’s agenda back into focus.

ECB rate decision and policy outlook in focus as EUR/USD tests key levels

Focus for the Euro is on Thursday’s docket, which includes the European Central Bank (ECB) rate decision. This will also be accompanied by the Monetary Policy Statement, which will provide additional insight into the potential trajectory of interest rates and the risks associated with the European economy.

With fundamental catalysts driving the broader narrative for EUR/USD, technical levels also play a significant role.

EUR/USD recovers above the descending trendline from the July high

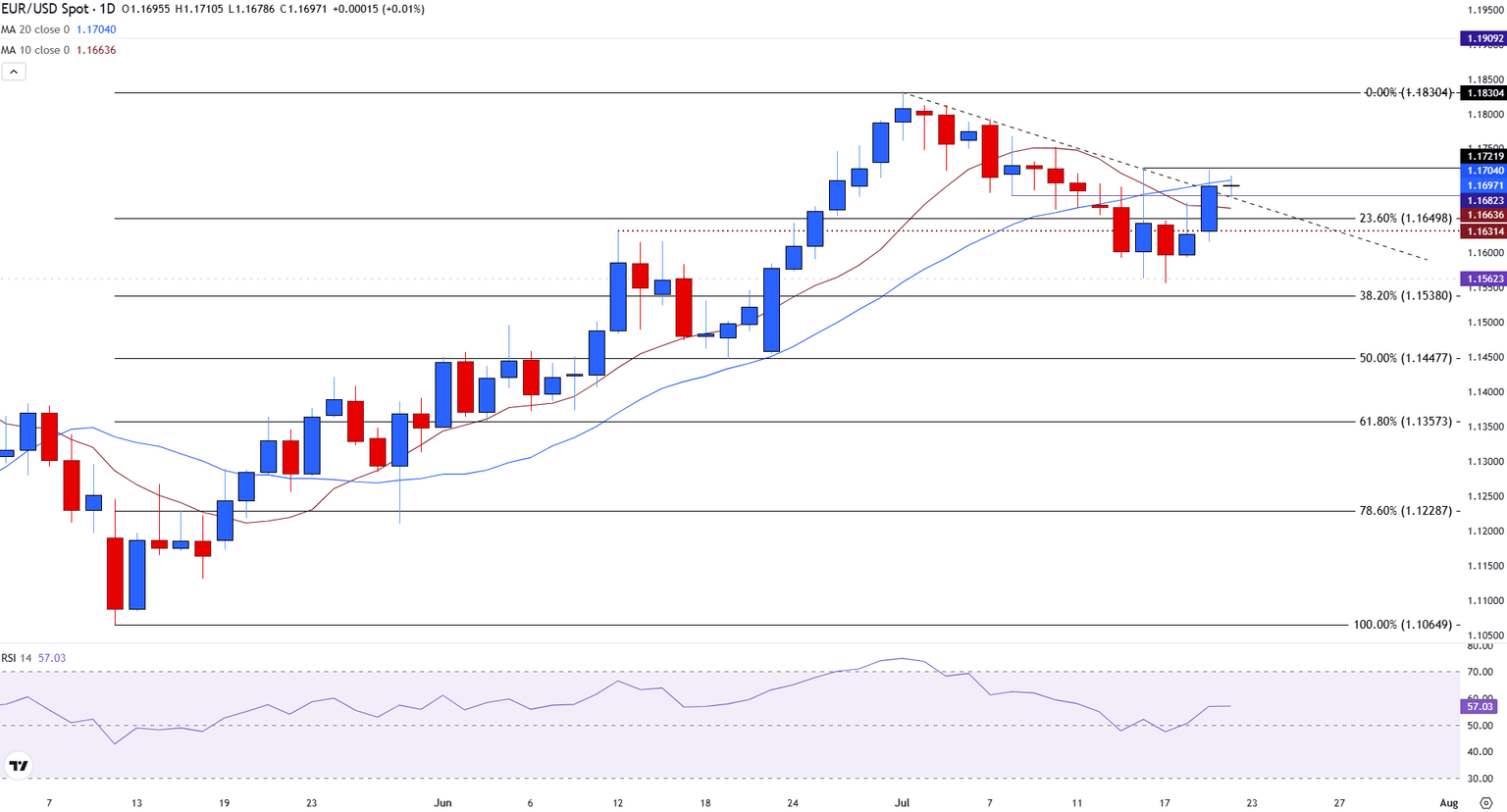

EUR/USD has recently recovered above the 23.6% Fibonacci retracement level of the May-July uptrend at 1.1649, allowing the pair to rise above the 10-day Simple Moving Average (SMA) at 1.1664.

As these levels now provide support for the imminent move, the 20-day SMA at 1.1704 is serving as near-term resistance.

EUR/USD daily chart

Above that is another key resistance zone near 1.1712, where the descending trendline from the July highs intersects with the 20-day SMA.

While the Relative Strength Index (RSI) at 57 suggests that momentum continues to trade with a bullish bias, a confirmed breakout above 1.1720 is needed to signal a shift toward further upside.

If cleared, the path opens toward the July swing high at 1.1830, followed by the 1.1900 psychological level.

On the downside, any failure to hold above 1.1649 could result in a decline toward the July low of 1.1556 and the 38.2% Fibo level at 1.1538. Overall, the short-term bias leans cautiously bullish, but a clean break above trendline resistance is key for confirmation.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.