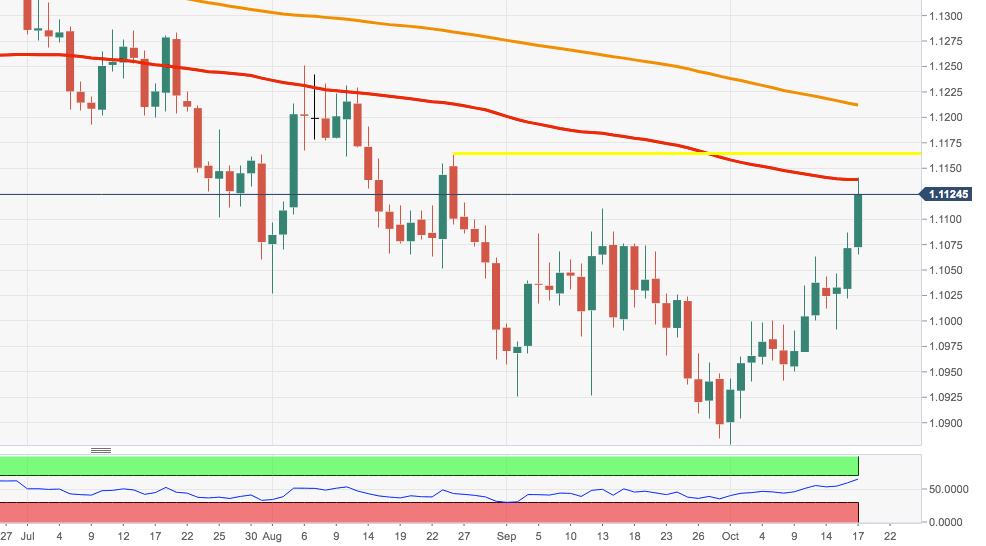

EUR/USD Technical Analysis: The up move faltered just ahead of the 100-day SMA near 1.1140

- EUR/USD has quickly climbed to fresh 2-month highs near 1.1140 boosted by news of a Brexit deal.

- While the 100-day SMA at 1.1140 should offer initial resistance, the continuation of the buying impetus could lift the pair to, initially, 1.1163 (high August 26th) ahead of the Fibo retracement at 1.1186.

- Further up emerges the critical 200-day SMA at 1.1210.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.