EUR/USD Technical Analysis: Looking to mark in a bullish run from 1.1500

- EUR/USD is marking in higher lows this week, and Friday's action is starting off with an early rally after turning around from 1.1490.

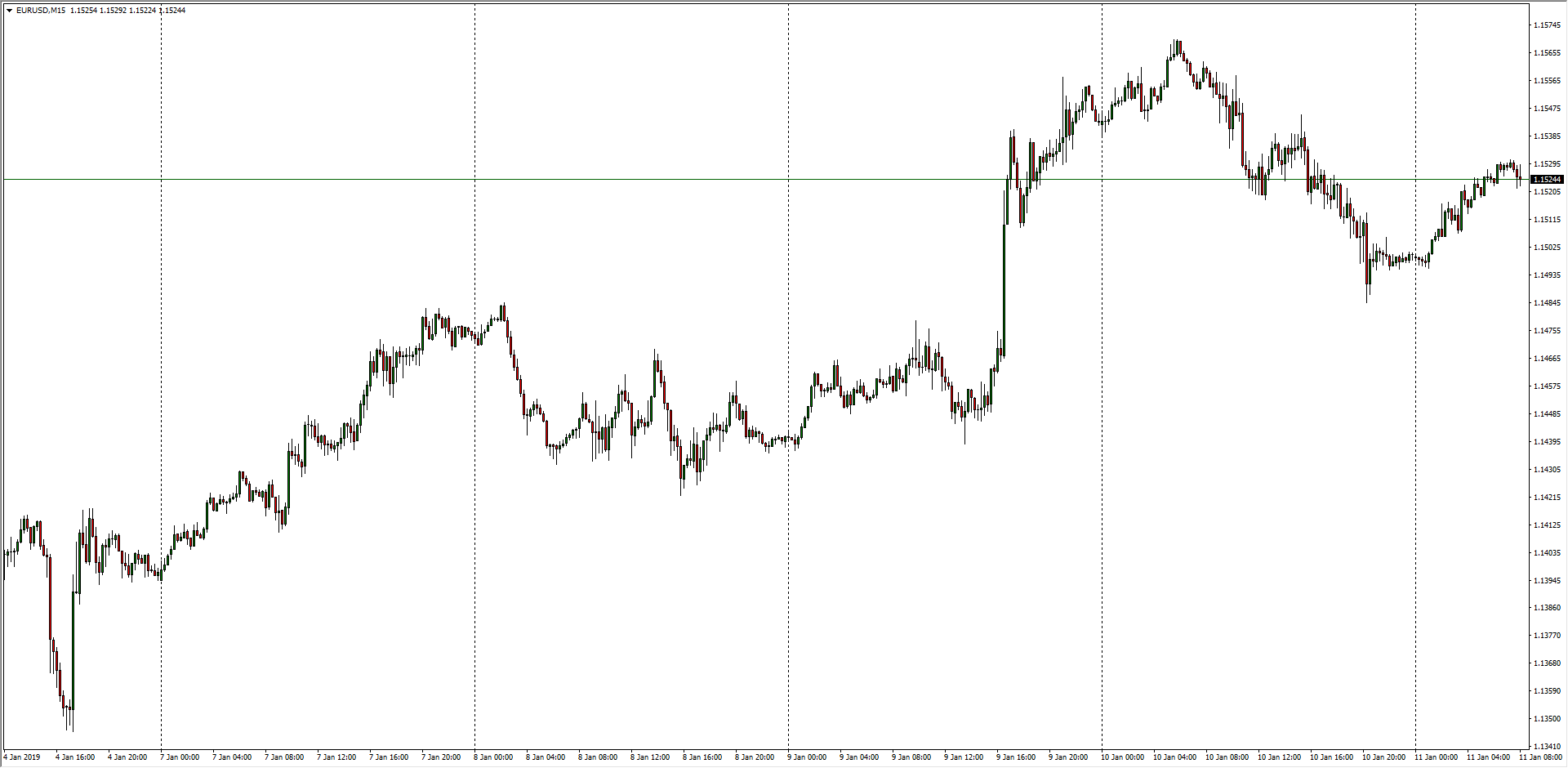

EUR/USD, 15-Minute

- Hourly candles show the Fiber pairing set for a continuation higher, but frequent downswings could see the pair struggle heading into the week's end as market sentiment hangs in the balance.

EUR/USD, 1-Hour

- This week's run-up in the Euro has broken through a significant resistance level near 1.1465, and bidders will be looking to send the Fiber into a meaningful bullish trend.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1528

Today Daily change: 30 pips

Today Daily change %: 0.261%

Today Daily Open: 1.1498

Trends:

Previous Daily SMA20: 1.1415

Previous Daily SMA50: 1.1383

Previous Daily SMA100: 1.1478

Previous Daily SMA200: 1.1631

Levels:

Previous Daily High: 1.1571

Previous Daily Low: 1.1485

Previous Weekly High: 1.1586

Previous Weekly Low: 1.1309

Previous Monthly High: 1.1486

Previous Monthly Low: 1.1269

Previous Daily Fibonacci 38.2%: 1.1518

Previous Daily Fibonacci 61.8%: 1.1538

Previous Daily Pivot Point S1: 1.1465

Previous Daily Pivot Point S2: 1.1431

Previous Daily Pivot Point S3: 1.1378

Previous Daily Pivot Point R1: 1.1552

Previous Daily Pivot Point R2: 1.1605

Previous Daily Pivot Point R3: 1.1638

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.