EUR/USD Technical Analysis: January set to continue rough sideways slide

- EUR/USD managed to escape this week's trading with no major changes, heading into Friday's final sessions virtually unchanged from last week's closing prices as the major pair cycles around 1.1400.

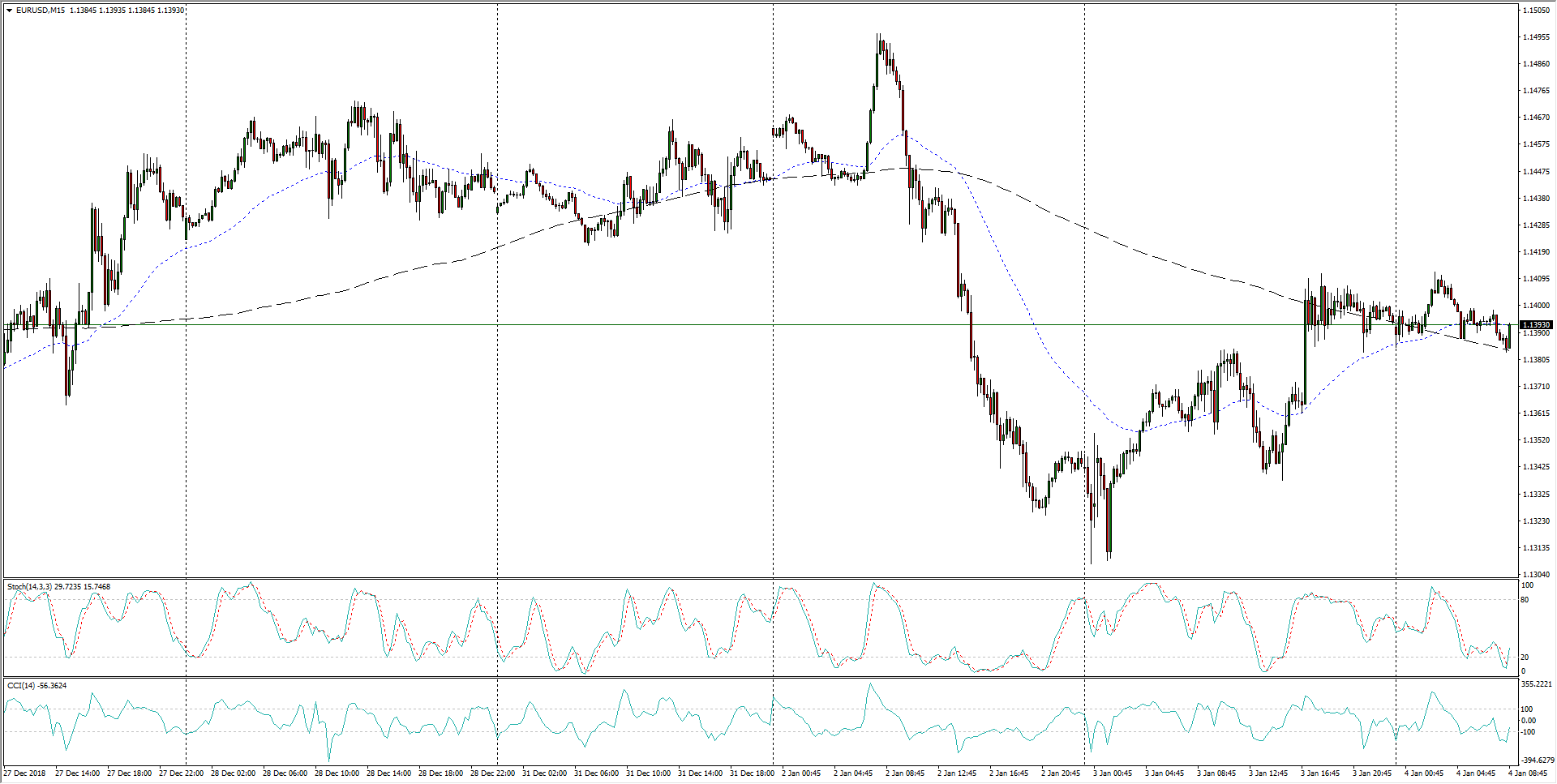

EUR/USD, 15-Minute

- December's trading sees the Fiber grinding sideways in choppy market action, but 1.1400 remains a key sticking point for EUR/USD as the two currencies battle it out at a major confluence point.

EUR/USD, 1-Hour

- EUR/USD's two-month-plus consolidation range continues into January, but the major pair is notable far off of September's highs near 1.1800.

EUR/USD, 4-Hour

EUR/USD

Overview:

Today Last Price: 1.1388

Today Daily change: -10 pips

Today Daily change %: -0.0877%

Today Daily Open: 1.1398

Trends:

Previous Daily SMA20: 1.1388

Previous Daily SMA50: 1.1372

Previous Daily SMA100: 1.148

Previous Daily SMA200: 1.1652

Levels:

Previous Daily High: 1.1412

Previous Daily Low: 1.1309

Previous Weekly High: 1.1478

Previous Weekly Low: 1.1343

Previous Monthly High: 1.1486

Previous Monthly Low: 1.1269

Previous Daily Fibonacci 38.2%: 1.1372

Previous Daily Fibonacci 61.8%: 1.1348

Previous Daily Pivot Point S1: 1.1335

Previous Daily Pivot Point S2: 1.1271

Previous Daily Pivot Point S3: 1.1232

Previous Daily Pivot Point R1: 1.1437

Previous Daily Pivot Point R2: 1.1475

Previous Daily Pivot Point R3: 1.1539

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.