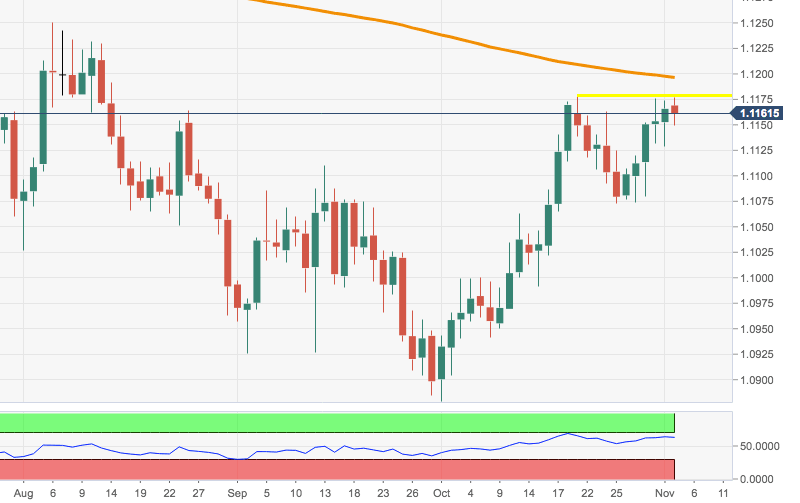

EUR/USD Technical Analysis: inability to surpass 1.1180 should give way to some consolidation

- The upside in EUR/USD continues to struggle in the proximity of October peaks in the 1.1180 region.

- A break above this area should put the critical 200-day SMA just below 1.1200 the figure back on the investors’ radar.

- On the broader view, the pair could move into a consolidative phase (ahead of the resumption of the downside) as long as it remains unable to clear the 1.1180 region in the short-term horizon.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.