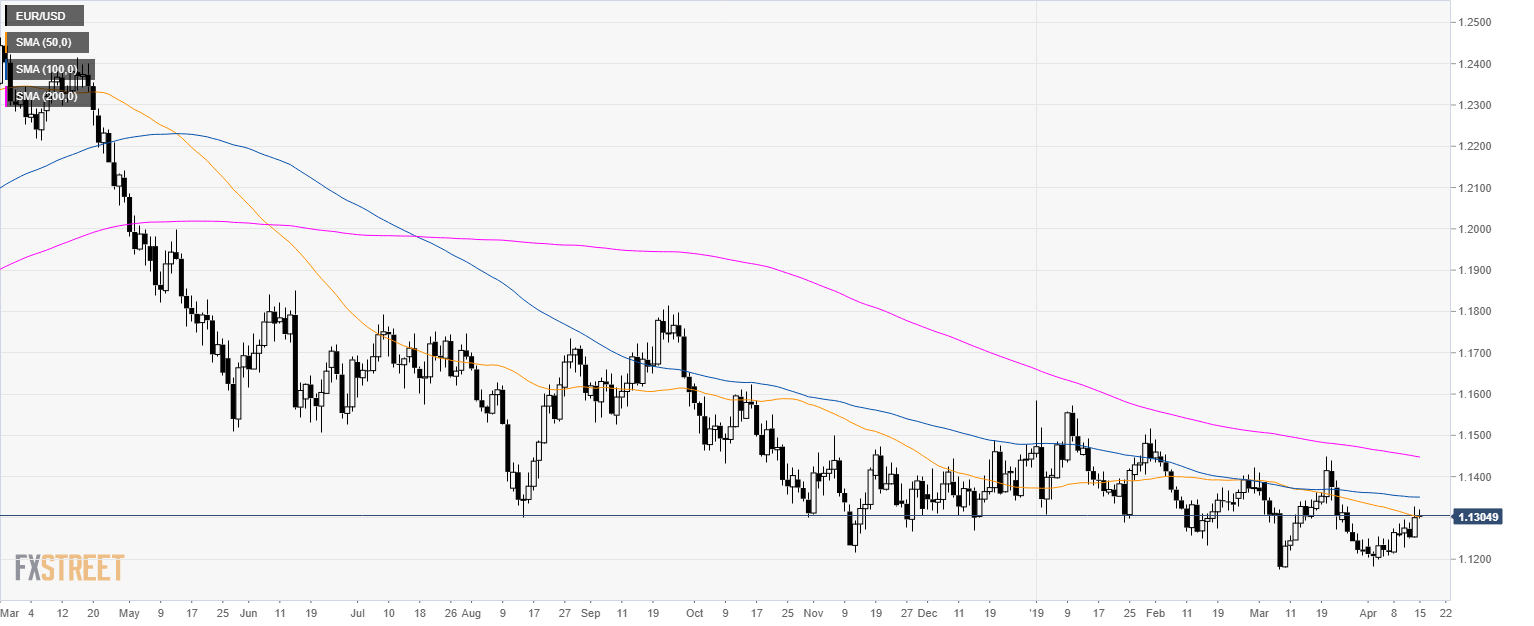

EUR/USD Technical Analysis: Fiber rolling into Asia near 1.1300 handle

EUR/USD daily chart

- EUR/USD is trading in a bear trend below its 200-day simple moving average (SMA).

- EUR/USD is trading above the main SMAs suggesting a bullish bias in the medium-term.

EUR/USD 30-minute chart

- EUR/USD is trading below the 50 SMA suggesting a correction down in the short-term.

- A break below 1.1300 can lead to 1.1280 and 1.1250 to the downside.

- Bulls would need to break the key resistance at 1.1330 followed by 1.1360 level.

Author

Flavio Tosti

Independent Analyst