EUR/USD struggling to hold onto 1.0660 heading into the Friday close

- The EUR/USD couldn’t extend recovery motivation after getting knocked back by Lagarde.

- Friday rebound facing downside pressure as US Dollar maintains strength.

- Next week sees market movers on the cards with EU inflation figures, FOMC.

The EUR/USD is set to close out Friday’s trading on the back foot, testing the week’s lows near 1.0650 as the US Dollar (USD) catches a late-week bid, sending the broad dollar index higher.

ECB strips down the Euro at the top of the rate hike cycle

The European Central Bank (ECB) managed to swing a dovish rate call that saw the central bank raising their benchmark interest rates 25 basis points to bring the overnight deposit rate to 4%. Despite the rate hike, markets lurched and the Euro (EUR) slumped on the news as the ECB effectively announced the end of the current rate hike cycle without directly saying it.

While the ECB has left the door open for possible rate hikes in the future, ECB President Christine Lagarde poured cold water over the Euro, declaring that the ECB has shifted to determining how long rates should remain at current levels instead of how much they should change.

Expectations of further rate hikes from the ECB have entirely evaporated in markets and investors are now anticipating the first rate cut to come from the European Union’s central bank in March of next year.

On the US side, the economic calendar did not disappoint, sending the Greenback (USD) higher at regular intervals as US data continues to surprise to the upside.

US retail sales figures for August beat expectations, printing at 0.6% against the forecast 0.2%, and climbing over the revised-upwards previous figure of 0.5%. The US economy appears to be healthy, and is shrugging off concerns of an impending recession. The “soft landing” narrative that has undershot markets recently appears to be receding as the US consumer segment appears to be in a healthy position.

EU inflation, US FOMC on the docket for next week

Next week sees EU inflation figures due on Tuesday, with the Harmonized Index of Consumer Prices (CPI) for August forecast to print in-line with the previous period. Pan-European inflation last came in at 0.3%, and investors are expecting a repeat showing. Inflation still remains a stubborn concern, and an excessive beat on the headline could see investors scurrying for safety.

On the US side it’s another ‘all eyes on the Federal Reserve (Fed)’ week, with the Fed’s Federal Open Market Committee broadly expected to keep the US benchmark interest rate steady at 5.5%, though inflation concerns sees markets still bracing for further hikes into the end of the year.

Thursday will also see US jobless claims and Friday will deliver preliminary EU manufacturing and services Purchasing Manager Indexes (PMI), followed by the US iteration of the same data publication later in the day.

EUR/USD technical outlook

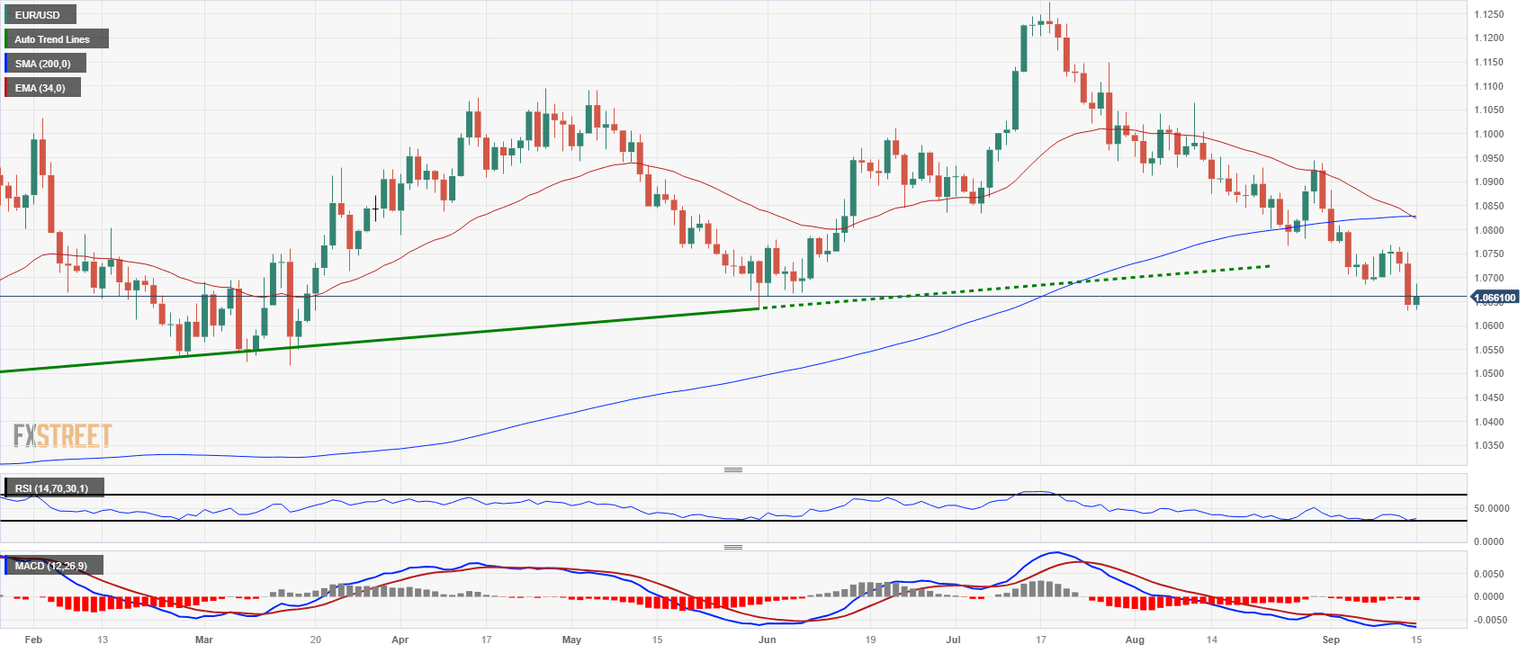

The Euro is set to close in the red for the ninth consecutive week, trading into four-month lows just north of the 1.0650 handle. Friday saw some bullish recovery for the Euro before broader US Dollar flows sent the pair back towards the day’s opening prices.

Daily candlesticks have drifted below the 200-day Simple Moving Average (SMA), and bidders will be keeping an eye on the 14-day Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) histogram indicators, both of which are flashing oversold conditions.

The 34-day Exponential Moving Average (EMA) is poised to confirm a bearish cross of the 200-day SMA just below 1.0850, and a series of lower highs sees the EUR/USD using the bearish-leaning 34-EMA as descending resistance further down the charts.

EUR/USD daily chart

EUR/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.