EUR/USD struggles to hold gains, set for weekly loss as it trades below 1.0700

- EUR/USD trades at 1.0699, up 0.03%, but set to finish the week down 0.69% as Wall Street shows a mixed performance.

- German inflation meets expectations at 6.1% YoY, but looming technical recession adds uncertainty ahead of ECB’s September 14 meeting.

- Fed officials show a split stance on monetary policy, adding complexity to the EUR/USD outlook as traders await key economic indicators next week.

The Euro (EUR) gave back earlier gains achieved vs. the Greenback (USD) in the first hour of the Wall Street opening, which lifted the exchange rate towards its daily high at 1.0743, but the pair reversed its course. The EUR/USD is trading at 1.0699, registering minuscule gains of 0.03%, set to finish the week with losses of 0.69%.

Euro seesaws against the US Dollar as both currencies face a lack of decisive economic data, with eyes on upcoming ECB and Fed decisions

As the North American session advances, the EUR/USD loses steam. Wall Street is set to finish the session mixed, with the S&P 500 and the Nasdaq in the red, while the Dow Jones Industrial clings to minuscule gains.

A scarce economic docket from the Eurozone (EU) and the United States (US) kept the pair looking for direction, seesawing within a 40-pip range before the EUR/USD settled down at around current exchange rates. On the EU, Germany revealed its Harmonised Consumer Price Index (HICP) for August, with data coming as expected, at 6.1% YoY, while core HICP hit 6.1%.

Even though inflation stalled, a Reuters poll showed that analysts expect the European Central Bank (ECB) will keep rates unchanged at the upcoming September 14 meeting.

In the meantime, the IFO head of forecasts Timo Wollmershaeuser, noted that Germany’s economy would shrink in Q3 by 0.2%, which would trigger a technical recession, and according to him, they “are not expecting a dramatic” one.

Meanwhile, US business activity in the services segment picked up, while the jobs market remains tight, as Initial Jobless claims show. A few Federal Reserve officials moderated its hawkish tone, turning more cautious as the US central bank walks within a fine line of overtightening monetary policy, which could tip the US economy into a recession.

Regional Federal Reserve Presidents Collins, Williams, and Bostic took a more dovish approach. Contrarily, the Chicago Fed President, Austan Goolsbee, adopted a more neutral stance, while Lorie Logan from the Dallas Fed said the US central bank needs to be data-dependant but added that more rate hikes are required to curb inflation.

In the next week, the EU economic docket will feature the ZEW Economic Sentiment, the Inflation rate in France and Italy, Industrial Production in the latter, and the European Central Bank’s interest rate decision. On the flip side, the US agenda will feature inflation data, Retail Sales, unemployment claims, Industrial Production, and Consumer Sentiment from the University of Michigan.

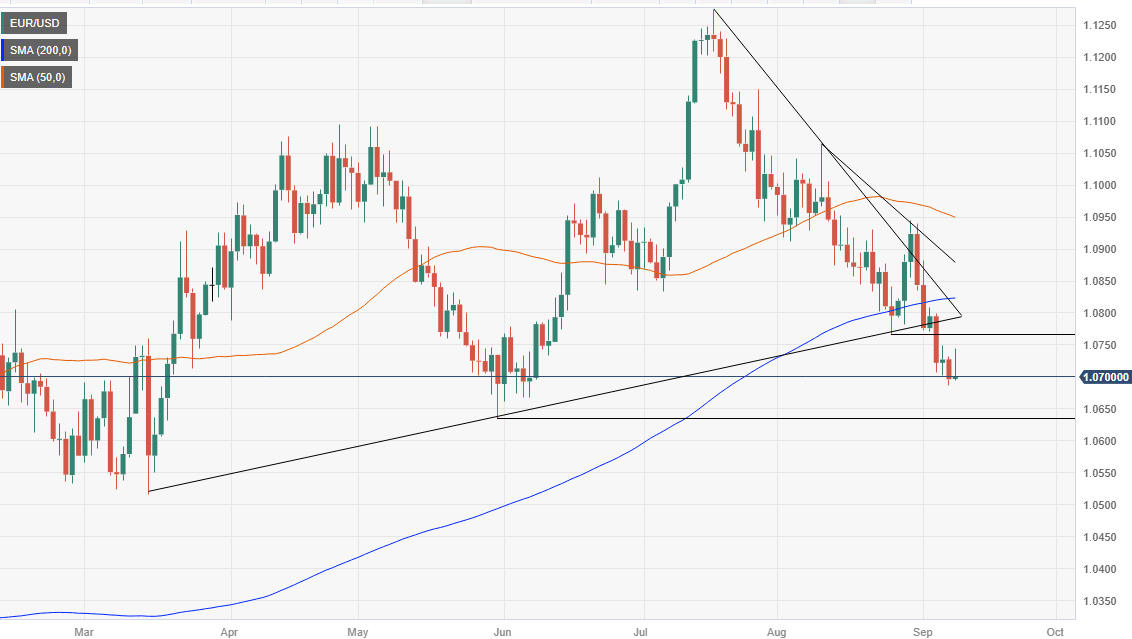

EUR/USD Price Analysis: Technical outlook

From a daily chart perspective, the pair remains neutral to a downward bias, set to test the May 31 swing low of 1.0635 if the EUR/USD achieves a daily close below the psychological 1.0700 mark. In that scenario, selling pressure could drive the major towards the former, followed by the 1.0600 figure and the March 15 daily low of 1.0516. On the other hand, if the EUR/USD finishes the week above 1.0700, an upward correction is expected, with buyers eyeing the 1.0750 area, followed by the September 5 high at 1.0798.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.