EUR/USD trims gains ahead of German CPI, US Job Openings figures

- The Euro treads water below 1.1750, halfway through last week's range.

- Concerns of a potential shutdown of the US government keep the US Dollar on the defensive.

- Downbeat Eurozone data and new US tariffs are weighing on risk appetite, keeping Euro upside attempts limited.

EUR/USD trades with moderate gains right below the 1.1750 level at the time of writing on Tuesday. The pair bounced up from last week's lows of 1.1660 as the US Dollar (USD) tumbled on concerns of a highly likely US government closure on Wednesday at 04:01 GMT, but the dismal market mood and weak Eurozone economic data are keeping Euro (EUR) bulls in check.

A meeting between US President Donald Trump and bipartisan congressional leaders on Monday ended without progress, as widely expected, and US Vice President JD Vance affirmed that the government is heading for a shutdown. The closure of the government will delay macroeconomic releases from the US Labour and Commerce Departments, including the key Nonfarm Payrolls (NFP) report on Friday, and is highly likely to weigh on economic growth.

Apart from that, Trump further soured market sentiment on Monday by announcing a new salvo on US tariffs. A 10% tariff on imports of softwood and a 25% levy on kitchen cabinets, vanities, and upholstered foreign furniture will be introduced on October 14, and will join the tariffs on trucks and branded pharmaceuticals that come into effect on Wednesday.

In the Eurozone, Retail Sales contracted in Germany for the second consecutive month in August, and the Unemployment increased beyond expectations, although the jobless rate remained steady, at 6.3%. The focus is now on the preliminary Consumer Prices Index (CPI) for September, ahead of a speech by European Central Bank (ECB) President Christine Lagarde. In the US, the highlight of the day will be the JOLTS Job Openings and August's Consumer Confidence data.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.09% | 0.04% | -0.40% | 0.07% | -0.43% | -0.24% | 0.04% | |

| EUR | 0.09% | 0.10% | -0.31% | 0.14% | -0.34% | -0.15% | 0.15% | |

| GBP | -0.04% | -0.10% | -0.40% | 0.06% | -0.46% | -0.25% | 0.05% | |

| JPY | 0.40% | 0.31% | 0.40% | 0.44% | -0.03% | 0.33% | 0.47% | |

| CAD | -0.07% | -0.14% | -0.06% | -0.44% | -0.50% | -0.29% | -0.00% | |

| AUD | 0.43% | 0.34% | 0.46% | 0.03% | 0.50% | 0.20% | 0.51% | |

| NZD | 0.24% | 0.15% | 0.25% | -0.33% | 0.29% | -0.20% | 0.31% | |

| CHF | -0.04% | -0.15% | -0.05% | -0.47% | 0.00% | -0.51% | -0.31% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Markets muted with potential US shutdown grabbing the focus

- The possibility of a US government shutdown keeps the US Dollar on its back foot, but President Trump's announcement of new trade tariffs has crushed the frail appetite for risk, keeping major FX crosses and the EUR/USD trapped within previous ranges.

- In Europe, macroeconomic data have been far from supportive. German Retail Sales disappointed earlier on Tuesday, contracting by 0.2% in August, following a 0.5% decline in July and against market expectations of a 0.6% rebound.

- At the same time, German Import Price Index dropped 0.5% further in August, more than twice the 0.2% decline forecasted by the market consensus, following July's 0.4% decline. Year-on-year, import prices dropped at a 1.5% pace, accelerating from the 1.4% seen in the previous month.

- Later on the day, the preliminary German Consumer Prices Index is expected to have remained growing at a steady 0.1% rate in September and to accelerate to a 2.3% yearly pace, from 2.2% in August.

- Eurozone figures released on Monday confirmed a mild improvement in the Consumer Confidence to a -14.9 reading in September, from -15.5 in August. Industrial Confidence edged down to -10.3, from -10.2 in August, although less than the -10.9 expected. Services Sentiment, on the other hand, fell to 3.6 in September, from 3.8 in August, beyond the consensus 3.7 reading.

- During the US Session, the focus will be on the JOLTS Job Openings, which are likely to attract particular interest for traders, as the US government shutdown is likely to delay Friday's NFP report. The market is bracing for a slight decline in Job vacancies, to 7.1 million in August, from 7.18 million in July.

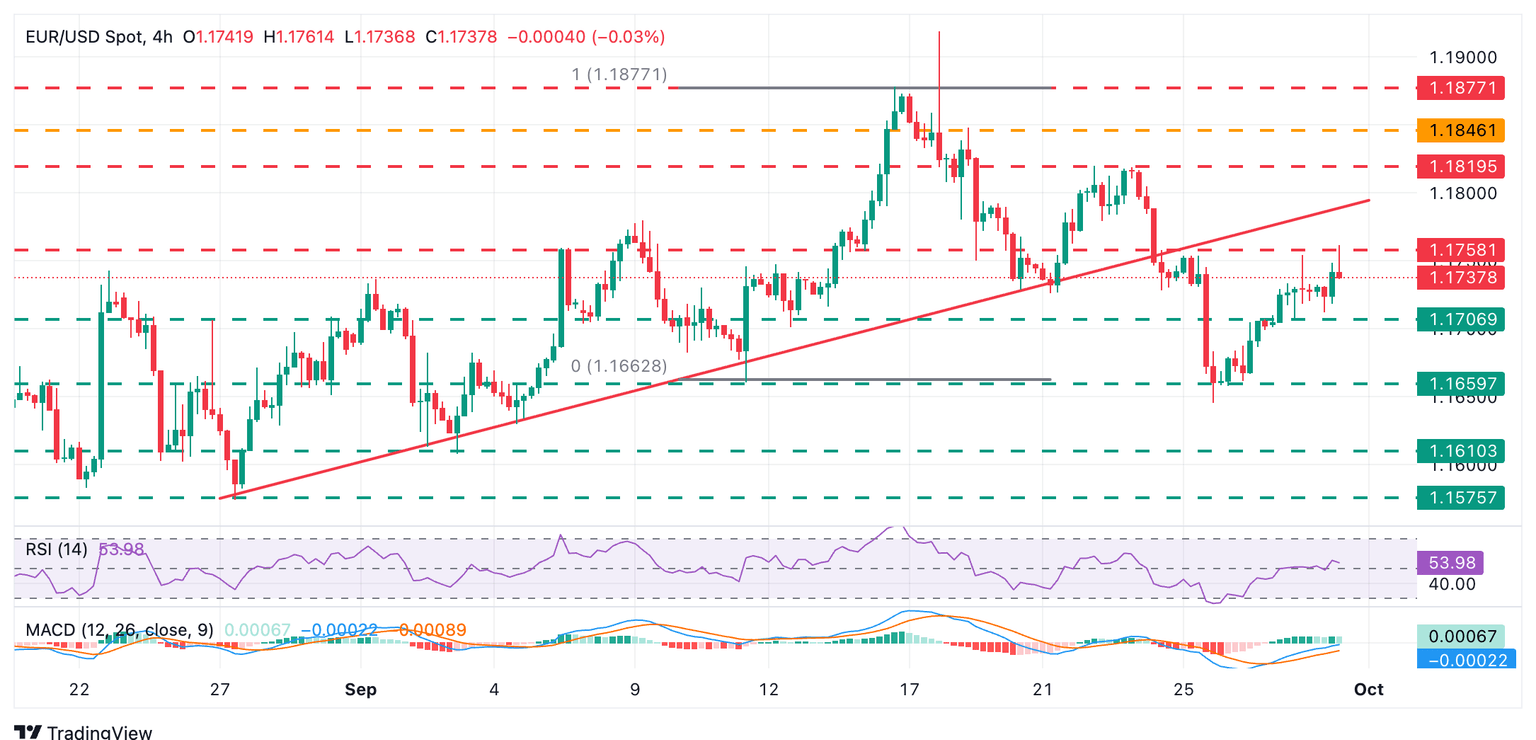

Technical Analysis: EUR/USD resistances are at 1.1755 and 1.1790

EUR/USD's technical picture shows a mild upside momentum. The 4-hour Relative Strength Index (RSI) has popped up above the 50 level, and the Moving Average Convergence Divergence (MACD) remains above the signal line, but the trend remains frail amid a cautious market mood.

To the upside, bulls were rejected at Thursday's high, right below 1.1755, on Monday. Beyond here, a reverse broken trendline, now at 1.1790, is likely to pose significant resistance. Bulls need to confirm above those levels to break the immediate bearish structure and shift the focus back to the September 23 and 24 highs, near 1.1820.

Intraday support at the 1.1710 area is holding bears for now, ahead of last week's lows at the 1.1645-1.1655 area. Further down, the September 2 and 3 lows, near 1.1610, and the August 27 low, at 1.1575, would be the next targets.

Economic Indicator

Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by the German statistics office Destatis on a monthly basis, measures the average price change for all goods and services purchased by households for consumption purposes. The CPI is the main indicator to measure inflation and changes in purchasing trends. The YoY reading compares prices in the reference month to a year earlier. Generally, a high reading is bullish for the Euro (EUR), while a low reading is bearish.

Read more.Next release: Tue Sep 30, 2025 12:00 (Prel)

Frequency: Monthly

Consensus: 2.3%

Previous: 2.2%

Economic Indicator

JOLTS Job Openings

JOLTS Job Openings is a survey done by the US Bureau of Labor Statistics to help measure job vacancies. It collects data from employers including retailers, manufacturers and different offices each month.

Read more.Next release: Tue Sep 30, 2025 14:00

Frequency: Monthly

Consensus: 7.2M

Previous: 7.181M

Source: US Bureau of Labor Statistics

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.