EUR/USD surges as US credit downgrade batters US Dollar

- EUR/USD gains sharply to near 1.1290 as the US Dollar has been battered sharply after Moody’s Rating downgraded US Sovereign Credit to Aa1.

- Traders expect that the Fed is unlikely to cut interest rates in the next two policy meetings.

- Investors await the announcement of a potential EU-UK trade deal.

EUR/USD trades 0.85% higher to near 1.1290 during North American trading hours on Monday. The major currency pair strengthens as the US Dollar (USD) underperforms its peers due to erosion in the United States (US) Sovereign Credit Rating. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, slides to near 100.20.

On Friday, Moody’s downgraded the long-term issuer and senior unsecured ratings of the US to Aa1 from Aaa. The one-notch downgrade in US Sovereign rating came on the back of mounting fiscal issues, which market experts believe the administration is unable to address in the near term.

US credit erosion has resulted in a sharp increase in Treasury yields, with investors discounting the risk premium. The 10-year US Treasury yields are up 2.3% to near 4.54%, at the time of writing. Additionally, financial market participants are worried that the so-called ‘big beautiful bill’ by the White House will further boost US bond yields.

Meanwhile, increasing optimism on a potential trade deal between the US and China is expected to support the US Dollar. Over the weekend, US President Donald Trump affirmed positively in an interview with Fox News after he was asked whether he would visit China for direct trade talks with President Xi Jinping.

During European trading hours, White House’s economic advisor, Kevin Hassett also expressed confidence about closing more trade deals this week, but didn't mention any trading partner. "I would not be surprised if there are more trade deals this week," Hassett said.

On the monetary policy front, traders are increasingly confident that the Federal Reserve (Fed) will not reduce interest rates in the next two policy meetings due to elevated consumer inflation expectations in the wake of import duties imposed by US President Trump. Meanwhile, Fed officials are also more inclined to bring consumer inflation expectations down than to act prematurely by reducing interest rates to provide interim support to potential economic shockwaves. "Right now, we [The Fed] see more risk of higher inflation than the employment side of the mandate," Atlanta Fed Bank President Raphael Bostic said in an interview with CNBC during North American trading hours.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the weakest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.83% | -0.60% | -0.13% | -0.19% | -0.54% | -0.39% | -0.27% | |

| EUR | 0.83% | -0.02% | 0.51% | 0.47% | 0.18% | 0.27% | 0.34% | |

| GBP | 0.60% | 0.02% | 0.25% | 0.50% | 0.20% | 0.29% | 0.36% | |

| JPY | 0.13% | -0.51% | -0.25% | -0.05% | -0.24% | -0.05% | -0.08% | |

| CAD | 0.19% | -0.47% | -0.50% | 0.05% | -0.34% | -0.20% | -0.13% | |

| AUD | 0.54% | -0.18% | -0.20% | 0.24% | 0.34% | 0.10% | 0.14% | |

| NZD | 0.39% | -0.27% | -0.29% | 0.05% | 0.20% | -0.10% | 0.07% | |

| CHF | 0.27% | -0.34% | -0.36% | 0.08% | 0.13% | -0.14% | -0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Daily digest market movers: EUR/USD performs strongly while ECB officials support more interest rate cuts

- Sheer strength in the EUR/USD pair is also driven by the Euro's (EUR) outperformance at the start of the week. The major currency performs strongly ahead of the announcement of a potential trade deal between the European Union (EU) and the United Kingdom (UK) later in the day, the first since the announcement of Brexit.

- The EU and the UK are expected to announce a trade pact across various industries, such as defense, agriculture, and energy. Strengthening economic ties between Europe’s neighbouring economies at a time when the Eurozone inflation has come down significantly, the European Central Bank (ECB) has lowered its interest rates substantially, and the German economy is on a path of fiscal reforms, which is favorable for the continent’s growth outlook.

- Additionally, the ECB is expected to reduce its interest rates further due to growing concerns over Eurozone growth and inflation. ECB policymaker and governor of the Belgian central bank, Pierre Wunsch, stated in an interview with the Financial Times (FT) over the weekend that interest rates would go slightly below 2% amid downside risks to inflation and growth. Wunsch warned that tariffs imposed by US President Trump have pushed “risks to inflation on the downside”. He ruled out the possibility of a “larger-than-usual interest rate cut” in the foreseeable future.

- The next major trigger for the Euro will be trade talks between Washington and Brussels. Meanwhile, EU trade commissioner Maroš Šefčovič stated in an interview with the FT over the weekend that the continent intends to buy US gas, weapons, and agricultural products to cut the US-EU trade deficit. Šefčovič signaled that he would meet US trade representative Jamieson Greer next month at an OECD ministerial meeting in Paris.

- Analysts at Capital Economics suspect that the trade deal between the EU and the US is imminent as Washington has not shown urgency in resolving trade disputes with the continent the way it has with China, Japan, and India. Another reason behind slower progress in US-EU trade talks is the difficulty for the continent in achieving consensus among the 27 member states.

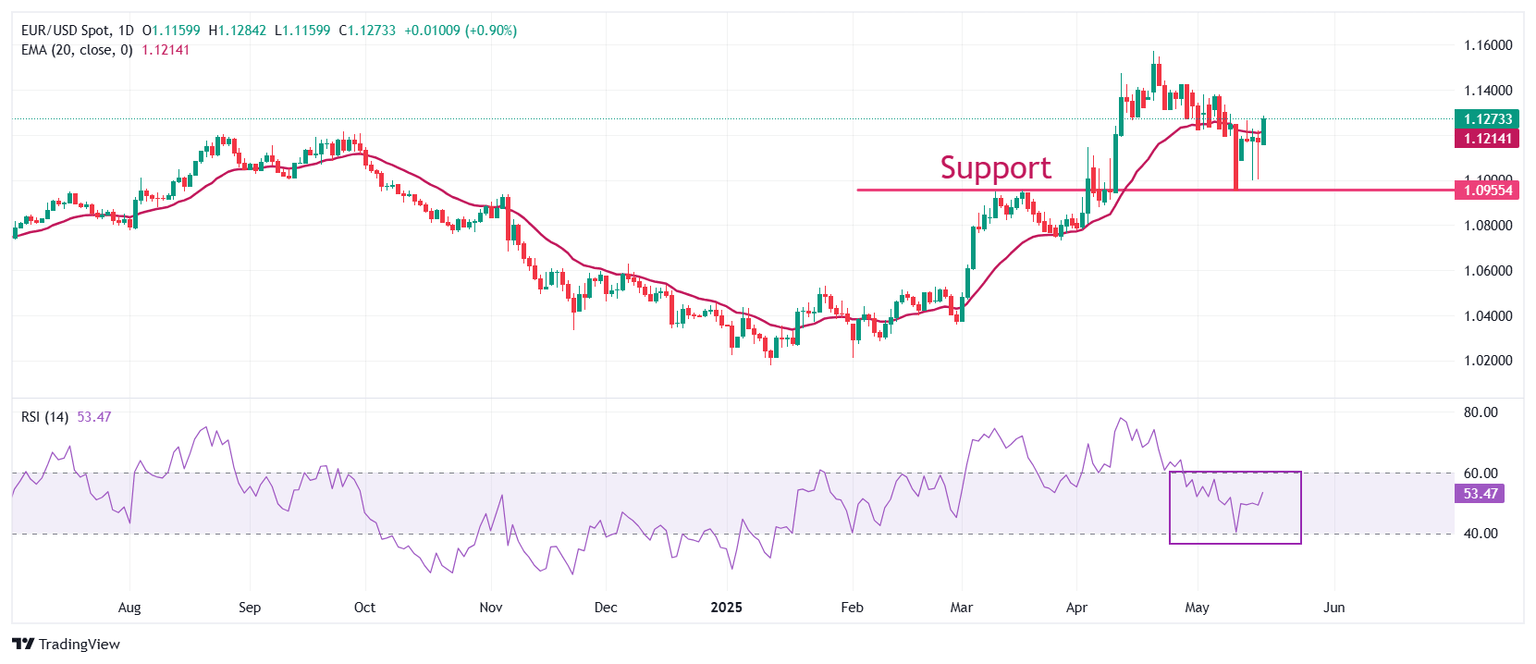

Technical Analysis: EUR/USD seeks more upside to near 1.1300

EUR/USD rallies to near 1.1270 at the start of the week. The near-term outlook of the pair has turned bullish as it manages to hold the 20-day Exponential Moving Average (EMA), which is around 1.1214.

The 14-period Relative Strength Index (RSI) recovers strongly above 50.00 after sliding to near 40.00, suggesting increasing bullish momentum.

Looking up, the April 28 high of 1.1425 will be the major resistance for the pair. Conversely, the psychological level of 1.1000 will be a key support for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.