US Dollar attempts to limit image dent with DXY down over 0.5%

- The US Dollar edges is in the red across the board with traders mulling the sustainability of the ballooning US debt.

- Fed's Williams closes the door for any rate cut odds before the summer.

- The US Dollar Index looks pressured, heading back to 100.00

The US Dollar Index (DXY), which tracks the performance of the US Dollar (USD) against six major currencies, stuck at the lower level for this Monday near 100.30 at the time of writing. The DXY remains subdued after several Federal Reserve (Fed) speakers came out saying that the outlook is too unclear and might take until the summer before showing clarity, limiting odds for a Fed rate cut before the summer months. The fact that Moody’s announced on Friday that it downgraded the United States' (US) credit rating to 'AA1' from 'AAA' and said in its report that “while we recognize the US’ significant economic and financial strengths, we believe these no longer fully counterbalance the decline in fiscal metrics,” Moody’s calls out what several analysts have already pointed out since US President Donald Trump enforced tariffs, Reuters reports.

It will be interesting to hear what the Federal Reserve (Fed) thinks from a slew of Fed speakers this Monday. With this downgrade from Moody’s, yields will increase as market participants demand a small risk premium before considering buying US debt. That could be a setback for the Fed if the central bank wants to cut its benchmark rate, with a possible dislocation between the actual monetary policy and where US rates are in the normal bidding market.

Daily digest market movers: Not before the summer at earliest

- An army of Fed speakers stands ready on an otherwise dry Monday in terms of US economic data:

- At 12:30 GMT, Federal Reserve Bank of Atlanta President Raphael Bostic spoke on a panel at the Atlanta Fed's 2025 Financial Markets Conference in Florida. Fed's Bostic said the downgrade could have a ripple effect through the economy. He went on by saying that another 3 to 6 months waiting time is needed to see how uncertainty settles. The longer tariff transition takes, the more it will impact consumer behavior, Bloomberg reports.

- At 12:45 GMT, Federal Reserve Bank Vice Chair Philip Jefferson delivered a speech about liquidity facilities at the Federal Reserve Bank of Atlanta in Florida. Fed's Jefferson said the Fed is well positioned, though added that the Fed is facing risk on both sides of its mandate: both price stability and on the jobs market.

- In that same timeframe, Federal Reserve Bank of New York President John Williams moderated a discussion at the MBA's Secondary and Capital Markets Conference in New York. Fed's Williams said it will take beyond June or July before a clearer outlook will be available. This closes the door for any rate cut odds before the summer.

- At 17:15 GMT, Federal Reserve Bank of Dallas President Lorie Logan delivers opening remarks at the 2025 Financial Markets Conference in Florida.

- Closing off at 17:30 GMT, President of the Federal Reserve Bank of Minneapolis Neel Kashkari participates in a conversation at the Minnesota Young American Leaders Program (MYALP) at the University of Minnesota.

- European equities are heading for positive numbers near their closing bell. US equities have dialed down on their losses, though fail to tie up with green results for this Monday for now.

- The CME FedWatch tool shows the chance of an interest rate cut by the Federal Reserve in June’s meeting at just 8.3%. Further ahead, the July 30 decision sees odds for rates being lower than current levels at 36.8%.

- The US 10-year yields trade around 4.51%, a steep rally from 4.3%, the low of the past Friday.

US Dollar Index Technical Analysis: Fed says not a chance

The US Dollar Index is losing its creditworthiness and its safe-haven status. Moody’s only confirmed what several analysts have long predicted since the Trump administration went all-in on tariffs. The US Dollar is no longer stable, and it is only a matter of time before that translates into the DXY.

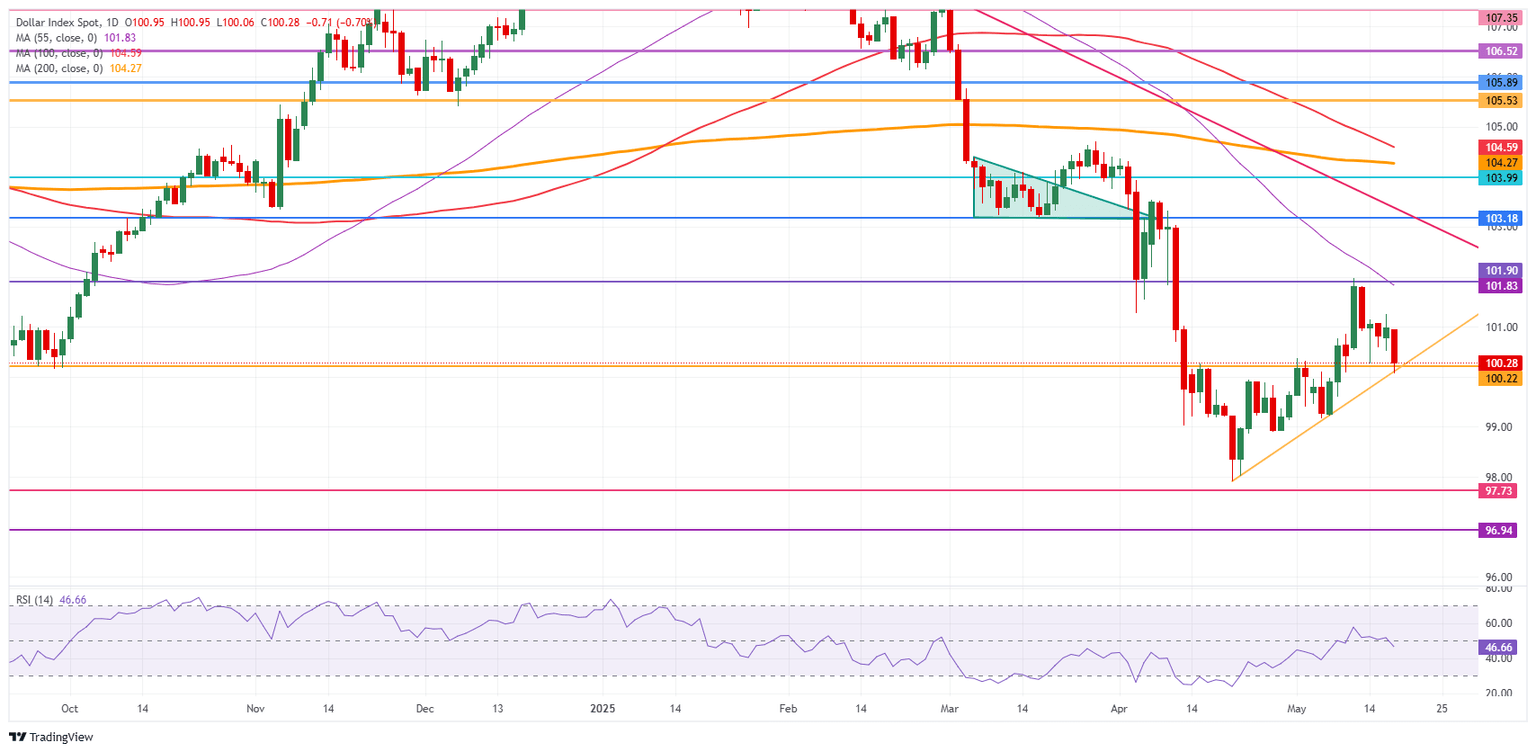

On the upside, 101.90 is the first big resistance again. It already acted as a pivotal level throughout December 2023 and as a base for the inverted head-and-shoulders (H&S) formation during the summer of 2024. The 55-day Simple Moving Average (SMA) at 101.94 reinforces this area as strong resistance. In case Dollar bulls push the DXY even higher, the 103.18 pivotal level comes into play.

On the other hand, the previous resistance at 100.22 is now acting as firm support, followed by the year-to-date low of 97.91 and the pivotal level of 97.73. Further below, a relatively thin technical support comes in at 96.94 before looking at the lower levels of this new price range. These would be at 95.25 and 94.56, meaning fresh lows not seen since 2022.

US Dollar Index: Daily Chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.