EUR/USD slumps as US Dollar extends recovery after Fed rate-cut bets fade

- EUR/USD dips to near 1.0830 as investors turn cautious ahead of Eurozone/US inflation data.

- ECB Knot advised the use of a gradual rate-cut approach due to dynamic components such as inflation, demand, and wage growth.

- The US Dollar bounces back as investors expect the Fed to start reducing interest rates in the last quarter of the year.

EUR/USD falls to 1.0830 in Wednesday’s New York session after failing to recapture a two-month high near 1.0900 on Tuesday. The near-term outlook of the major currency pair turns uncertain as investors shift focus to the release of the Eurozone preliminary Consumer Price Index (CPI) data for May and the United States (US) core Personal Consumption Expenditure Price Index (PCE) data for April, which will be published on Friday.

The Eurozone CPI and US core PCE inflation data will significantly influence market speculation for interest rate cuts by the European Central Bank (ECB) and the US Federal Reserve (Fed).

The Fed’s preferred inflation measure is estimated to have grown steadily on a monthly and annual basis at 0.3% and 2.8%, respectively.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, extends recovery to 104.80. The sharp recovery in the US Dollar is prompted by dismal market sentiment. Investors turn risk-averse after traders pare Fed rate cut bets for the September meeting as officials have been guiding to keep interest rates at their current levels until they see significant progress in the disinflation process. Currently, investors expect the Fed to start reducing interest rates from the last quarter of the year.

Daily digest market movers: EUR/USD remains on backfoot despite German HICP beats estimates

- EUR/USD drops sharply near 1.0830 despite the release of a slightly hot German CPI data for May. Monthly headline CPI grew at a slower pace of 0.1% from the estimates of 0.2%. In the same period, the harmonized inflation rose by 0.2% as expected. Annual headline inflation data grew in line with estimates of 2.4%. The pace at which headline inflation rose was higher than the prior reading of 2.2%. The harmonized inflation rose strongly by 2.8% from the consensus of 2.7% and the former reading of 2.4. The German inflation data will have a significant impact on the European Central Bank’s interest rate outlook as the nation is the largest contributor to the Eurozone’s Gross Domestic Product (GDP).

- Currently, the ECB is widely anticipated to roll back its restrictive interest rate framework, which has been maintained since July 2022. Therefore, investors are interested to know more about how far and fast the ECB will cut its key borrowing rates beyond June. ECB policymakers are reluctant to commit to any subsequent rate cut path and want to remain data-dependent.

- Earlier this week, ECB policymaker and French central bank governor François Villeroy de Galhau rebuffed suggestions of one rate cut each quarter and said, "I don't say that we should commit already in July, but let us keep our freedom on the timing and pace."

- On Tuesday, ECB governing council member and Dutch central bank chief Klaas Knot advised adopting a gradual rate-cut approach and making decisions on interest rates based on quarterly economic projections. Knot highlighted that March projections suggested three or four rate cuts would be appropriate this year. However, recent data showed that wage growth has elevated and the Manufacturing PMI has improved, which undermines the projected rate-cut path based on March’s data.

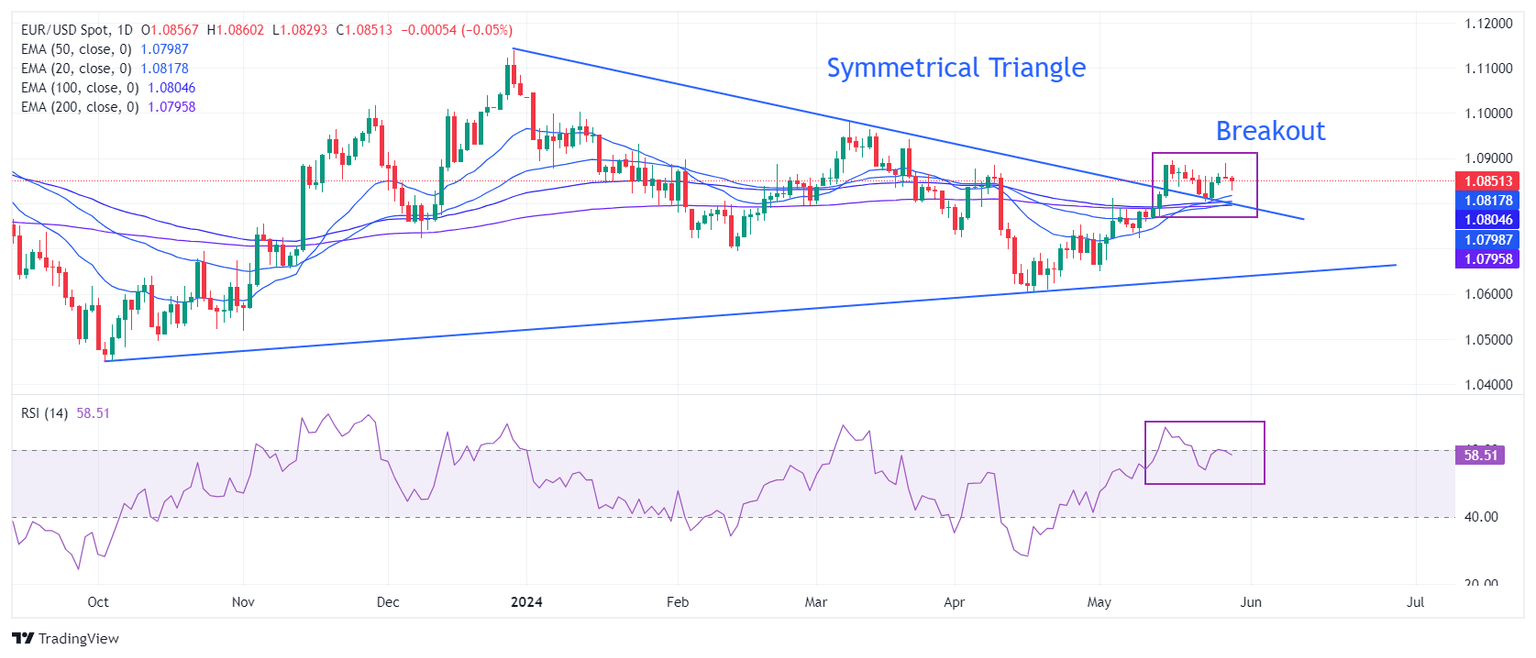

Technical Analysis: EUR/USD recovery stalls near 1.0900

EUR/USD faces sharp selling pressure as the US Dollar bounces back strongly. The major currency pair struggles to hold strength even though the breakout of the Symmetrical Triangle chart pattern formed on a daily timeframe.

The shared currency pair's near-term outlook remains firm, as it trades well above all short-to-long-term Exponential Moving Averages (EMAs).

The 14-period Relative Strength Index (RSI) has slipped into the 40.00-60.00 range, suggesting that the momentum, which was leaned toward the upside, has faded for now.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.