EUR/USD slumps as Trump sparks fresh trade-war fears

- EUR/USD drops 0.44% to 1.1718, hitting six-day low of 1.1686 before modest rebound.

- Trump imposes 25%–40% tariffs on South Korea, Japan, Malaysia and others.

- Reuters: EU exempt from latest tariff wave, aiding EUR/USD recovery.

- German Industrial Production posts slight improvement in May.

EUR/USD tumbled on Monday during the North American session amid a risk-off impulse, courtesy of an escalation in the trade war, as US President Donald Trump began sending letters with tariffs imposed on some countries. This boosted the US Dollar to the detriment of the shared currency, which trades at 1.1718, down 0.44%.

Trump announced tariffs of 25% on all Korean and Japanese products imported to the US. Additionally, he applied duties to Malaysia, Kazakhstan, Myanmar, Laos, and South Africa within the range of 25% to 40%. Once the headlines were known, the EUR/USD dipped to its lowest level in six days at 1.1686.

However, Reuters revealed that the European Union (EU) would not be receiving a letter setting out higher tariffs from the US, which boosted the EUR/USD back above 1.1700 to its current exchange rate.

Meanwhile, the US economic docket remains absent on Monday and Tuesday. Traders are eyeing the release of June’s Federal Open Market Committee (FOMC) Minutes. In the EU, German Industrial Production figures for May showed a slight improvement, as revealed by the Federal Statistics Office of Germany.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.63% | 0.40% | 1.34% | 0.58% | 1.07% | 1.12% | 0.63% | |

| EUR | -0.63% | -0.21% | 0.46% | -0.07% | 0.50% | 0.49% | -0.00% | |

| GBP | -0.40% | 0.21% | 0.66% | 0.16% | 0.73% | 0.71% | 0.09% | |

| JPY | -1.34% | -0.46% | -0.66% | -0.52% | -0.06% | 0.01% | -0.64% | |

| CAD | -0.58% | 0.07% | -0.16% | 0.52% | 0.50% | 0.54% | -0.08% | |

| AUD | -1.07% | -0.50% | -0.73% | 0.06% | -0.50% | 0.09% | -0.62% | |

| NZD | -1.12% | -0.49% | -0.71% | -0.01% | -0.54% | -0.09% | -0.61% | |

| CHF | -0.63% | 0.00% | -0.09% | 0.64% | 0.08% | 0.62% | 0.61% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The Dollar strengthens on risk-off mood; Euro tumbles

- The strength of the Greenback pressures the EUR/USD. The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, is up 0.56% at 97.53.

- The White House has sent a total of 7 letters to the following countries, with its corresponding tariffs: South Korea (25%), Japan (25%), Malaysia (25%), Kazakhstan (25%), Laos (40%), South Africa (30%) and Myanmar (40%). These levies will be applied on August 1.

- US President Donald Trump stated that the rates did not include “sectoral-specific tariffs.” Meanwhile, the White House announced that the 90-day deadline set on April 2's Liberation Day has been extended to August 1.

- The EU stated that there has been some progress on a framework trade deal with the United States (US), according to EU spokesman Olof Gill. He indicated that Ursula Von der Leyen held a call with Trump on Sunday, saying that “they had a good exchange.”

- German Industrial Production in May rose more than expected, increased 1.2% MoM, exceeding forecasts of 0%. On a yearly basis, it improved from April’s 1.6% plunge to 1% expansion. Franziska Palmas, senior Europe economist at Capital Economics, said, “The better-than-expected German industrial production figures for May are partly due to continued tariff front-running in the pharmaceuticals sector.”

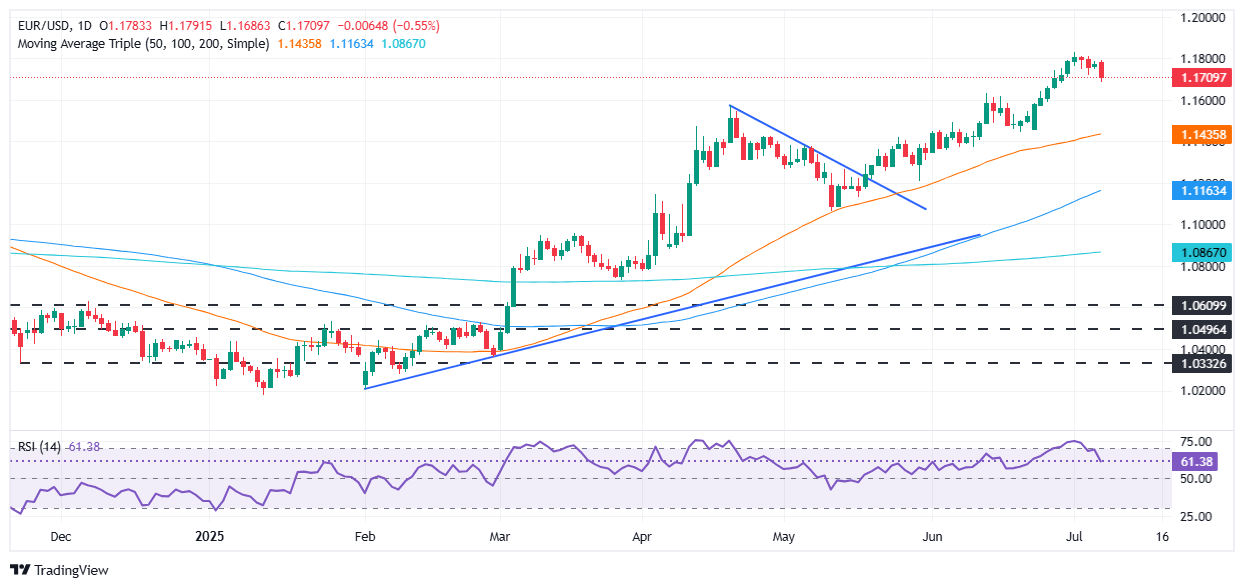

Euro technical outlook: EUR/USD drops, bears eye 1.1700

The EUR/USD edges lower on the daily chart, threatening to print a new seven-day low below the June 27 cycle low of 1.1680, which could clear the path to challenge 1.1650 and the 20-day Simple Moving Average (SMA) at 1.1622. Further downside is seen at 1.1600.

The Relative Strength Index (RSI) suggests that buyers are losing momentum as the RSI is falling steeply toward its neutral level.

Conversely, if EUR/USD stays above 1.1700, the next key resistance would be 1.1750, the 1.1800 mark, and the year-to-date (YTD) high of 1.1829.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.