EUR/USD cracks below 1.1400 on upbeat US data, soft French CPI

- The Euro drops to 1.1335 amid US Dollar rebound, diverging inflation paths and mixed ECB policy signals.

- US Consumer Confidence surges to 4-year high, boosting DXY above 99.50.

- France’s cooling inflation raises bets on ECB rate cuts despite hawkish pushback.

The EUR/USD pair retreats below 1.1400 for the second consecutive day, driven by a recovery in the US Dollar (USD) following an upbeat Consumer Confidence report. Additionally, soft inflation data in France undermined the shared currency, which trades on Tuesday at 1.1335, down over 0.40%.

Risk appetite has improved as market participants digested news that US President Donald Trump stated trade talks between the United States (US) and the European Union (EU) picked up some steam following his 50% tariff threats last Friday. Although he backpedaled, giving some room for negotiations, it remains to be seen if both parties reach an agreement before July 9.

Upbeat US Consumer Confidence data in May, as revealed by the Conference Board (CB), provided a leg down on the EUR/USD pair. The US Dollar Index (DXY), which tracks the value of the American currency against the other six, rises by over 0.62% to 99.54.

Other data in the US showed that Durable Goods Orders plunged in April, hitting their lowest level since October 2020.

Across the pond, France's inflation figures continued to show an improvement in the deflationary process, opening the door for further easing by the European Central Bank (ECB).

ECB’s Gediminas Simkus revealed that he sees scope for an “interest rate reduction in June.” Nevertheless, some voices at the ECB had turned slightly hawkish, with Robert Holzmann, an Austrian Central Bank member and an ECB member, stating in an interview with the Financial Times (FT) that he doesn’t see any reason to lower rates at the policy meetings in June and July.

Data from the entire bloc revealed that the EU Economic Sentiment Indicator improved for the first time in three months in May, in line with the German GfK Consumer Sentiment for June.

EUR/USD daily market movers: Undermined by solid US Consumer Confidence data, soft French inflation reading

- US Consumer Confidence in May rose by 98.0, the highest level seen in the last four years. Stephanie Guichard, senior economist at The Conference Board, said, “The rebound was already visible before the May 12 US-China trade deal but gained momentum afterward.”

- US Durable Goods Orders disappointed investors, plummeting 6.3% MoM in April, down from March's 7.6% increase but exceeding forecasts of a 7.8% contraction.

- France’s Harmonized Index of Consumer Price (HICP) rose 0.6% YoY in May, down from a 0.9% increase in April and below estimates of 0.9%. This was the lowest reading since December 2020.

- The Gfk Consumer Sentiment Index in June improved from -20.8 to -19.9 but missed forecasts of -19. The rise was driven by an improvement in income prospects, although there is an increased willingness to save, rather than spend, which could dampen the prospects for Retail Sales.

- On Monday, European Central Bank (ECB) President Christine Lagarde stated the Euro could become a viable alternative to the US Dollar as the world’s reserve currency. However, she noted this could happen if governments strengthened the bloc's financial and security architecture.

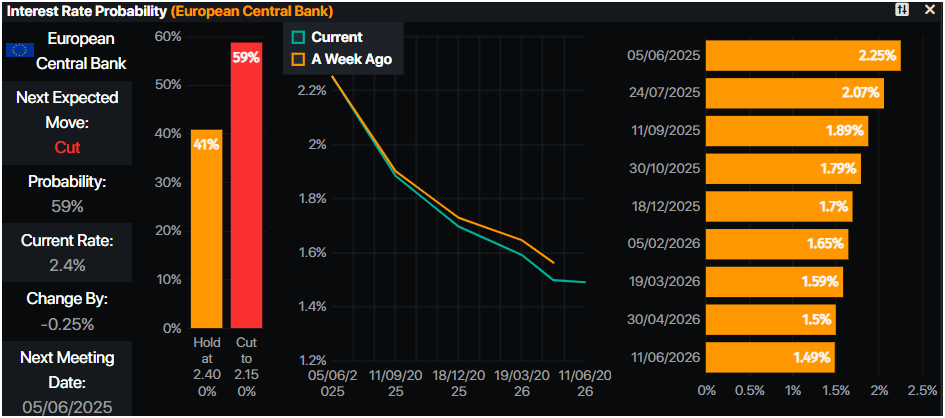

- Financial market players had fully priced in that the ECB would reduce its Deposit Facility Rate by 25 basis points (bps) to 2% at the monetary policy meeting next week.

Source: Prime Market Terminal

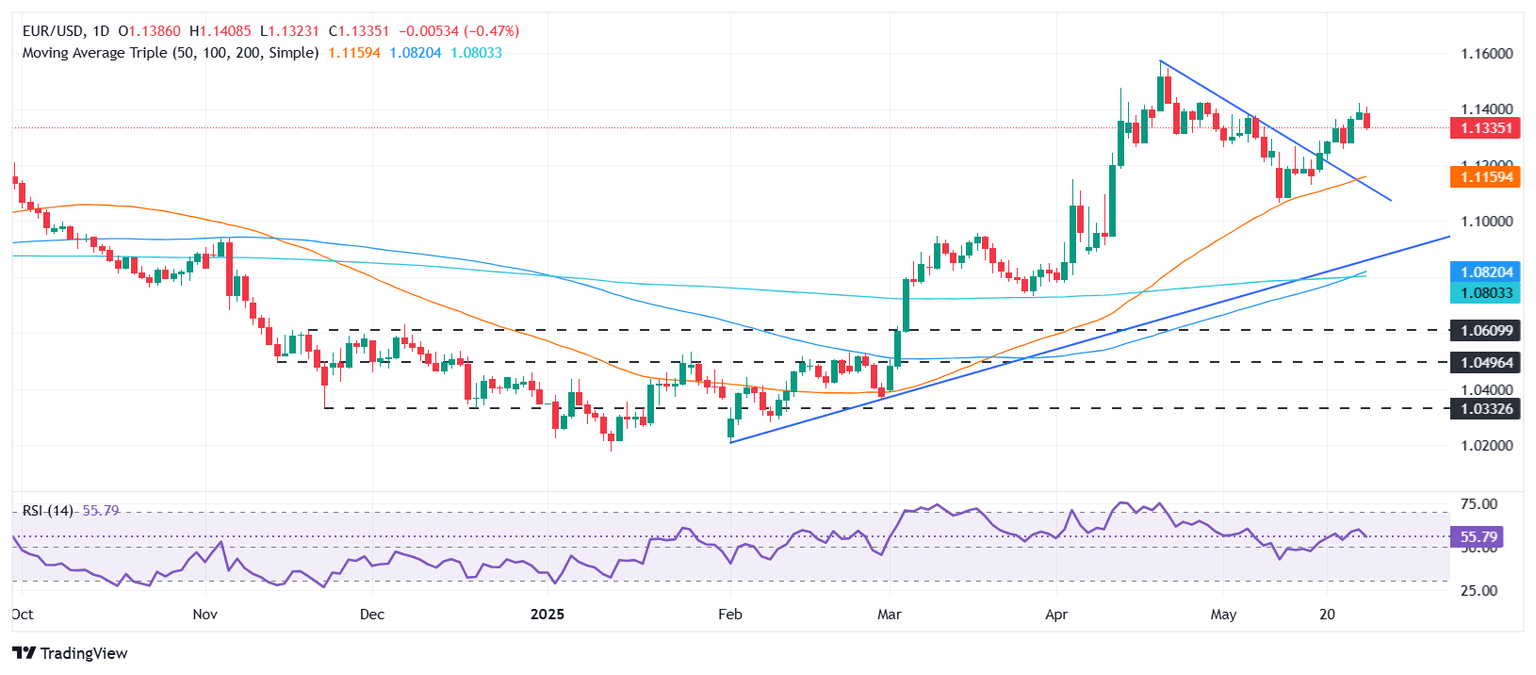

EUR/USD technical outlook: Struggles at 1.14, dives beneath 1.1350 with eyes on 1.13

EUR/USD is upwardly biased, although it faced stiff resistance at 1.1400. Monday’s price action formed an ‘inverted hammer’, a candlestick pattern that indicates sellers may be gaining control. However, further confirmation was needed at the time. As of writing, the pair has fallen below Monday’s low of 1.1358, opening the door for lower prices.

A daily close below the latter could send EUR/USD diving towards the 1.1300 figure. Further downside is seen at the 20-day Simple Moving Average (SMA) at 1.1267, followed by the 1.1200 mark.

On the upside, if EUR/USD stays above 1.1375, the next resistance would be the May 26 high of 1.1418, followed by 1.1450 and 1.1500.

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.