EUR/USD slides as Dollar gains strength ahead of Fed minutes and Jackson Hole

- EUR/USD down 0.30%, pressured by Dollar strength as markets await Fed minutes and Jackson Hole.

- Quick Ukraine war resolution could stabilize energy markets, support Eurozone growth, and aid Euro.

- EU data-heavy week ahead: PMIs, inflation, and German GDP likely to sway sentiment and ECB outlook.

EUR/USD begins the week on a lower note, down 0.30% as traders await the outcome of the meeting between US President Donald Trump and Ukraine’s Volodymyr Zelenskiy, after the former met with his Russian counterpart Vladimir Putin last Friday. The pair trades at 1.1669 after hitting a daily high of 1.1715.

Positive news emerged from the meeting between Trump, Zelensky, and European leaders in the White House. Trump said that the day has been successful so far as Russia agreed to security guarantees, though in exchange for some territory. He answered German Chancellor Merz’s demands about a ceasefire, that the last six conflicts that ended due to Washington’s involvement were settled despite the lack of a truce.

Trump added that he would like to arrange a tri-lateral meeting with the US, Ukraine, and Russia.

A quick resolution of the war would be bullish for the Euro as the European Union (EU) is a major importer of energy products. This could stabilize Oil and Natural Gas products to the benefit of the whole bloc.

Aside from this, traders are also eyeing the release of the latest Federal Reserve (Fed) monetary policy minutes, along with the Fed Chair Jerome Powell's commencement speech at the Jackson Hole Symposium.

Across the pond, the EU’s economic docket will feature the release of inflation figures in the EU, HCOB Flash PMIs for August, and Germany's Gross Domestic Product (GDP) figures.

Euro PRICE Last 7 days

The table below shows the percentage change of Euro (EUR) against listed major currencies last 7 days. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.13% | -0.42% | 0.15% | 0.36% | 0.45% | 0.64% | -0.11% | |

| EUR | 0.13% | -0.32% | 0.29% | 0.49% | 0.58% | 0.72% | 0.02% | |

| GBP | 0.42% | 0.32% | 0.56% | 0.81% | 0.92% | 1.04% | 0.27% | |

| JPY | -0.15% | -0.29% | -0.56% | 0.24% | 0.34% | 0.55% | -0.18% | |

| CAD | -0.36% | -0.49% | -0.81% | -0.24% | 0.10% | 0.23% | -0.51% | |

| AUD | -0.45% | -0.58% | -0.92% | -0.34% | -0.10% | 0.14% | -0.62% | |

| NZD | -0.64% | -0.72% | -1.04% | -0.55% | -0.23% | -0.14% | -0.76% | |

| CHF | 0.11% | -0.02% | -0.27% | 0.18% | 0.51% | 0.62% | 0.76% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: EUR/USD dives as the Greenback strengthens

- Euro’s rally halted as the US Dollar advances. The US Dollar Index, which measures the buck’s performance against a basket of peers, is up 0.30% daily to 98.13.

- The EUR/USD direction is directly influenced by monetary policy divergence between the Fed and the European Central Bank (ECB). Expectations that the Fed would reduce rates at the September meeting dropped from around 95% to 86% following a red-hot US Producer Price Index (PPI) report. Conversely, the ECB is expected to hold rates unchanged, with odds standing at 92% odds for the ECB to keep rates unchanged, and a slim 8% chance of a 25 basis points (bps) rate cut.

- Last Friday, strong Retail Sales in the US showed that consumer spending remains solid. Nevertheless, consumers had grown less optimistic about the economic outlook, as Consumer Sentiment fell from 61.7 in July to 58.6 in August. Inflation was cited as the primary driver of the sudden change in consumers' mood as one-year inflation expectations rose to 4.9% from 4.5% and the five-year outlook climbed to 3.9% from 3.4%.

- Given the fundamental backdrop, traders diminished the odds of a jumbo rate cut by the Fed. Instead, the chances of the central bank holding rates unchanged had begun to be priced in.

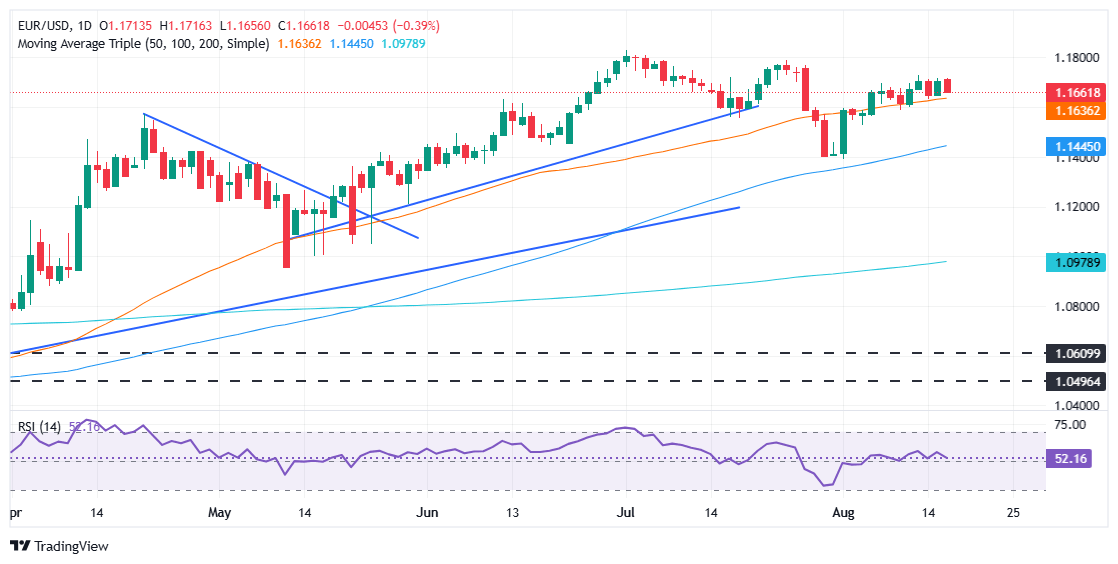

Technical outlook: EUR/USD tumbles below 1.1700, sellers eye 1.1600

The EUR/USD uptrend stalled on Monday, with traders unable to hold gains above the 1.1700 figure, clearing the path for a pullback towards the 1.1650 mark. If traders clear the latter, they could challenge the 50-day Simple Moving Average (SMA) at 1.1640, ahead of the 20-day SMA at 1.1628. On further weakness, the pair could reach 1.1600 and the 100-day SMA at 1.1460.

On the flipside, if buyers push prices higher, they could test 1.1700. On further strength, key resistance lies overhead, on July 24 high at 1.1788, the 1.1800 handle and the year-to-date peak at 1.1829.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.