EUR/USD extends losses with the US Dollar firmer ahead of the US ADP report

- The Euro is pulling lower as the US Dollar bounces up from long-term lows.

- A cautious Powell and strong US Job Openings have provided some support for the Greenback.

- EUR/USD is under growing bearish momentum after rejection above 1.1800.

The EUR/USD pair is accelerating its reversal from multi-year lows at 1.1830 and trades near 1.175 ahead of Wednesday's US session opening. An unexpected increase in the Eurozone unemployment in May and dovish comments from ECB speakers have increased bearish pressure on the Euro (EUR).

The US Dollar (USD), on the other hand, is a tad firmer, following strong US employment data and an unyielding Federal Reserve (Fed) Chairman Jerome Powell, who maintained his "wait-and-see" stance at the European Central Bank's (ECB) Forum on Central Banking in Sintra.

On Tuesday, US JOLTS Job Openings showed a larger-than-expected increment in June, endorsing Powell's cautious stance, and the ISM Manufacturing PMI improved beyond expectations, with the Production sub-index returning to expansion levels for the first time since February, and prices increasing. These figures have given a fresh boost to the US Dollar.

Eurozone data was also positive on Tuesday, as German manufacturing activity improved, and German unemployment increased less than forecasted. Additionally, the Eurozone Consumer Price Index (CPI) report confirmed that inflation remains steady near the ECB's target. All in all, supportive data for the Euro.

Later on Wednesday. European Central Bank (ECB) President, Christine Lagarde, will will speak again at the Sintra Summit. In the US, the focus will be on the ADP Employment Change for June, which will frame Thursday's Nonfarm Payrolls (NFP) release.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.32% | 0.37% | -0.01% | 0.15% | 0.27% | 0.15% | |

| EUR | -0.25% | 0.03% | 0.10% | -0.29% | -0.08% | 0.13% | -0.09% | |

| GBP | -0.32% | -0.03% | 0.08% | -0.34% | -0.17% | 0.07% | -0.16% | |

| JPY | -0.37% | -0.10% | -0.08% | -0.37% | -0.23% | -0.06% | -0.22% | |

| CAD | 0.00% | 0.29% | 0.34% | 0.37% | 0.17% | 0.39% | 0.17% | |

| AUD | -0.15% | 0.08% | 0.17% | 0.23% | -0.17% | 0.27% | 0.02% | |

| NZD | -0.27% | -0.13% | -0.07% | 0.06% | -0.39% | -0.27% | -0.22% | |

| CHF | -0.15% | 0.09% | 0.16% | 0.22% | -0.17% | -0.02% | 0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Strong US data and a firm Powell give some air to the USD

- Fed Chairman Jerome Powell dismissed the attacks from President Trump at his speech in Sintra and maintained that the central bank needs to "wait and learn more" about the potential impact of trade tariffs on inflation before cutting interest rates.

- On Tuesday, the US Bureau of Labour Statistics reported a 7.769 million in the JOLTS Job Openings, beating expectations of a 7.3 million reading. These figures highlight the resilience of the labour market and leave investors looking to Thursday's Nonfarm Payrolls reading for more clues about the next Fed decisions.

- The US ISM Manufacturing PMI advanced to 49.0 in June from 48.5 in May and beyond the 48.8 reading forecasted by market analysts. The Production subindex jumped to 50.3 from 45.4 in May, but the Employment index deteriorated unexpectedly, offsetting the positive impact of the report.

- In the Eurozone, the Unemployment Rate increased to 6.3% in May against market expectations of a steady 6.2% rate.

- ECB officials Olli Rehn and Mario Centeno have warned about the risks of persistently low inflation in the Euro Area. These comments, coupled with the soft employment figures hint to further monetary easing in the mid-term and have added pressure on the Euro.

- The highlight today will be the US ADP Employment Change, which is expected to show a 95K net increase in June, following a 37K reading in May.

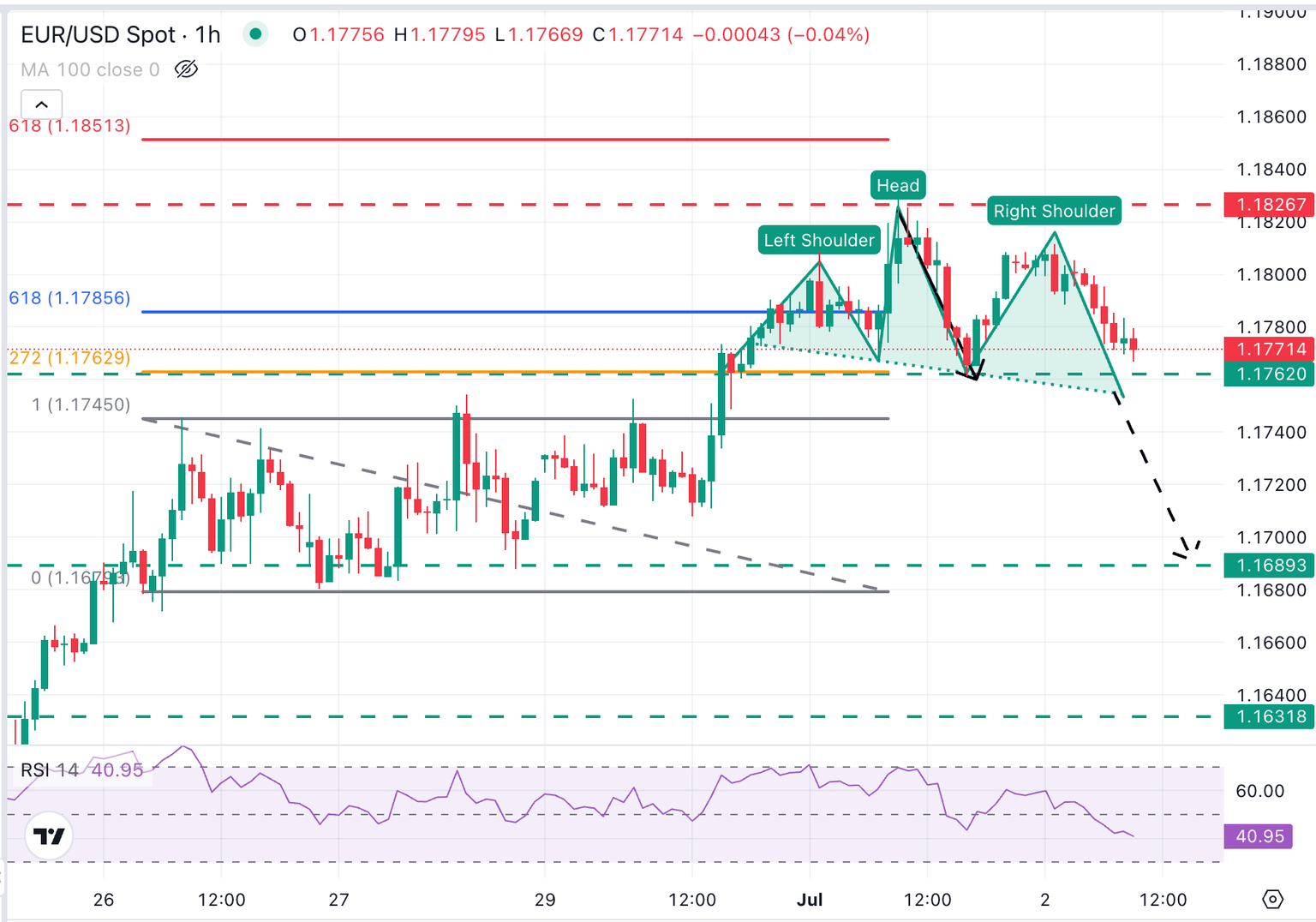

EUR/USD is on a bearish correction from multi-year highs above 1.1800

The EUR/USD is trimming gains, after rallying more than 2% in just over a week, reaching nearly four-year highs at 1.1830. The pair has been unable to confirm above 1.1800 and trades lower on Wednesday, as the US Dollar regains lost ground.

A look at the 1-hour chart shows an increasing bearish momentum, with the 14-period Relative Strength Index (RSI) treading lower into negative territory as price action broke the neckline of a Head & Shoulders (H&S) pattern.

A confirmation below the mentioned level, which is also Tuesday's low, at 1.1760, brings the measured target of the H&S pattern, at 1.1690, into focus. Further down, the area between the June 27 low at 1.1680, and the June 26 low at 1.1650 offers significant support for a bearish correction.

On the upside, immediate resistance is at the intra-day high of 1.1810 ahead of Tuesday's high at 1.1830. Above here, the 261.8% Fibonacci extension level of the June 26 to June 30 trading range is at 1.1850.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Jul 02, 2025 12:15

Frequency: Monthly

Consensus: 95K

Previous: 37K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.