EUR/USD Price Forecast: Holds steady around 1.1625 area; not out of the woods yet

- EUR/USD struggles to capitalize on last week’s modest bounce from a multi-year low.

- Trade jitters cap the upside for the EUR, though subdued USD demand lends support.

- The technical setup favors bearish traders and backs the case for further depreciation.

The EUR/USD pair kicks off the new week on a subdued note and oscillates in a narrow trading band through the Asian session. Spot prices currently trade around the 1.1625 area, nearly unchanged for the day, amid mixed cues. The uncertainty over the Federal Reserve's (Fed) rate-cut path keeps the US Dollar (USD) on the defensive. However, reports that US President Donald Trump was considering a 15% to 20% levy on the European Union, even if a trade deal is reached, act as a headwind for the EUR and the currency pair.

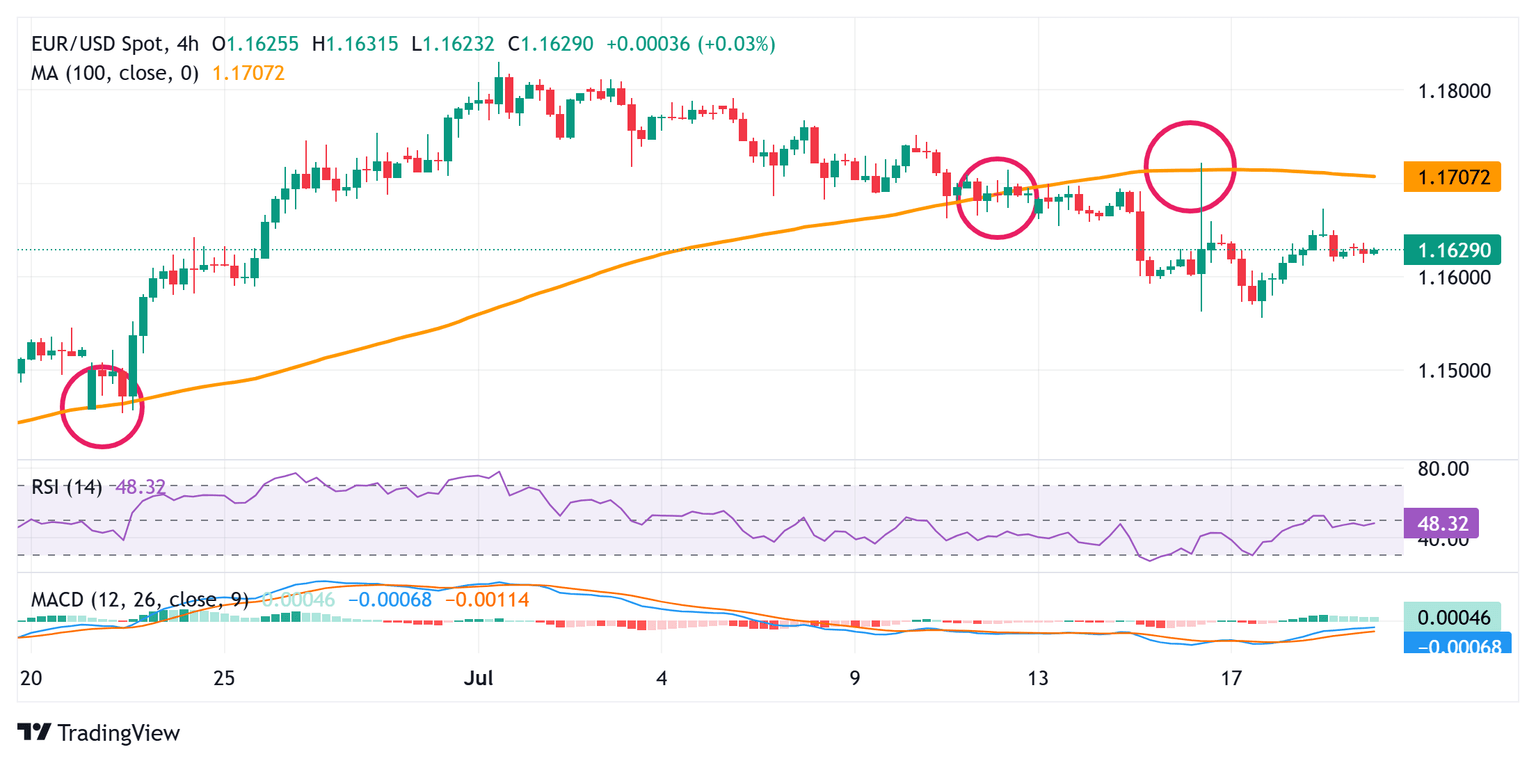

From a technical perspective, last week's failure near the 100-period Simple Moving Average (SMA) support turned hurdle on the 4-hour chart was seen as a key trigger for the EUR/USD bears. However, neutral oscillators on the daily chart warrant some caution before positioning for any further depreciating move. Hence, it will be prudent to wait for some follow-through selling below the 1.1560 , or the multi-week low, below which spot prices could weaken to the 1.1500 psychological mark. The downward trajectory could extend further towards the 1.1455-1.1450 zone before spot prices eventually drop to the 1.1400 round figure.

On the flip side, Friday's swing high, around the 1.1670 area, could act as an immediate hurdle ahead of the 1.1700 round figure. A sustained strength beyond the latter might trigger a near-term short-covering rally and lift the EUR/USD pair to the 1.1740-1.1745 intermediate hurdle en route to the 1.1800 round figure. The recovery momentum could extend further towards the 1.1830 area, or the highest level since September 2021 touched earlier this month, and the 1.1900 mark.

EUR/USD 4-hour chart

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.