EUR/USD Price Analysis: Volatile action looks likely as US debt-ceiling raise proposal approved

- EUR/USD is trading sideways above 1.0700, and remains lackluster despite approval of the US debt-ceiling raise.

- In spite of the German recession, the ECB is expected to raise interest rates further.

- EUR/USD has slipped below the 61.8% Fibonacci retracement at 1.0738.

The EUR/USD pair is showing a back-and-forth action above the round-level support of 1.0700 in the Asian session. The major currency pair is expected to remain in action as the proposal of raising the $31.4 trillion US borrowing limit has been approved for two years after compromising for the budget’s spending initiatives by Democrats.

The US Dollar Index (DXY) is facing barricades in extending its recovery above 104.30 despite the Federal Reserve (Fed) is expected to continue its policy-tightening regime after observing persistence in US households’ spending.

Despite a record of recession in the German economy after showing contraction in Gross Domestic Product (GDP) numbers consecutively for two quarters, the European Central Bank (ECB) is expected to raise interest rates further to tame stubborn inflation. ECB President Christine Lagarde has already announced that more than one interest rate hike is anticipated to bring down inflation.

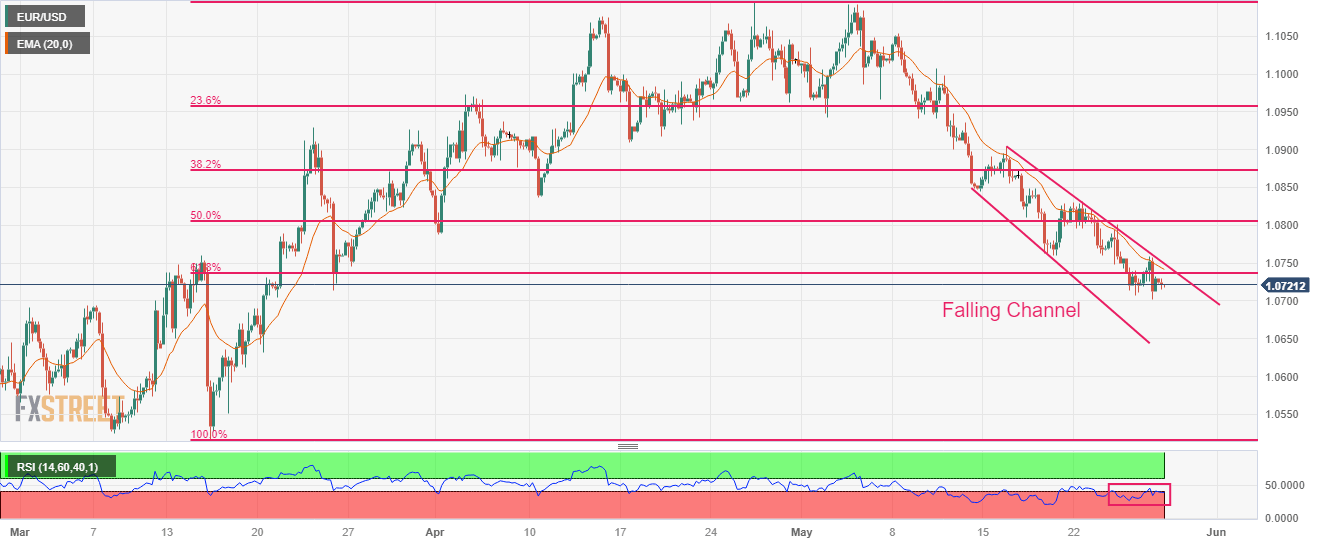

EUR/USD has slipped below the 61.8% Fibonacci retracement (plotted from March 15 low at 1.0516 to April 26 high at 1.1095) at 1.0738 on a four-hour scale. The 20-period Exponential Moving Average (EMA) at 1.0740 is acting as a strong barrier for the Euro bulls. The asset is auctioning in a Falling Channel in which each pullback is considered as a selling opportunity by market participants.

The Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-40.00, indicating the continuation of the bearish momentum.

The downside move will resume if the shared currency pair drops below the round-level support of 1.0700. This will drag the asset toward March 13 low at 1.0650 followed by March 03 low at 1.0588.

On the flip side, a recovery move above May 24 high around 1.0800 would push the ball in Euro’s court. A solid recovery above 1.0800 would drive the asset toward May 18 high at 1.0848 and May 16 high at 1.0904.

EUR/USD four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.