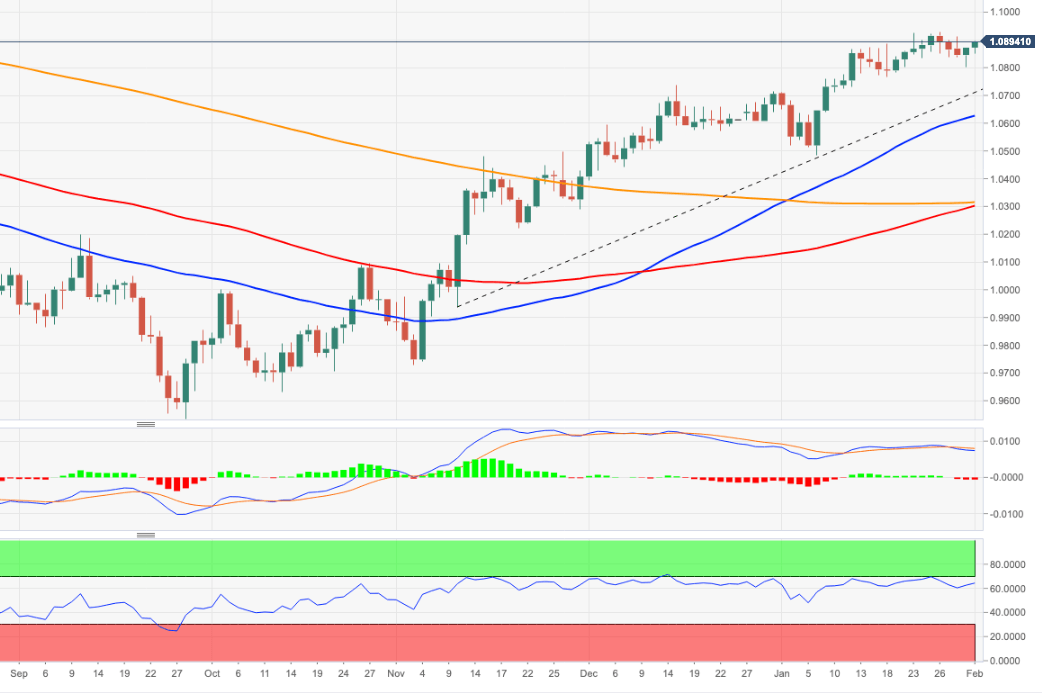

EUR/USD Price Analysis: Topside continues to look at 1.0930

- EUR/USD extends the 2-day rebound to the boundaries of 1.0900.

- Further upside could see the 2023 high at 1.0929 revisited.

EUR/USD picks up extra upside traction and approaches once again the 1.0900 neighbourhood in pre-FOMC trading on Wednesday.

The continuation of the uptrend now needs to clear the 2023 high at 1.0929 (January 26) to allow for a test of the weekly top at 1.0936 (April 21 2022). A sustainable break above this level could pave the way for a challenge of the key barrier at 1.1000

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0313.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.