EUR/USD Price Analysis: Sustained gains look likely above 1.0300

- EUR/USD looks to advance further north of the 1.0200 mark.

- Extra gains are in store once 1.0300 is cleared.

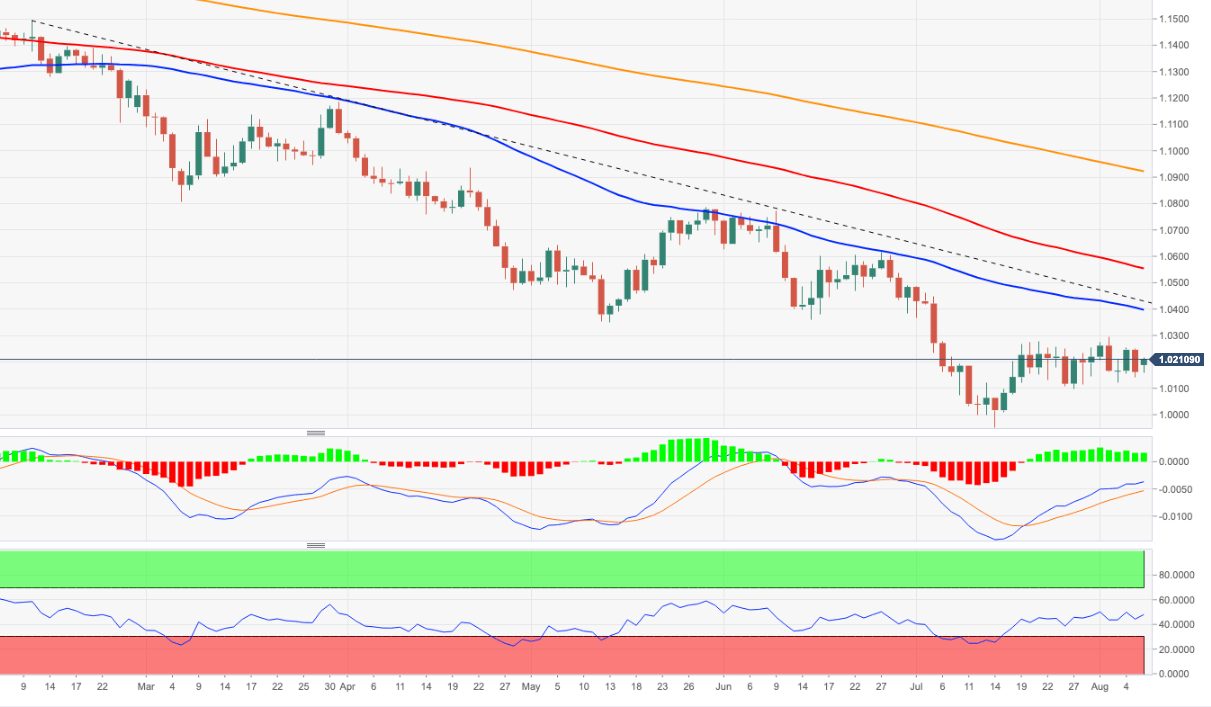

EUR/USD embarks on a decent recovery following Friday’s marked retracement at the beginning of the week.

The so far August high at 1.0293 (August 2) emerges as the magnet for bulls for the time being. Above this level, spot is expected to see its uptrend reinvigorated and could challenge the temporary 55-day SMA in the near term, today at 1.0394.

In the longer run, the pair’s bearish view is expected to prevail as long as it trades below the 200-day SMA at 1.0920.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.