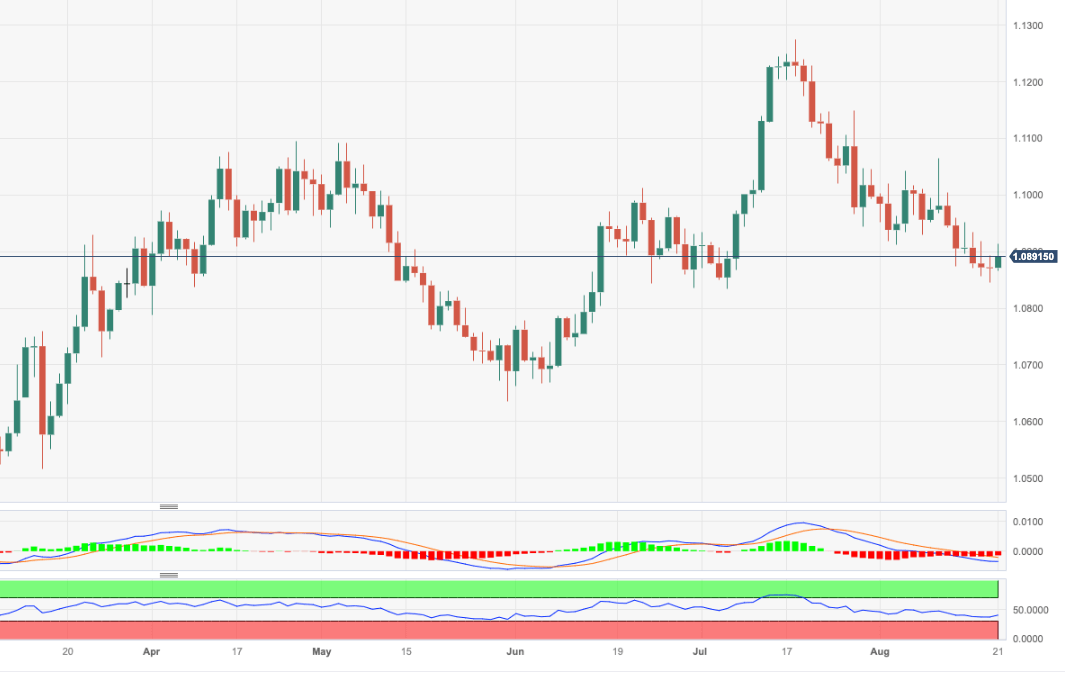

EUR/USD Price Analysis: Still scope for extra losses

- EUR/USD manages to rebound past the 1.0900 hurdle.

- A drop below 1.0844 exposes extra retracements near term.

EUR/USD reverses six consecutive daily pullbacks and regains the 1.0900 hurdle and above on Monday.

If the pair resumes the downside it is expected to revisit the August low of 1.0844 (August 18) prior to the July low of 1.0833 (July 6). The loss of this region leaves the pair vulnerable to a probable test of the critical 200-day SMA at 1.0792 in the short-term horizon.

In the meantime, the pair’s positive outlook remains unchanged while above the 200-day SMA.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.