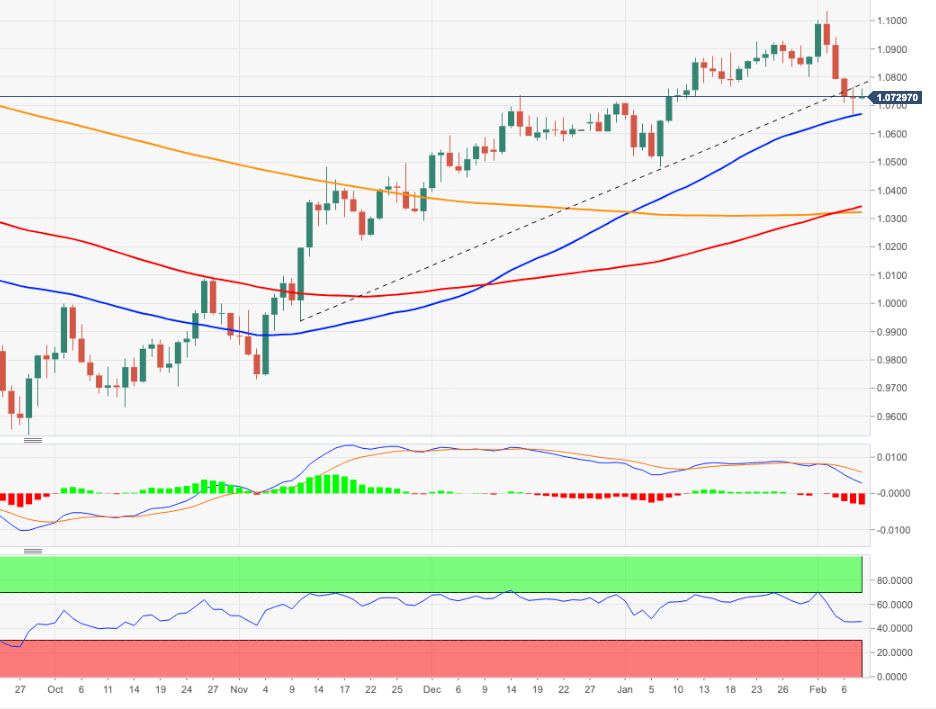

EUR/USD Price Analysis: Remains under pressure below 1.0780

- EUR/USD fails to extend the bounce past the 1.0780 level.

- The 3-month line near 1.0780 keeps capping the upside.

EUR/USD bounces off Tuesday’s lows near 1.0670, although the bullish attempt runs out of steam near 1.0760.

As long as the 3-month resistance line near 1.0780 continues to cap the upside, the pair is expected to remain under pressure and thus another move to the February low near 1.0670 should not be discarded just yet.

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0319.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.