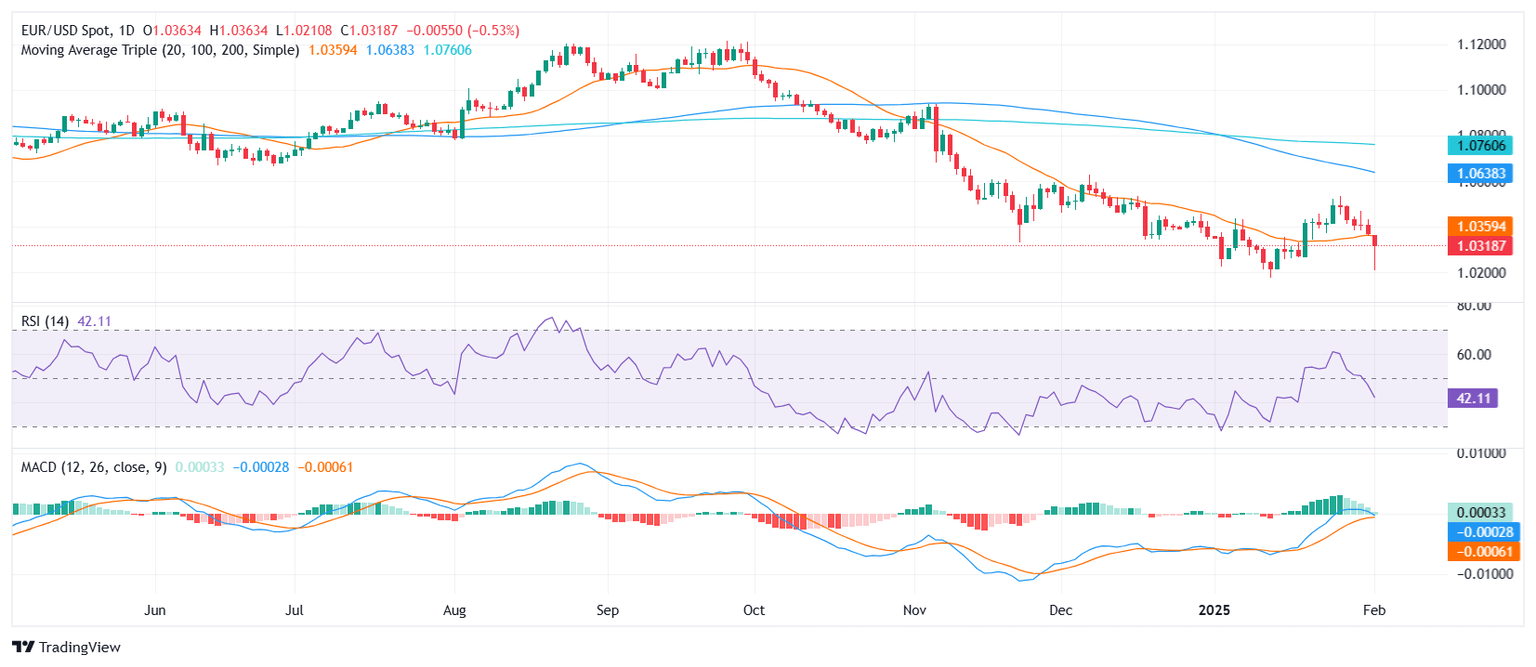

EUR/USD Price Analysis: Pair trims losses after sharp drop, remains below 20-day SMA

- EUR/USD declines to lows around 1.0200 on Monday, marking a 0.90% drop as bearish pressure intensifies.

- The pair managed to trim losses towards 1.0300 but the outlook remains negative.

- RSI declines to 42, signaling weakening momentum, while MACD prints rising red bars, reflecting persistent bearish traction.

The EUR/USD pair continued its downward trajectory on Monday, slipping to a low around 1.0200 before staging a brief rebound to 1.0300. However, the failed attempt to extend gains highlights the prevailing selling pressure, keeping the pair below its 20-day Simple Moving Average (SMA) and maintaining a bearish outlook.

Technical indicators further support the negative bias. The Relative Strength Index (RSI) has declined to 42, suggesting that downside momentum is gaining traction. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is showing rising red bars, indicating that selling pressure remains dominant despite intermittent recovery attempts.

Looking ahead, immediate support stands at 1.0200, a key level that, if broken, could trigger a move toward 1.0150. On the upside, the first resistance appears at 1.0300, followed by the 20-day SMA near 1.0350. Until the pair clears these resistance zones, the broader trend remains tilted to the downside.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.