EUR/USD Price Analysis: Not out of the woods yet

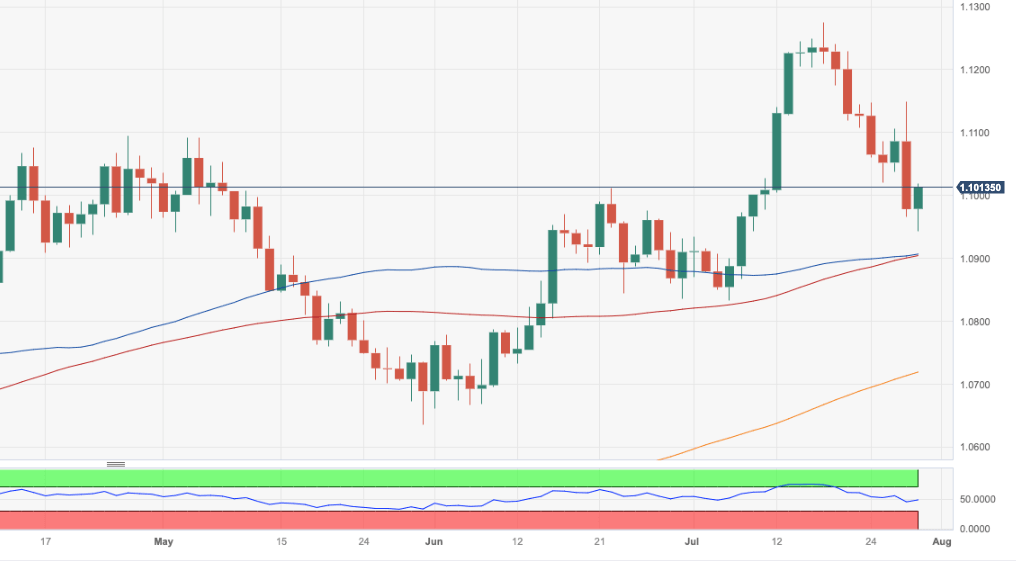

- EUR/USD bounces off 3-week lows near 1.0940 on Friday.

- A deeper pullback could see the 1.0900 region revisited.

EUR/USD manages well to rebound from earlier 3-week lows in the 1.0945/40 band and reclaim the area just beyond 1.1000 the figure at the end of the week.

Considering the recent price action, extra weakness should not be discarded. Once the weekly low of 1.0943 (July 28) is cleared, further losses could extend to the transitory 55-day and 100-day SMAs just above the 1.0900 mark.

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0718.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.