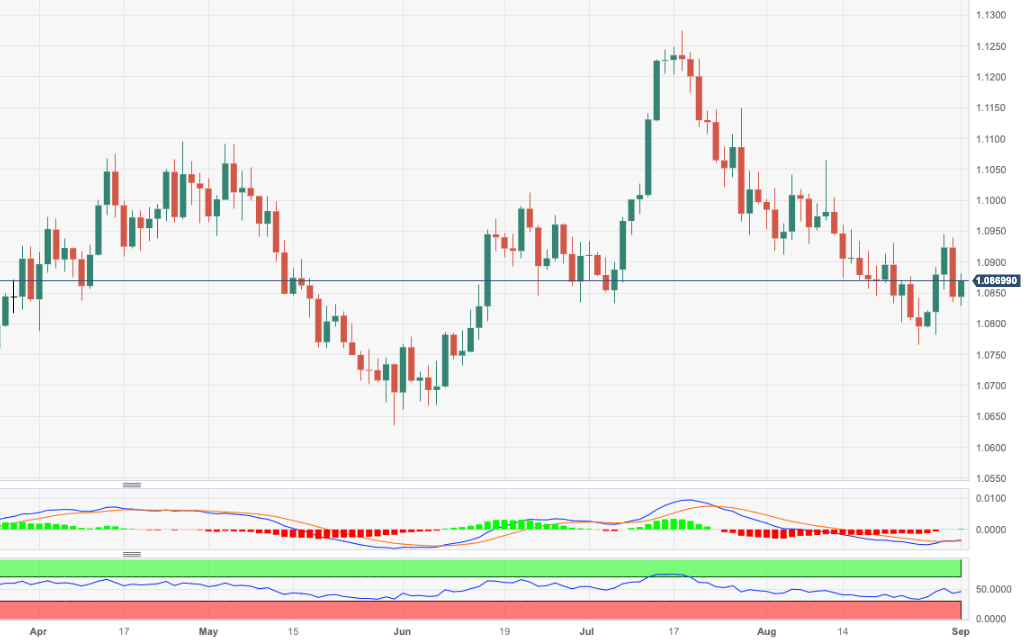

EUR/USD Price Analysis: Next on the upside comes 1.0945

- EUR/USD fades Thursday’s downtick and approaches 1.0900.

- Immediate up-barrier remains near 1.0950 so far.

EUR/USD manages to set aside part of Thursday’s sharp pullback and gradually approaches the 1.0900 mark on Friday.

Despite the daily knee-jerk, the pair’s current momentum seems to be favouring the continuation of the march north for the time being. That said, the next hurdle emerges at the weekly top at 1.0945 (August 30), prior to the interim 55-day SMA at 1.0965 and the psychological 1.1000 mark.

In the meantime, the pair is likely to keep the bullish outlook unchanged while above the 200-day SMA, today at 1.0816.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.