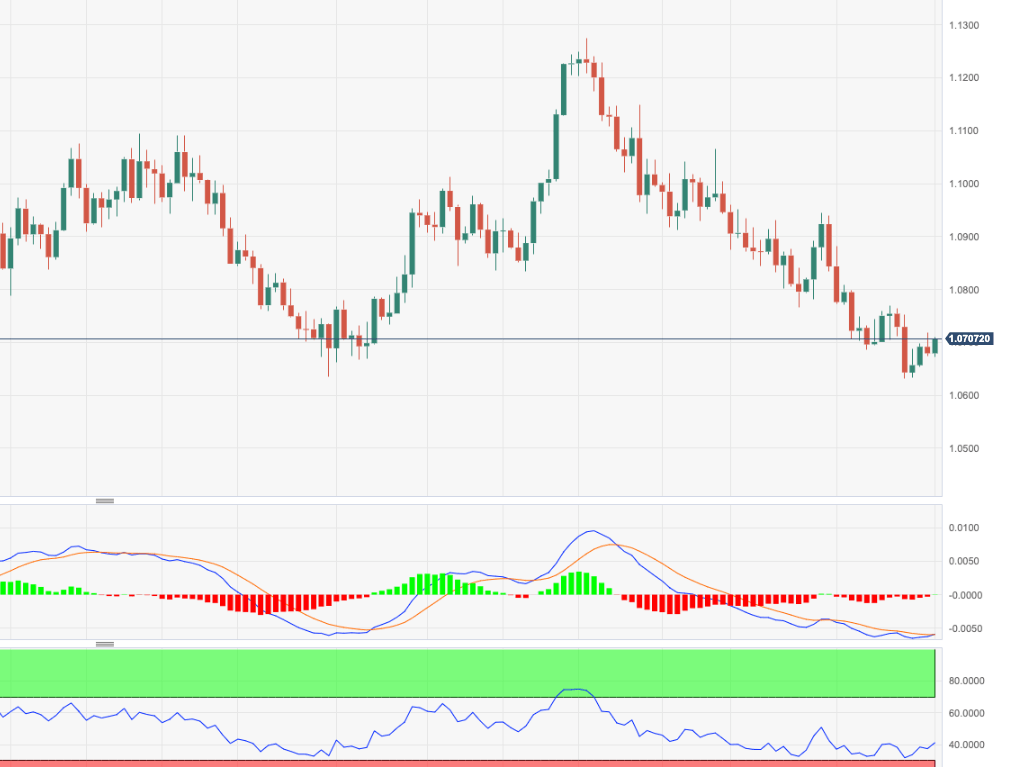

EUR/USD Price Analysis: Next on the upside aligns 1.0770

- EUR/USD resumes the upside beyond the 1.0700 barrier.

- Further gains should meet the weekly high near 1.0770.

EUR/USD leaves behind Tuesday’s pullback and reclaims the area above 1.0700 the figure during pre-FOMC trade on Wednesday.

If the rebound gathers extra steam, the pair should face a minor hurdle at the weekly high of 1.0767 (September 12) prior to the critical 200-day SMA at 1.0828.

Despite the so far two-day bounce, the pair’s underlying bearish sentiment remains unchanged and leaves the door open to extra pullbacks in the short-term horizon. Against that backdrop, further losses could see the September low at 1.0631 (September 14) revisited ahead of the March low of 1.0516 (March 15).

While below the key 200-day SMA, the pair is likely to face extra weakness.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.