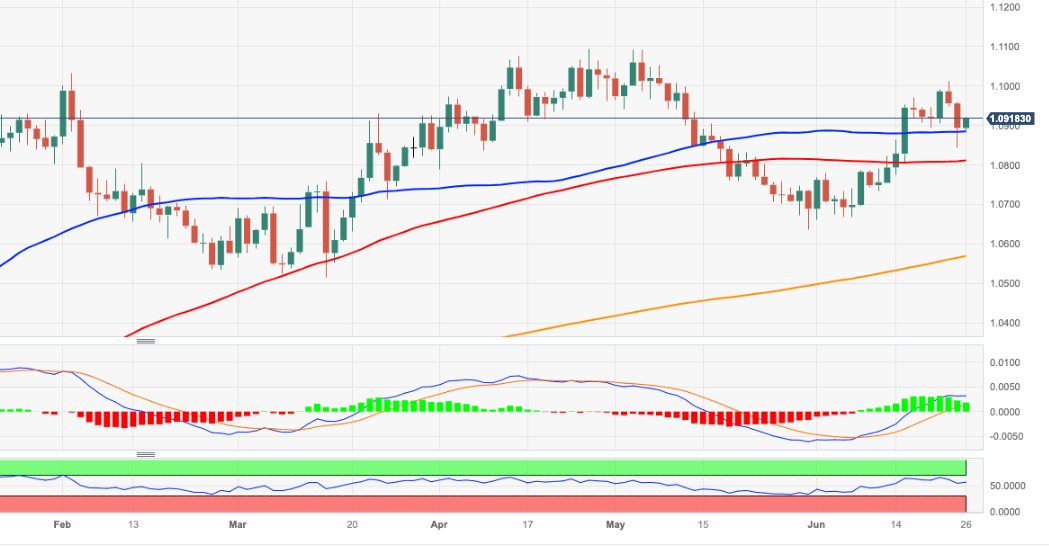

EUR/USD Price Analysis: Minor support emerges near 1.0840

- EUR/USD reverses part of the recent weakness and regains 1.0900.

- So far, there is decent contention around 1.0840.

EUR/USD starts the week on the positive foot and reclaims the area beyond 1.0900 the figure on Monday.

The inability of the pair to regain the area of recent peaks around 1.1010 (June 22) could motivate sellers to return to the market and open the door to a potential revisit to recent weekly lows near 1.0840 (June 23).

The loss of the latter should face the next support of note around the round level of 1.0800, which also appears reinforced by the 100-day SMA (1.0809).

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA, today at 1.0568.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.