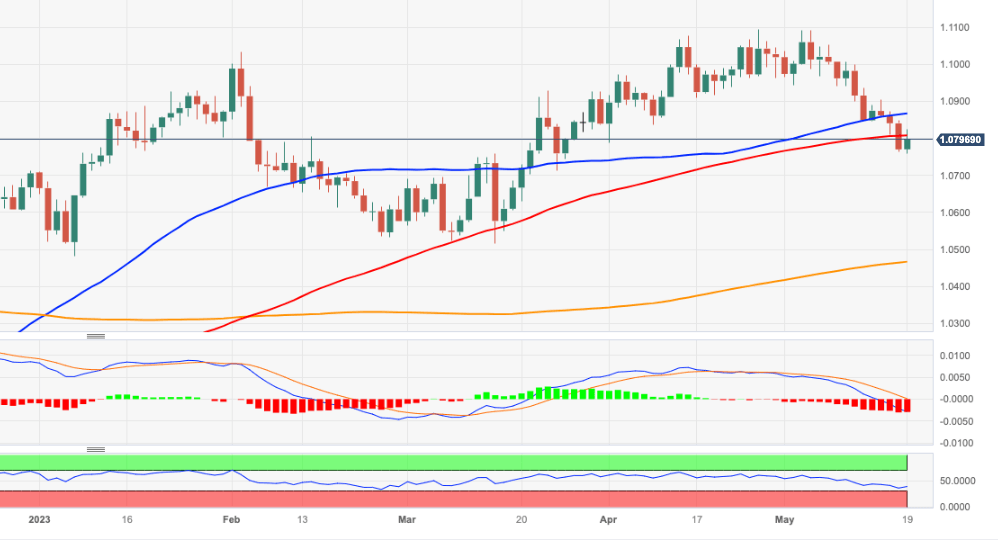

EUR/USD Price Analysis: Initial support turns up near 1.0760

- EUR/USD attempts a mild bounce after testing lows around 1.0760.

- There is a temporary hurdle at the 55-day SMA near 1.0870.

EUR/USD rebounds from new 2-month lows in the 1.0760/55 band and manages to briefly surpass the 1.0800 hurdle at the end of the week.

While initially supported by the 1.0760 region, occasional bullish attempts could see the pair confront the temporary hurdle at the 55-day SMA at 1.0865 ahead of the more significant 1.1000 mark.

Extra losses are not ruled out in the current context, although a sustained retracement to the March bottom of 1.0516 (March 15) is not favoured for the time being.

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0465.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.