EUR/USD Price Analysis: Initial support emerges near 1.0910

- EUR/USD appear to have met some contention around 1.0910.

- The loss of this region exposes a drop to 1.0830.

The selling pressure around EUR/USD remains everything but abated on Thursday, as this time the pair visits new multi-week lows around 1.0910.

Considering the ongoing price action, spot risks more sustained losses once 1.0900 is cleared. Against that, the pair could then challenge the July low of 1.0833 (July 6) sooner rather than later.

A deeper retracement from here should put a potential test of the key 200-day SMA at 1.0737 back on the radar, although this scenario remains out of favour for the time being.

Looking at the longer run, the positive view remains unchanged while above the 200-day SMA.

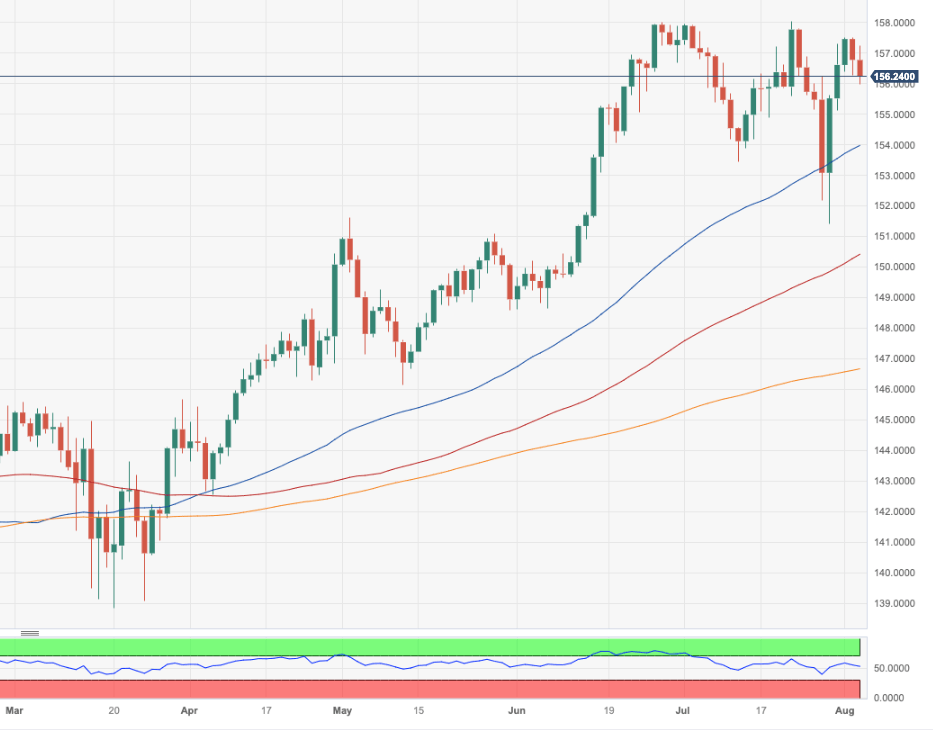

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.