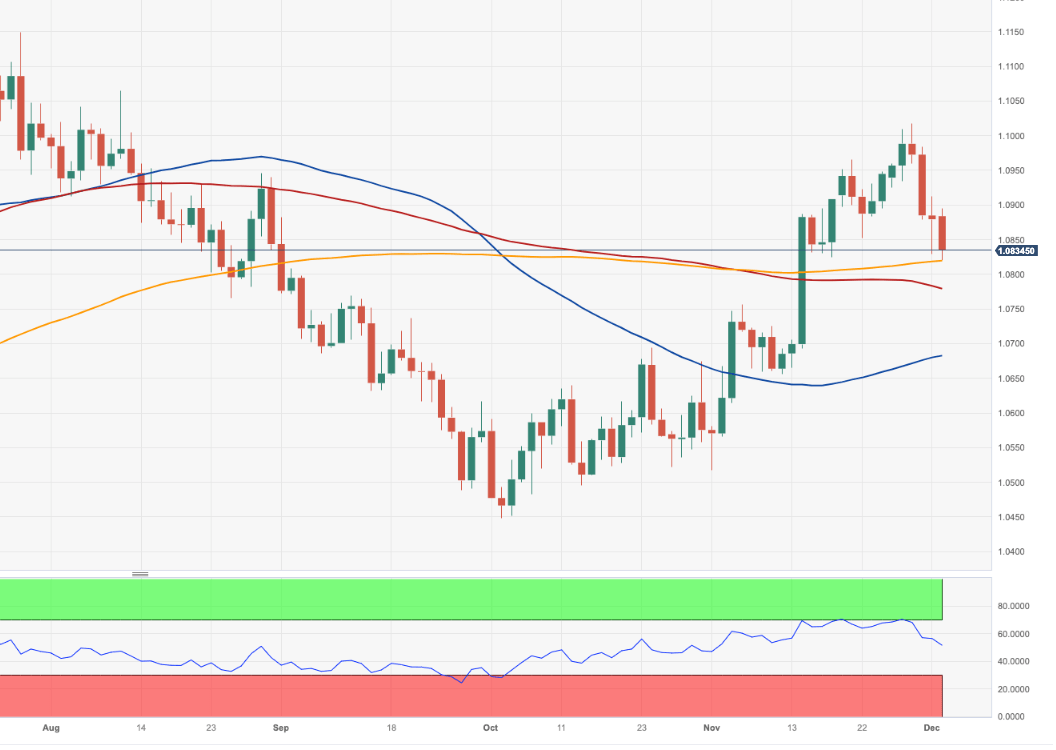

EUR/USD Price Analysis: Initial support emerges at 1.0820

- EUR/USD gives away further ground and retests 1.0820.

- The loss of the 200-day SMA should spark extra declines.

EUR/USD retreats for the fourth session in a row and puts the key 200-day SMA to the test on Monday.

A drop below the latter should pave the way for a deeper pullback to, initially, the intermediate 100-day SMA at 1.0778 and the 55-day SMA at 1.0681.

So far, while above the significant 200-day SMA, the pair’s outlook should remain constructive.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.