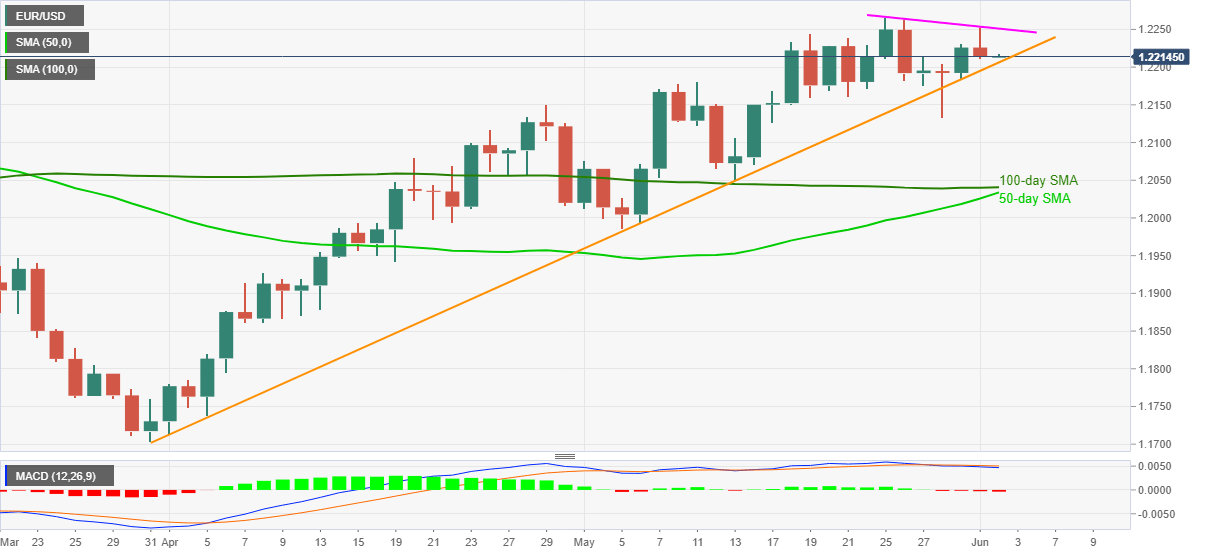

EUR/USD Price Analysis: Impending bull cross keeps buyers hopeful above 1.2200

- EUR/USD edges lower following a pullback from one-week top.

- Two-month-old rising support line probes sellers, 50-day SMA is up for crossing 100-DMA.

- Weekly resistance line holds the key to yearly high.

EUR/USD remains sidelines around 1.2215 during the initial hours of Wednesday’s Asian session. The currency major pair dropped the most in one week after stepping back from 1.2254 the previous day.

However, a looming cross-over of the 50-day SMA (DMA) to the 100-DMA, coupled with a strong support line from March 31, suggests the pair’s recovery moves to target the weekly resistance line.

It’s worth mentioning that a clear run-up beyond the stated hurdle around 1.2250 will help the EUR/USD buyers to attack the yearly top surrounding 1.2350. During the run-up, the 1.2300 threshold can offer an intermediate halt.

Alternatively, a clear downside break of the stated support line, near 1.2200 will have multiple supports around 1.21470 before testing April’s top near 1.2150.

In a case where EUR/USD selling extends below 1.2150, the mid-May lows near 1.2050, followed by the key SMAs around 1.2040-35, will test the bears.

Overall, EUR/USD remains on the front foot despite recent pullback moves.

EUR/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.