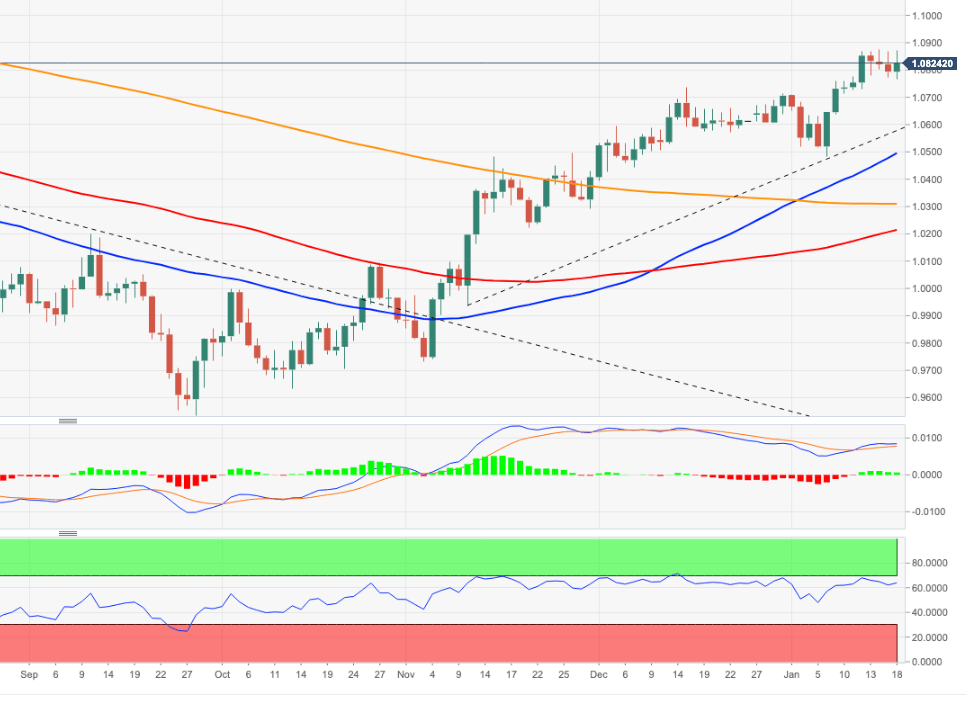

EUR/USD Price Analysis: Immediately to the upside comes 1.0874

- EUR/USD rebounds from earlier lows near 1.0770 on Wednesday.

- The next up barrier of note remains at the YTD high at 1.0874.

EUR/USD reverses three consecutive daily pullbacks and regains the 1.0800 hurdle and beyond midweek.

It seems the pair is moving within a range bound theme ahead of the potential resumption of the uptrend. Against that, the immediate resistance level comes at the so far YTD high at 1.0874 (January 16), which once cleared it could lead up to a probable visit to the round level at 1.0900 in the relatively short-term horizon.

Furthermore, while above the short-term support line near 1.0600, extra gains should remain in store.

In the longer run, the constructive view remains unchanged while above the 200-day SMA at 1.0307.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.