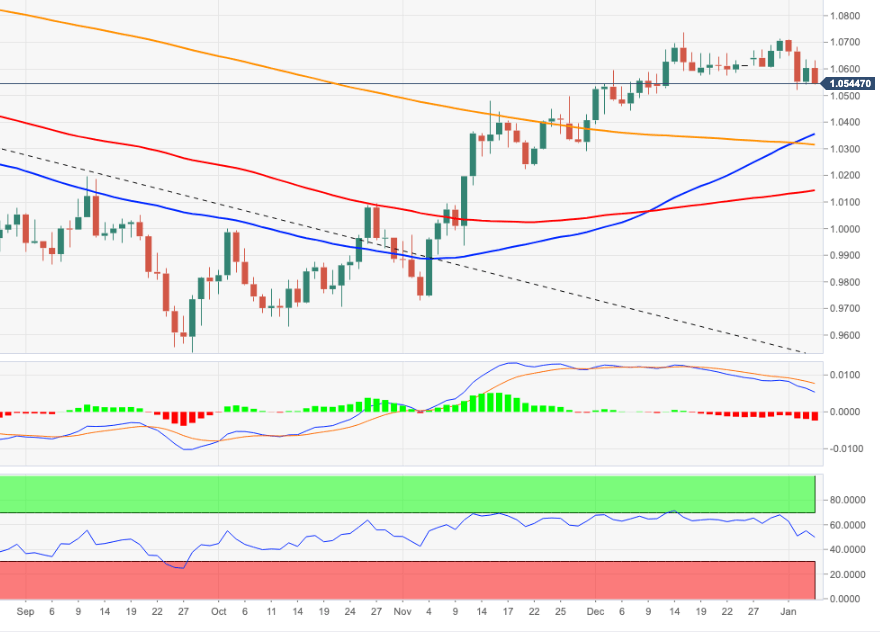

EUR/USD Price Analysis: Immediate target comes around 1.0630

- EUR/USD’s upside momentum faltered once again around 1.0630.

- The breakout of that resistance could lead up to a test of 1.0713.

EUR/USD gives away initial gains and sinks in the red territory well south of the 1.0600 support on Thursday.

Subsequent bullish attempts need to clear the short-term top in the 1.0630/35 band (January 4,5) to allow for a potential visit to the weekly top at 1.0713 (December 30). Once cleared, the pair could then confront the December 2022 peak at 1.0736 (December 15).

The constructive outlook for EUR/USD should remain unchanged while above the key 200-day SMA, today at 1.0314.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.