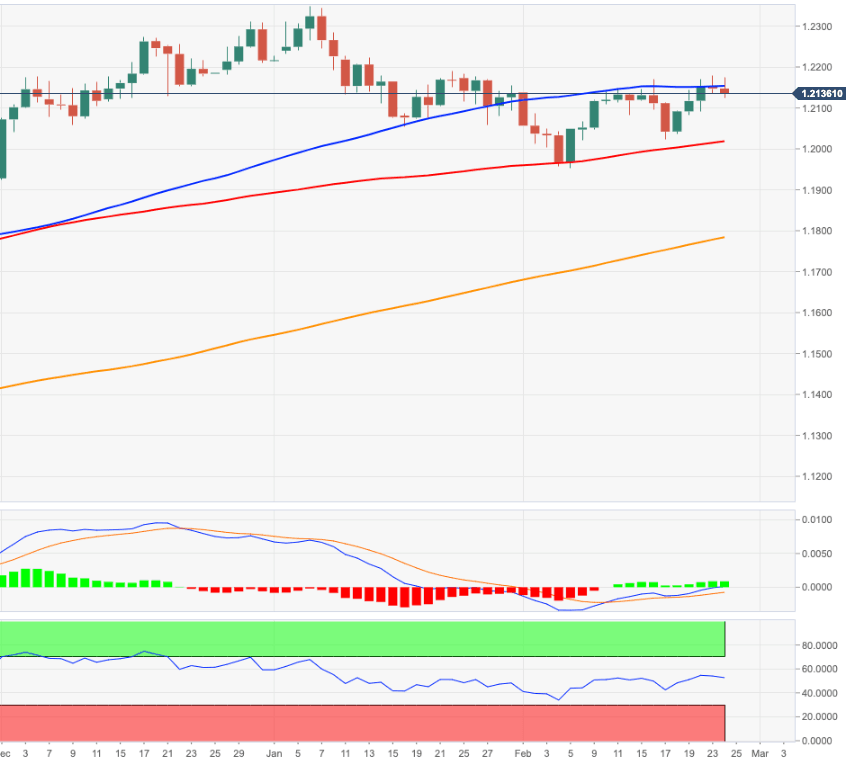

EUR/USD Price Analysis: Further rangebound likely while below 1.2190

- EUR/USD’s weekly upside lost momentum around 1.2180.

- The vicinity of 1.2200 remains a key hurdle for EUR-bulls.

EUR/USD’s bullish attempt faltered once again near 1.2180, or multi-day highs, on Wednesday. In this area also converges a Fibo level at 1.2173.

As longs as bulls can’t surpass the 1.2180/90 band in the short-term horizon, further consolidation remains likely. When and If the buying impulse picks up convincing pace and leaves behind this region, selling pressure is expected to mitigate and allow for a probable visit to the YTD highs in the 1.2350 zone.

On the broader picture, the constructive stance in EUR/USD remains unchanged while above the critical 200-day SMA, today at 1.1770.

Looking at the monthly chart, the (solid) breakout of the 2008-2020 line is a big bullish event and should underpin the continuation of the current trend in the longer run.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.