EUR/USD Price Analysis: Falls to near 1.0830 as bearish stance remains robust

- EUR/USD could move downward to retesting the nine-day EMA at 1.0822.

- Lagging indicators suggest that the bearish stance holds strong.

- The psychological level of 1.0800 appears as the key support region.

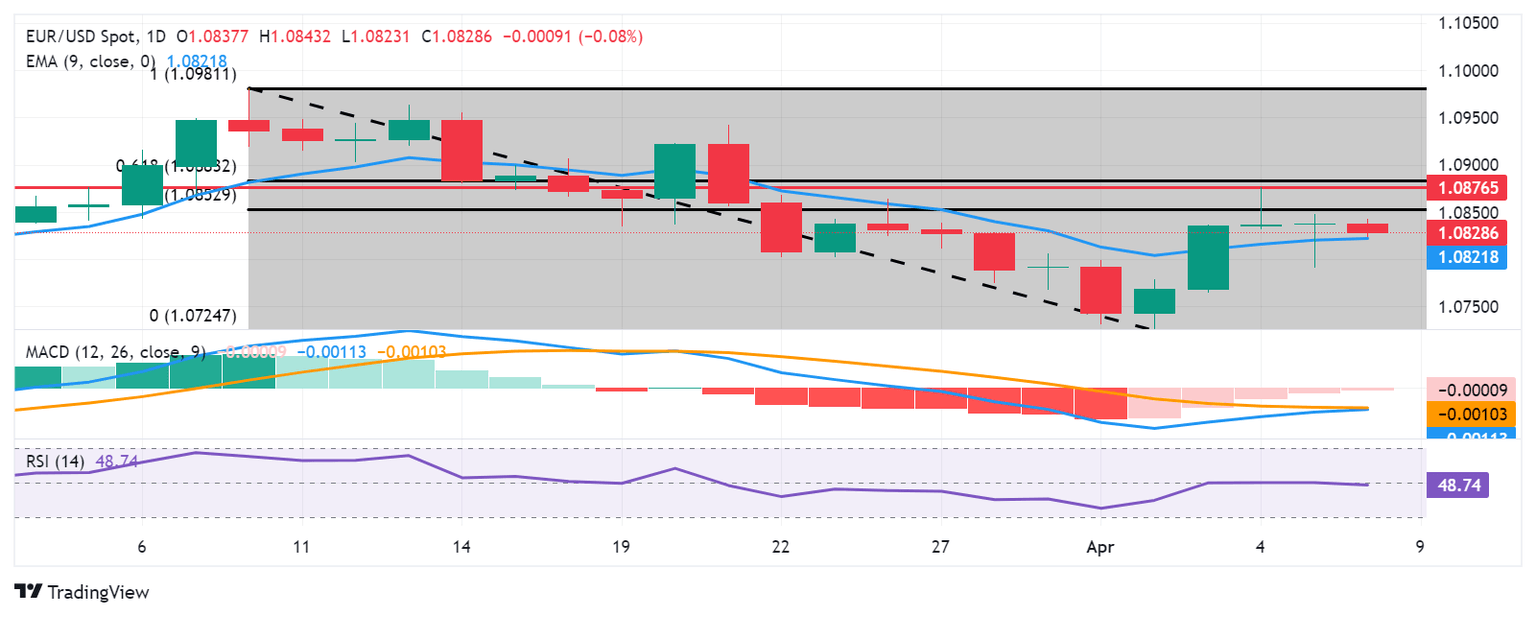

EUR/USD snaps its four-day winning streak, declining to near 1.0830 during the early European hours on Monday. The pair could move downward to retest the nine-day Exponential Moving Average (EMA) at 1.0822.

Additionally, technical analysis suggests a bearish sentiment for the EUR/USD pair. The 14-day Relative Strength Index (RSI) is positioned below the 50 mark, indicating weakness in buying momentum.

The Moving Average Convergence Divergence (MACD) remains below the centerline and exhibits a convergence below the signal line. This alignment suggests a momentum shift for the EUR/USD pair. Traders are likely to await confirmation from this lagging indicator to provide a clearer trend direction.

The EUR/USD pair could find immediate support at the psychological level of 1.0800. A break below the latter could exert pressure on the pair to navigate the region around the major level at 1.0750, followed by the previous week’s low at 1.0724.

On the upside, the major level at 1.0850 appears as the immediate resistance, aligned with the 50.0% retracement level at 1.0852. A breakthrough above this level could lead the EUR/USD pair to explore the 61.8% Fibonacci retracement level of 1.0883, followed by the psychological level of 1.0900.

EUR/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.