EUR/USD Price Analysis: Extra rangebound on the cards

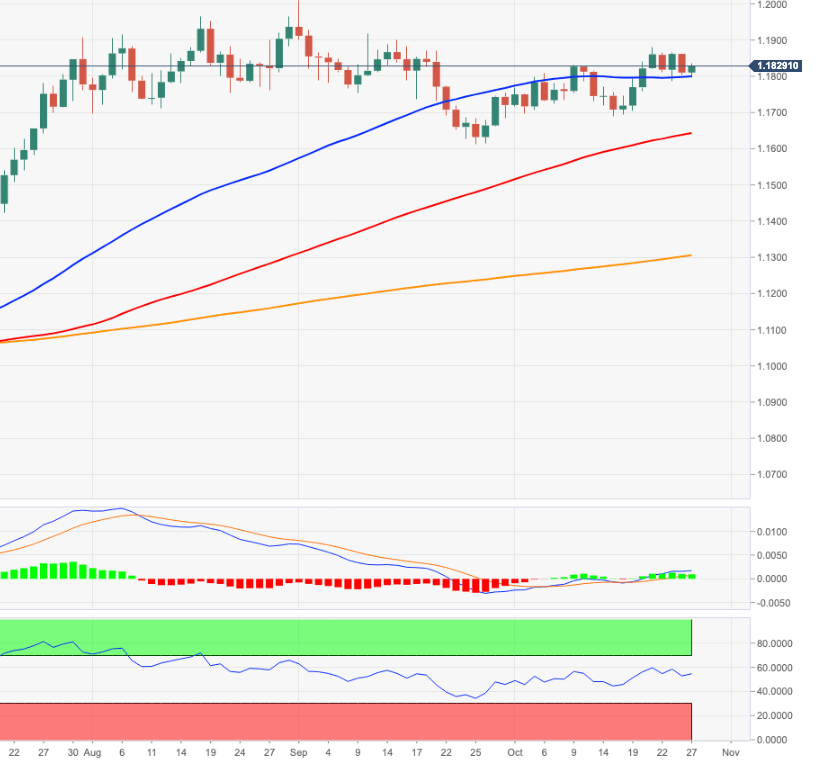

- EUR/USD extends the consolidative mood at/above the 1.18 mark.

- Extra losses appear contained near 1.1790 for the time being.

EUR/USD has entered into a consolidative phase around the 1.18 level in tandem with the prevailing cautiousness ahead of the ECB event on Thursday.

The continuation of the side-lined mood seems likely at least in the very near-term. A break of this multi-session consolidation in either direction is expected to face a deeper pullback to the 1.1700 area, while the resumption of the bull trend is seen facing an initial hurdle at 1.1880.

Looking at the broader scenario, the bullish view on EUR/USD is expected to remain unchanged as long as the pair trades above the critical 200-day SMA, today at 1.1304.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.