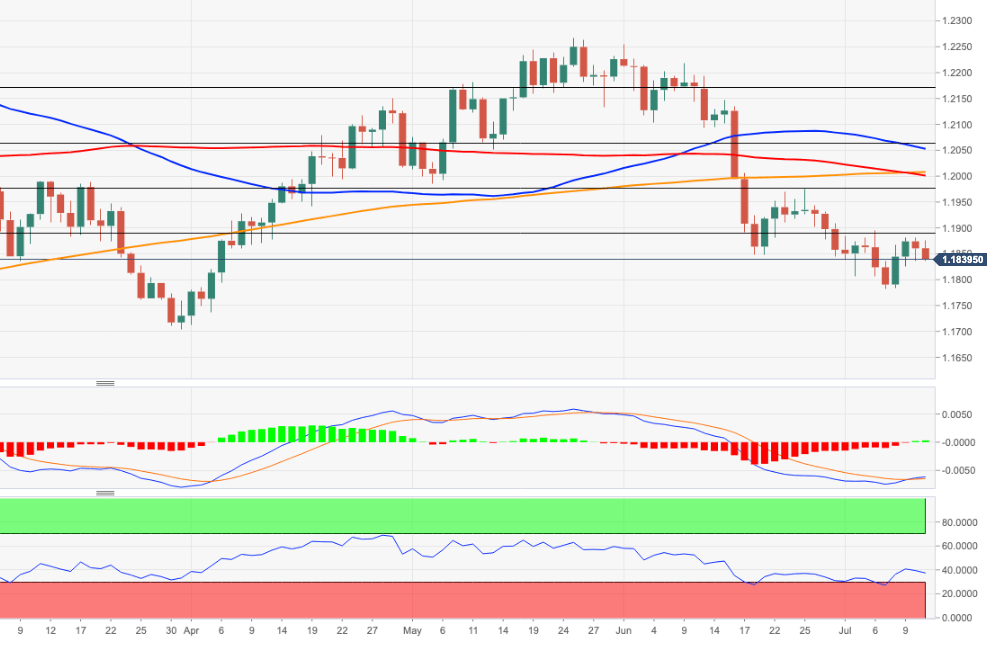

EUR/USD Price Analysis: Extra losses likely below 1.1880/90

- EUR/USD extends the weekly leg lower to the 1.1830 area.

- The 1.1780 zone remains a magnet for bears.

EUR/USD sparked a corrective downside following another rejection from the 1.1880/90 band at the beginning of the week.

While the upside remains capped by this area, further pullbacks are likely. Against this, the next stop on the downside comes in at the so far monthly lows around 1.1780 (July 7). This area of contention is reinforced by the 2020-2021 support line.

Further out, the near-term outlook for EUR/USD is seen on the negative side while below the key 200-day SMA, today at 1.2001.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.