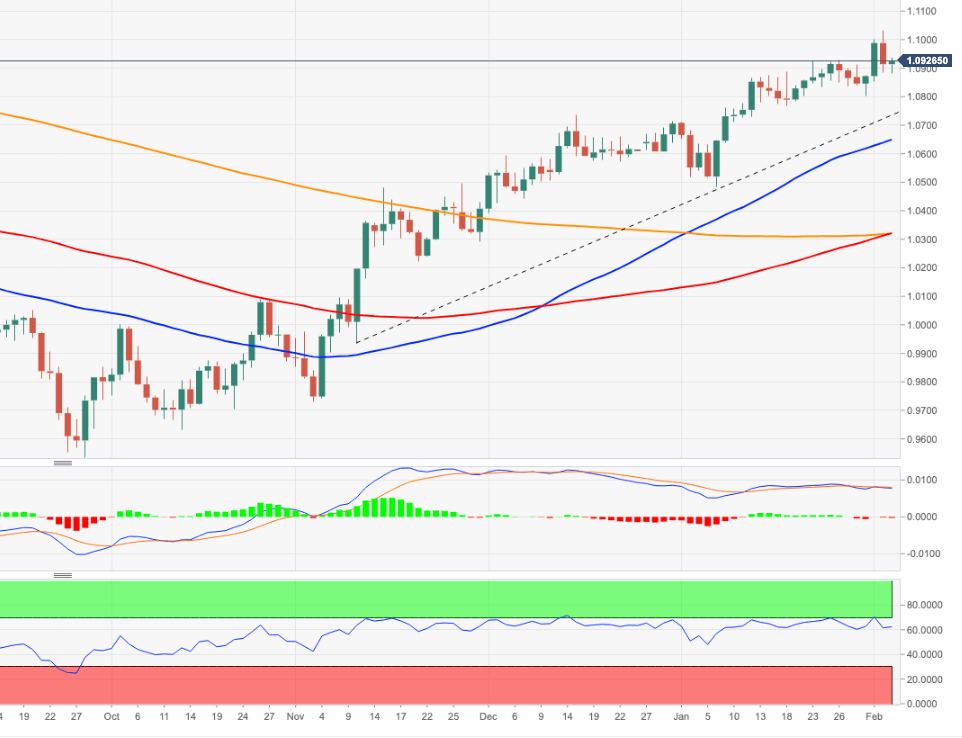

EUR/USD Price Analysis: Extra gains remain favoured

- EUR/USD resumes the upside following the post-ECB sell-off.

- The surpass of 1.1030 exposes a move to 1.1100.

EUR/USD reverses the recent pessimism and embarks on a recovery north of the 1.0900 hurdle on Friday.

A move beyond the so far 2023 high at 1.1032 (February 2) should retarget the round level at 1.1100 prior to the weekly peak at 1.1184 (March 31 2022).

In the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0317.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.