EUR/USD Price Analysis: Euro fades bullish bias within monthly triangle, focus on 1.0920 and US inflation

- EUR/USD snaps two-day winning streak but lacks follow-through amid sluggish session.

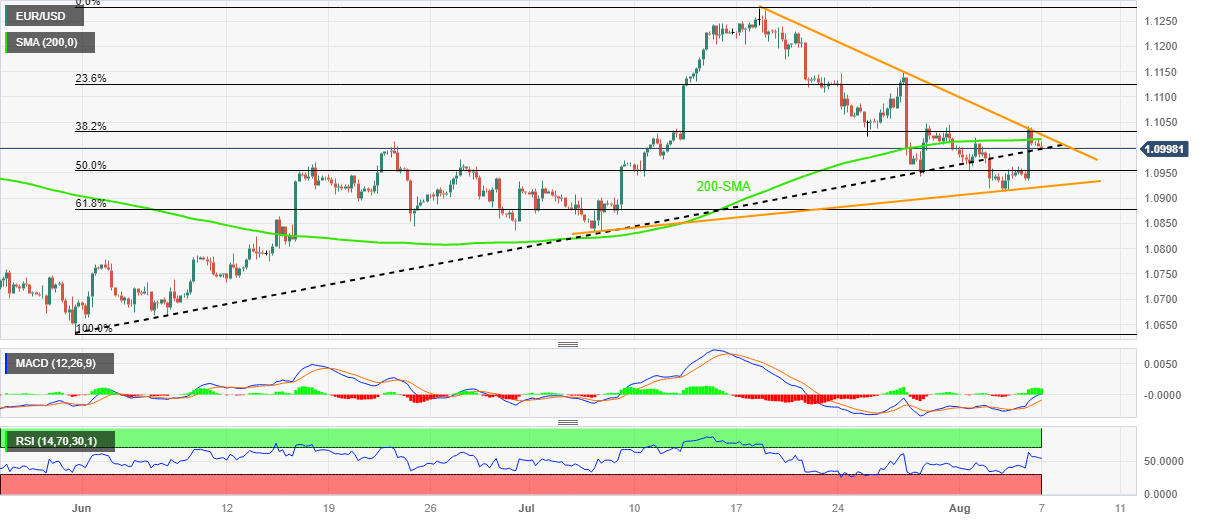

- One-month-old symmetrical triangle restricts immediate Euro moves as US CPI week begins.

- Failure to cross 200-SMA triggers pullback moves but oscillators keep EUR/USD buyers hopeful unless breaking 1.0920 support.

EUR/USD prints the first daily loss in three as it drops to 1.0995 while posting mild losses during the mid-Asian session on Monday. Even so, the Euro pair remains within a one-month-old symmetrical triangle, recently reversing from the top line and slipping back below the 200-SMA hurdle.

It’s worth noting that the previous support line from early July joins the bullish MACD signals and upbeat RSI (14) line to keep the Euro buyers hopeful as they await this week’s US inflation numbers, namely the Consumer Price Index (CPI) and Producer Price Index (PPI) for July.

Even if the quote breaks the 1.0990 immediate support, the 50% Fibonacci retracement of May-July upside, near 1.0950 and the stated triangle’s bottom line around 1.0920 will be crucial challenges for the EUR/USD bears to watch for retaking control.

Also likely to challenge the Euro sellers is the 61.8% Fibonacci retracement surrounding 1.0880 and the previous monthly low of around 1.0830.

Meanwhile, the 200-SMA level of around 1.1020 guards the immediate recovery of the EUR/USD pair ahead of the stated triangle’s top line, close to 1.1030 at the latest.

Following that, the late July swing high around 1.1050 may act as the last defense of the Euro bears before directing the quote towards the yearly of 1.1275.

EUR/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.