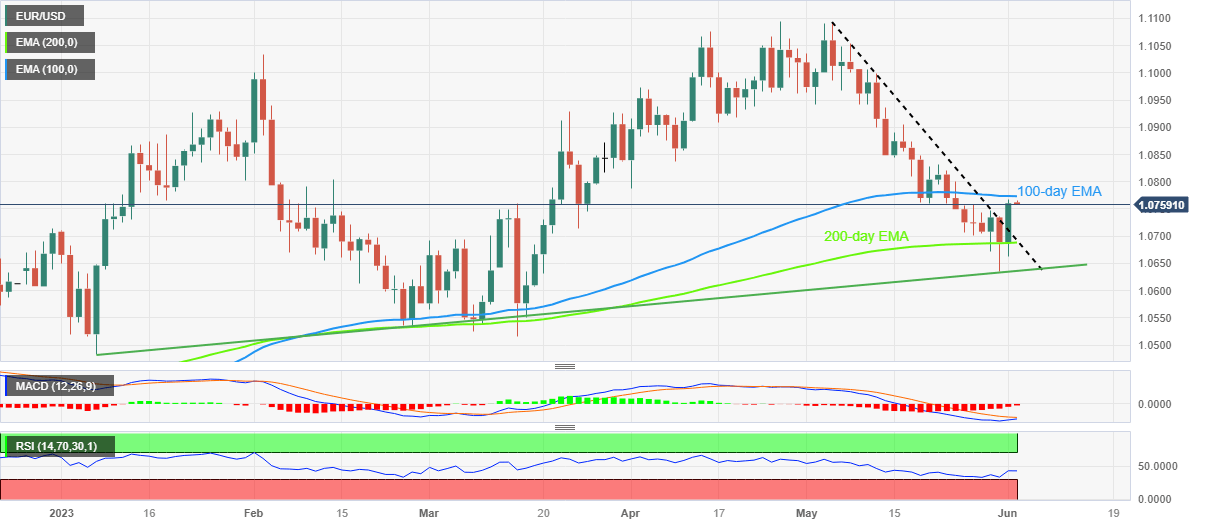

EUR/USD Price Analysis: Euro bulls need validation from 100-day EMA and US NFP

- EUR/USD bulls approach 100-day EMA hurdle after rising the most in seven weeks.

- Clear rebound from multi-day-old ascending support line, 200-day EMA favors buyers.

- 100-day EMA, downbeat RSI and US NFP may recall Euro bears in case of surprises.

EUR/USD seesaws around 1.0760 during Friday’s sluggish Asian session, after rising the most in nearly two months the previous day. In doing so, the Euro pair portrays the pre-NFP consolidation amid a cautious mood and a light calendar, as well as mixed technical catalysts.

Also read: Forex Today: The rally is finally here, and the Dollar knows it

That said, the Euro pair’s successful break of a one-month-old descending trend line joins the receding bearish bias of the MACD indicator to keep the EUR/USD bulls hopeful in crossing the immediate hurdle comprising the 100-day Exponential Moving Average (EMA) of near 1.0775.

However, the RSI (14) line remains below 50.0 and suggests a lack of upside momentum, which in turn may join a surprise improvement in the US jobs report, which is less likely, to recall the EUR/USD bears.

In a case where the EUR/USD crosses the 1.0775 hurdle, the 1.0800 round figure and the late May swing high near 1.0835 may prod the bulls.

On the flip side, a convergence of the previous resistance line and the 200-day EMA, around 1.0690-85, restrict immediate declines of the EUR/USD pair ahead of the previously mentioned rising support line from October 2022, close to 1.0635 at the latest.

It’s worth noting that the EUR/USD pair’s weakness past 1.0635 makes it vulnerable to drop toward the yearly low of around 1.0480 marked in January.

EUR/USD: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.