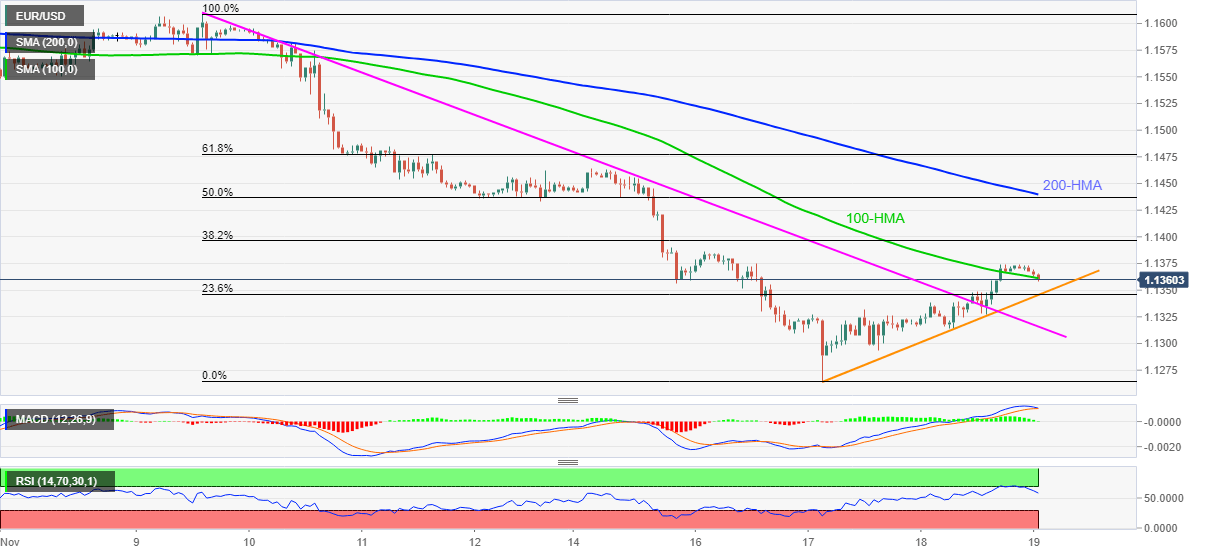

EUR/USD Price Analysis: Drops back below 100-HMA, eyes on 1.1350-48

- EUR/USD consolidates previous day’s gains, refreshes intraday low of late.

- 23.6% Fibonacci retracement, two-day-old support line limit immediate downside.

- Confluence of 200-HMA, 50.0% Fibonacci retracement level offer tough nut to crack for the bulls.

EUR/USD pares heaviest daily gains of November, marked the previous day, during early Friday. In doing so, the major currency pair refreshes intraday low to 1.1359 while declining below 100-HMA.

Given the RSI retreat and a likely bearish cross of the MACD line, the latest weakness is expected to stretch towards 1.1350-48 support convergence, comprising a two-day-old support line and 23.6% Fibonacci retracement (Fibo.) of November 09-17 downtrend.

Even if the quote stretches the latest weakness past 1.1348, the previous resistance line from November 09, around 1.1315, adds to the downside filters before directing the quote to the yearly low of 1.1263.

Alternatively, buyers will wait for a clear break of the previous day’s high near 1.1375 for re-entry. Following that, a joint of the 200-HMA and 50.0% Fibo. near 1.1440 will be crucial for the EUR/USD pair’s further upside.

Also acting as an additional challenge to the bulls is the 61.8% Fibonacci retracement level near 1.1480.

EUR/USD: Hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.