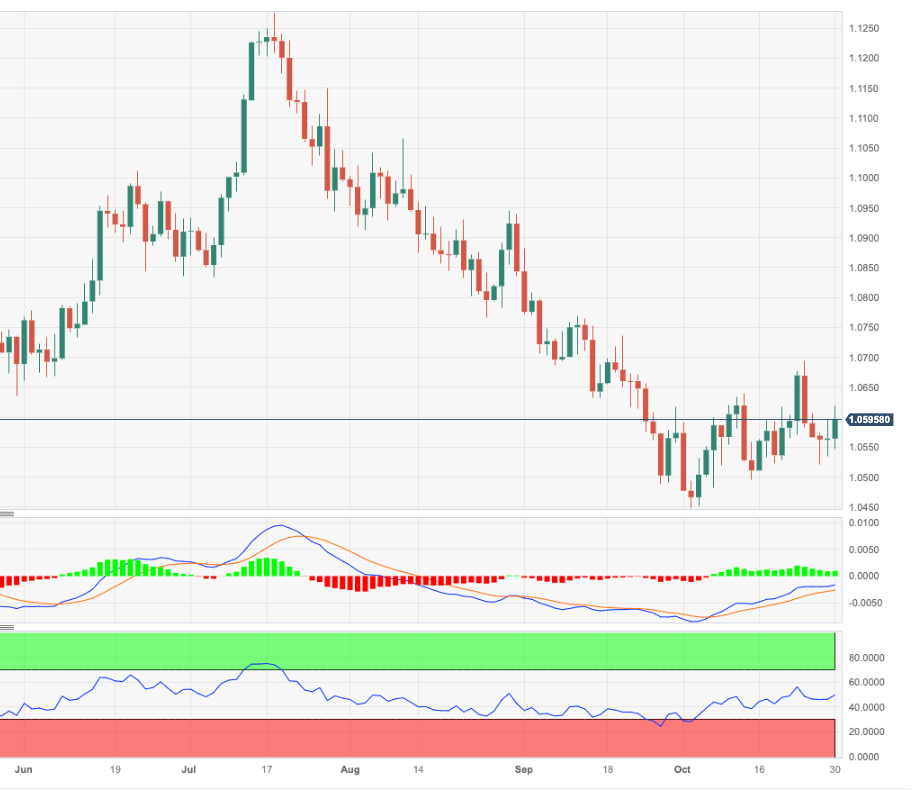

EUR/USD Price Analysis: Downside pressure should alleviate above 1.0700

- EUR/USD regains the smile and briefly surpasses the 1.0600 barrier.

- Once the 1.0700 region is cleared, the pair’s selling bias could alleviate somewhat.

EUR/USD picks up some buying interest and manages to surpass the key hurdle at 1.0600 the figure on Monday.

In case bulls push harder, the pair should meet the next hurdle at the monthly high of 1.0694 (October 24), which comes just ahead of the round level of 1.0700 and prior to the weekly peaks of 1.0736 (September 20) and 1.0767 (September 12).

In the meantime, while below the 200-day SMA at 1.0811, the pair’s outlook should remain negative.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.