EUR/USD Price Analysis: Bulls take a breather but 1.0660 holds gate for sellers’ entry

- EUR/USD snaps three-day winning streak with mild losses.

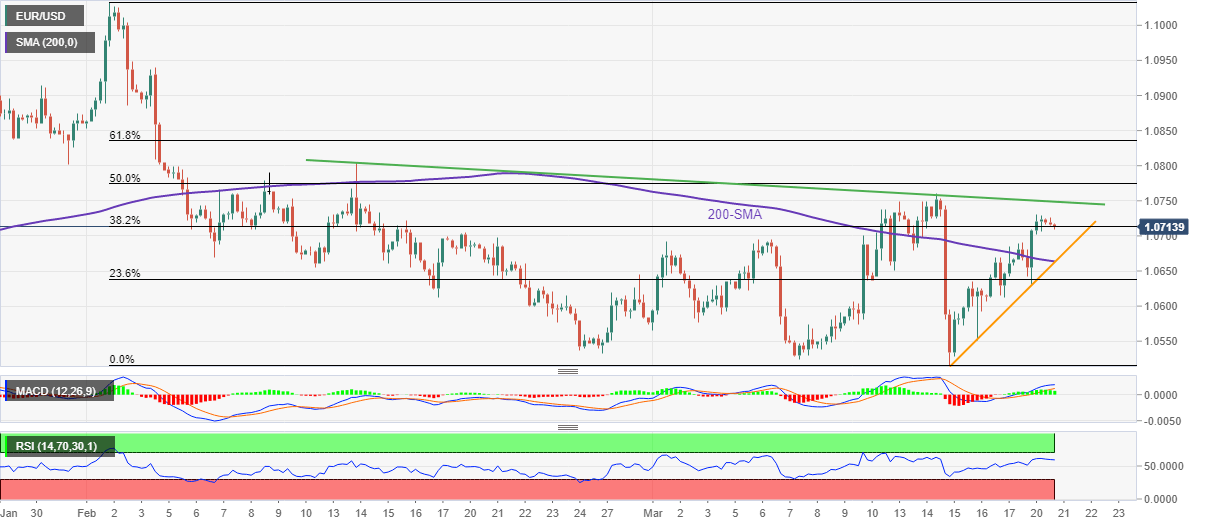

- Convergence of 200-SMA, weekly support line appears a tough nut to crack for bears before retaking control.

- Euro buyers need validation from five-week-old resistance line to keep the reins.

EUR/USD struggles to defend the 1.0700 threshold, printing mild losses heading into Tuesday’s European session, as it snaps a three-day uptrend.

The Euro pair’s pullback joins the RSI (14) line’s retreat and receding bullish bias of the MACD signals to suggest further downside.

However, the 200-SMA and an ascending trend line from the last Wednesday, around 1.0660, appear strong support for the bears to break before ushering further.

In a case where the EUR/USD price drops below 1.0660, multiple supports may test the bears around 1.0540 and 1.0525 before highlighting the monthly low of 1.0516.

Additionally, the quote’s weakness past 1.0516 could direct sellers to aim for January’s low surrounding 1.0480 for further dominance.

Meanwhile, EUR/USD recovery remains elusive unless crossing a one-month-old descending resistance line, around 1.0750 at the latest.

Following that, the monthly high and mid-February peak, respectively around 1.0760 and 1.0805, could challenge the Euro pair’s further upside.

Should the quote remains firmer past 1.0805, the odds of witnessing a run-up to refresh the Year-To-Date (YTD) high, currently around 1.1035 can’t be ruled out.

Overall, EUR/USD is likely to witness a short-term pullback but the bears are far from retaking control.

EUR/USD: Four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.