EUR/USD Price Analysis: Bulls reclaim ground after bouncing off key support

- EUR/USD rises to 1.0440 on Thursday, reversing losses after a three-day decline.

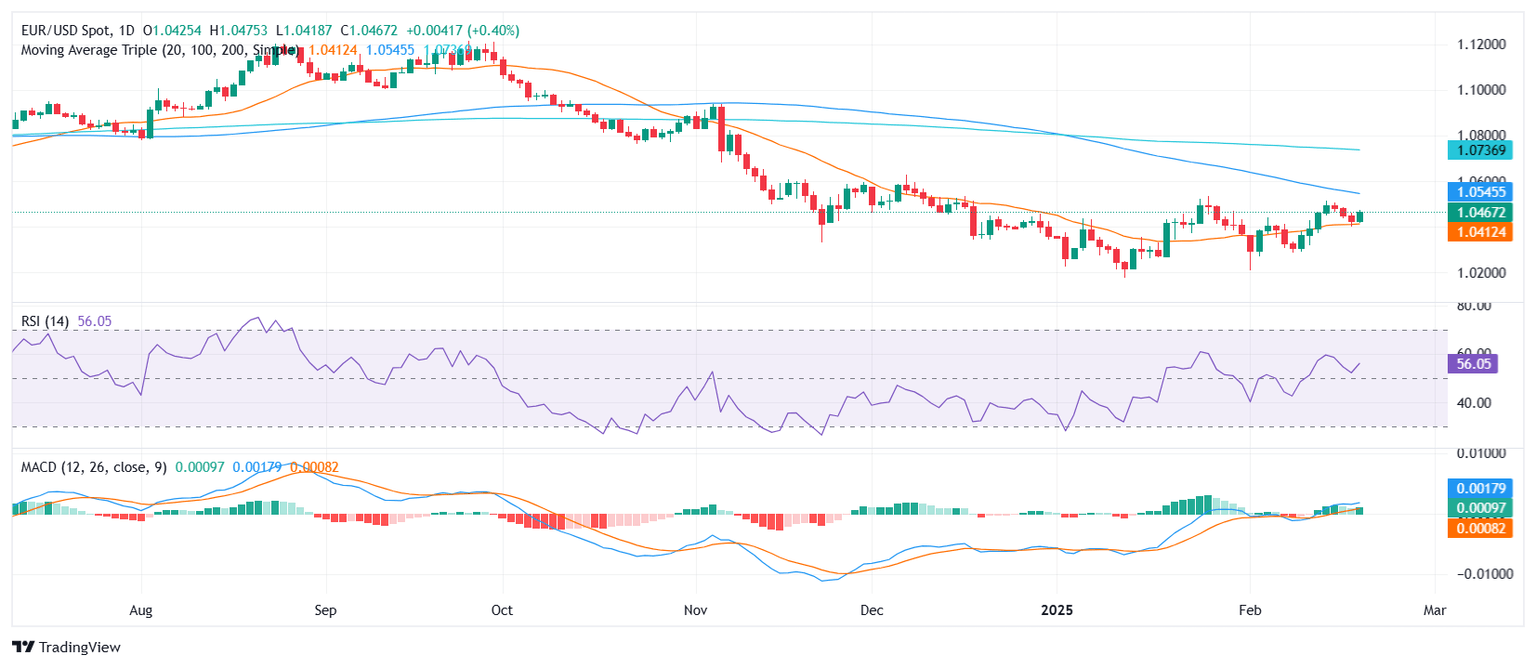

- The pair rebounded strongly off the 20-day SMA, gaining over 0.40% of its intra-week drop.

- Momentum indicators show signs of stabilization, with RSI rising sharply and MACD flattening in positive territory.

After a sharp three-day decline that saw EUR/USD shed more than 0.50% of its value following last week’s rally, bulls regained control on Thursday. The pair climbed to 1.0440, marking a 0.40% gain as buyers defended the 20-day Simple Moving Average (SMA), which acted as a key technical floor.

Momentum indicators hint at a shift in sentiment. The Relative Strength Index (RSI) has turned higher, now at 57, signaling renewed upside momentum after dipping earlier in the week. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram remains flat but holds in green territory, suggesting that bearish momentum has stalled.

Looking ahead, the pair’s ability to hold above the 20-day SMA will be crucial for sustaining a broader recovery. If buyers maintain control, the next key resistance lies near 1.0500, where stronger selling pressure could emerge. On the downside, a break below 1.0420 would invalidate the latest rebound and expose EUR/USD to further losses toward 1.0380.

EUR/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.