EUR/USD Price Analysis: Bulls now look at 1.0800 and beyond

- The upside momentum in EUR/USD picks up pace on Monday.

- Next on the upside comes the 1.0800 mark.

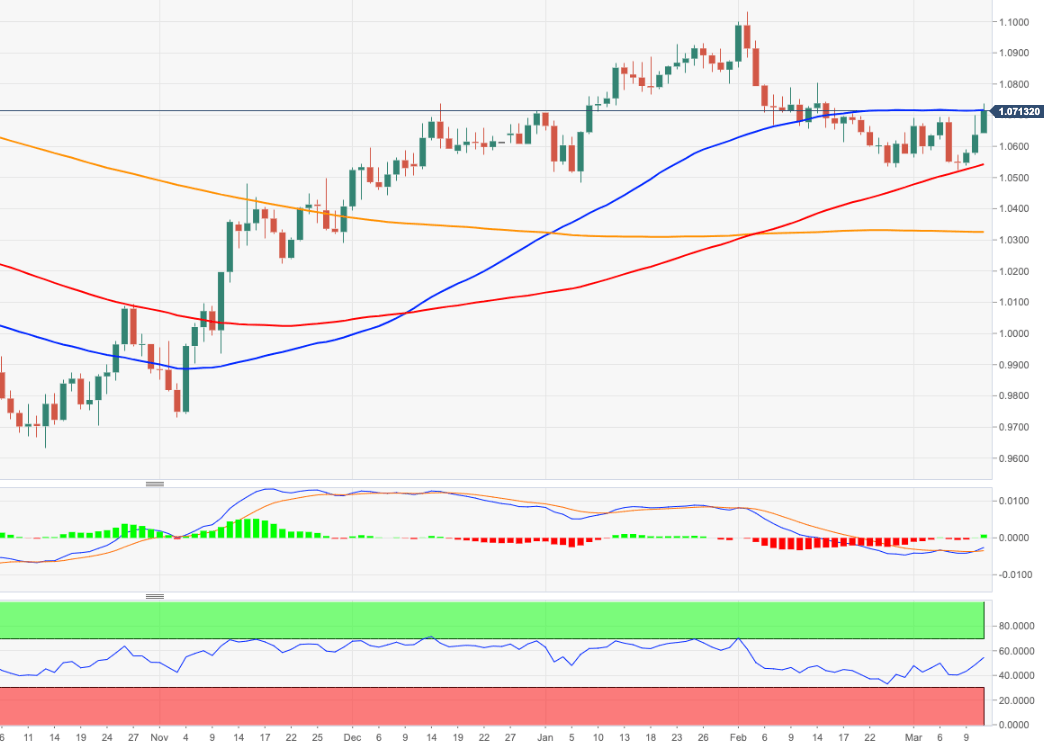

EUR/USD extends the buying interest to fresh multi-week highs north of 1.0700 the figure at the beginning of the week.

The continuation of the uptrend appears favoured for the time being. Against that, a convincing move above Monday’s peak at 1.0737 should open the door the wekly high at 1.0804 (February 14). Further up, there are no resistance levels of note until the 2023 high at 1.1032 (February 2).

Looking at the longer run, the constructive view remains unchanged while above the 200-day SMA, today at 1.0324.

EUR/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.