EUR/USD Price Analysis: Bulls eye a break of key 1.0550 area, eyes on 1.0600

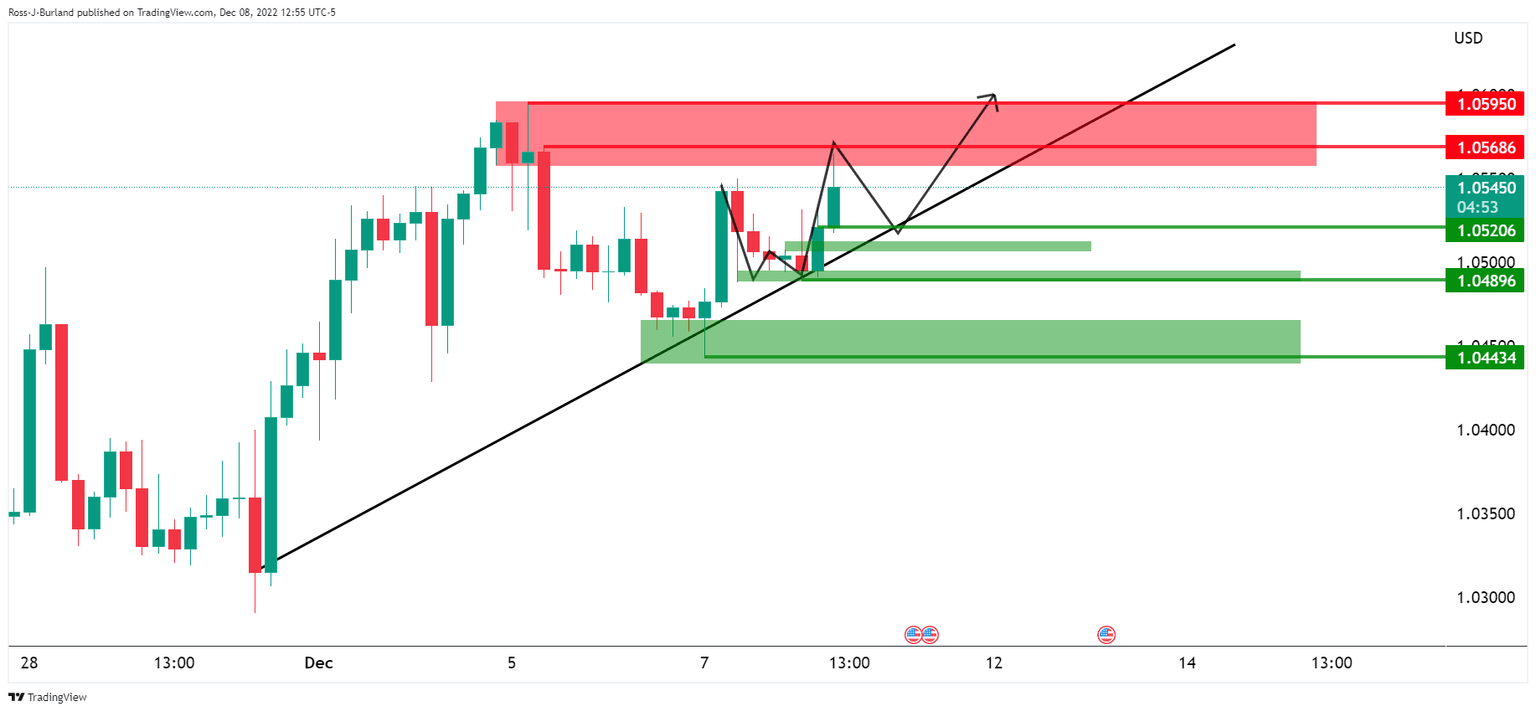

- EUR/USD remains in a bullish structure with a focus on a break above 1.0600.

- The bull's first challenge will be the micro trendline resistance and the 1.0550s.

As per the prior analysis, EUR/USD bulls have committed to the course and remain on the front side of the bullish dynamic trendline support as the following will illustrate:

EUR/USD prior analysis

While on the front side of the daily trendline, it was noted that EUR/USD bulls were firming from near 1.0480 support and were taking on resistance around 1.0570.

A break there has opened the risk of a move in EUR/USD beyond 1.0600.

A move in EUR/USD below the trendline and 1.0490 would open prospects of a deeper correction towards 1.0400.

EUR/USD update

The price remains in a bullish structure while holding in the 1.05s and the focus for the opening sessions is on a bullish continuation:

EUR/USD H1 chart

The bull's first challenge will be the micro trendline resistance and the 1.0550s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.